In recent times, the artificial intelligence market has experienced remarkable expansion, and it appears that the field soon to emulate this growth could be quantum computing. This emerging technology is capable of executing calculations that outmatch current supercomputers, potentially boosting the performance of AI as well as the overall computing sector significantly.

As an AI and tech enthusiast, I can’t help but be captivated by the fact that while Nvidia (NVDA) is widely known for its role in artificial intelligence, it’s also venturing into the exciting realm of quantum computing, signaling its forward-thinking approach. On the other hand, IonQ (IONQ), a company dedicated solely to quantum computing, aims high, striving to revolutionize our current internet infrastructure with a quantum-powered alternative.

Is it worthwhile to consider investing in Nvidia or IonQ stocks as they might offer promising returns in the field of quantum technology? To make an informed decision about a potential long-term investment, let’s delve deeper into the specifics of both businesses and evaluate their respective merits.

IonQ’s quantum tech ambitions

IonQ envisions a transformative role in shaping the future of quantum computing, as expressed by its chair and ex-CEO, Peter Chapman, who describes their ambition as “constructing the successor to today’s internet.

As an excited pioneer, I’m actively involved in building a quantum networking system! You know, like how our current internet is a result of computer networking. But imagine if we could take this to the next level by connecting quantum devices! This would significantly amplify their computational power. It’s a game-changer for various fields such as fusion energy and medicine, where it could help us discover groundbreaking solutions!

IonQ has been on a buying spree, acquiring various businesses to accomplish its goal. In January, it purchased Qubitekk, a front-runner in quantum networking. In May, it incorporated ID Quantique, focusing on quantum network security, and Lightsynq Technologies, an expert in extending the reach for connecting quantum computers.

Despite the high costs associated with it, the company aims to construct a quantum internet. In Q1, IonQ reported earnings of $7.6 million, yet incurred an operating loss of $75.7 million – a significant increase from last year’s deficit of $52.9 million.

Instead of continuously racking up such a vast loss compared to income, it’s not feasible in the long run. That’s why IonQ accumulated cash and short-term investments worth $588.3 million on its Q1 financial statement. To further strengthen its resources, the company is planning a $1 billion equity offering.

Nvidia’s measured quantum approach

Nvidia soared to an unprecedented market value of $4 trillion, boosted by the success of its AI-focused products like the GPU. Moving forward, the company is now focusing on developing a quantum processing unit (QPU), which could be their next big leap.

Excitedly speaking as a tech-savvy individual, I must say that the current quantum computers often stumble when it comes to calculations due to their error-prone nature. To tackle this issue head-on, Nvidia has chosen an innovative path by merging GPUs and QPUs in a hybrid quantum system. This real-time correction of calculation errors is a game-changer, bridging the gap between our classical computers today and the quantum devices of tomorrow. Utilizing its GPU framework is indeed a shrewd move, serving as an intelligent stepping stone towards mastering the intricacies of quantum technology.

The company’s advancement in AI technology is evident in its impressive financial achievements. In the 2025 fiscal year, which concluded on January 26, the company reported a staggering revenue of 130.5 billion dollars, marking a remarkable 114% growth compared to the previous year. This stellar performance was further reinforced with a 69% year-over-year growth to $44.1 billion in the first quarter of its fiscal year, which ended on April 27.

Nvidia, too, boasts a successful operation, reporting an impressive Q1 earnings of $21.6 billion, marking a significant 28% increase compared to the same period last year.

I’m thrilled to be part of a company that’s pushing boundaries in technology innovation! Our commitment to groundbreaking advancements is evident through the establishment of our research center, specifically designed to propel quantum computing forward. As Nvidia’s CEO Jensen Huang put it, this center will serve as the hub where we’ll make monumental leaps towards creating powerful, practical, and accelerated quantum supercomputers. I can hardly wait to witness the breakthroughs that will unfold here!

Making a choice between Nvidia and IonQ stock

It’s a question on everyone’s mind: Which between Nvidia and IonQ will ultimately prove to be the superior long-term investment in the budding field of quantum computing?

IonQ’s aspirations are grand, as they aim to build the quantum internet of tomorrow, but this ambitious project demands substantial resources. Interestingly, their Q1 revenue remained steady at $7.6 million compared to the previous year, which raises doubts about their ability to increase sales at a rate that matches their spending in order to realize these lofty goals. It seems they might be tackling more than they can handle.

During its first fiscal quarter, Nvidia amassed an impressive $53.7 billion in cash and short-term investments, thanks to its thriving AI success. Additionally, it ended the quarter with a substantial $26.1 billion in free cash flow, representing an increase from $14.9 billion in the previous year. This substantial financial cushion allows Nvidia to address the challenges in quantum computing, particularly those that have been limiting the technology’s potential for cost-effective scaling.

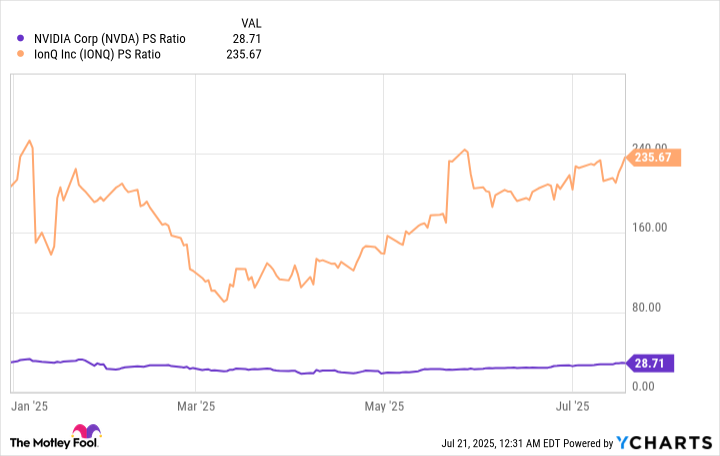

Furthermore, when considering the stock prices of IonQ and Nvidia, it’s evident that Nvidia offers a better value. This is particularly true when we look at the Price-to-Sales (P/S) ratio, a widely used tool for evaluating companies like IonQ that are not yet profitable.

The graph demonstrates that IonQ’s price-to-sales (P/S) ratio has been climbing since its earlier decline this year, and currently stands about eight times higher than Nvidia’s. This implies that IonQ’s stock may be overvalued.

Investing in Nvidia for quantum computing seems the better choice due to its competitive valuation and numerous other advantages. However, it’s essential to note that Nvidia shares recently reached a 52-week high of $174.25 on July 18, indicating a hot stock market. Therefore, it might be wise to hold off on purchasing until the share price decreases.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-25 14:48