In simpler terms, SoFi Technologies (SOFI) and Robinhood Markets (HOOD) are currently two of the most popular companies in the financial technology sector, exhibiting rapid growth. These firms specialize in innovative financial services.

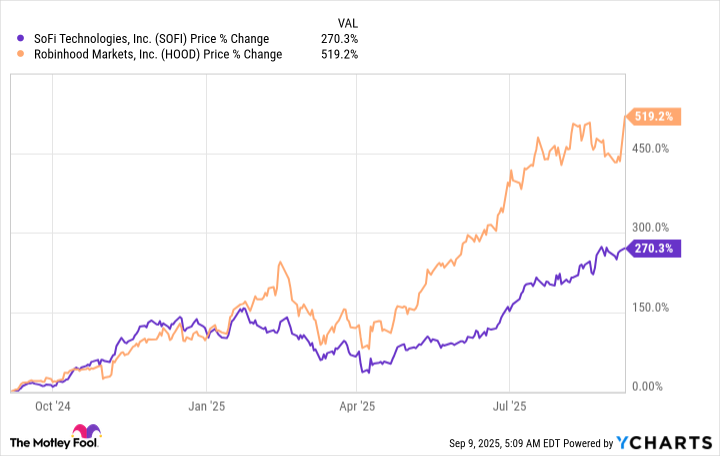

As a trader, I’ve witnessed an unexpected triumph for Robinhood, initially known for its meme stock fame. Over the past year, their stocks have skyrocketed, outshining many competitors. While SoFi has also been generous to investors, it pales in comparison to the returns from Robinhood.

But what happens next? Let’s see which of these is the better growth stock today.

Disrupting finance in different ways

Robinhood garnered both praise and criticism as the venue where individual investors participated in driving up stock prices following a Reddit community called wallstreetbets’ attempt to squeeze short investors several years ago. However, it drew scrutiny for its business model – trades are commission-free for users, but it operates using the payment for order flow system, which allows market makers to pay Robinhood for directing trades to their firms. Additionally, it generates income from interest on customer’s cash holdings and recently started earning revenue through its Gold accounts, which carry a $50 yearly fee or a $5 monthly charge.

Despite initial worries about questionable marketing strategies aimed at inexperienced investors, it appears the platform has largely navigated past these contentious issues. Now, they’ve introduced a broadened financial application that’s consistently evolving. Beyond trading, the app now includes credit cards and banking services, and its trading platform has been enhanced with various features such as cryptocurrency trading capabilities.

SoFi functions similarly to a traditional bank but operates digitally, focusing on delivering user-friendly services to its main demographic of students and young professionals. Beyond the norm, it strives for excellence by providing unique investment options such as exclusive exchange-traded funds (ETFs) and even access to private equity funds.

The primary focus is on providing loans, but the business has broadened to include various fee-generating financial services beyond lending, which are actually growing at a faster pace than the loan sector. Initially, when it went public, it had a somewhat risky image due to its youth and lack of profitability.

Growth, profits, and opportunities

These two firms are expanding at a fast pace and they both generate profits. Now, let’s compare their latest performances to understand which one is outperforming the other.

| Company | Revenue | Revenue Growth | Net Income | Net Income Growth | Members | Membership Growth |

|---|---|---|---|---|---|---|

| Robinhood | $989 million | 45% | $386 million | 105% | 26.5 million | 10% |

| SoFi | $855 million | 43% | $97 million | 459% | 11.7 million | 34% |

During the last year, membership in Robinhood Gold grew by an impressive 76%, reaching 3.5 million active members in the most recent quarter. This not only provides a steady income stream, but it also means that these actively involved customers spend more time trading, thereby generating additional service-based earnings for Robinhood.

Robinhood, while currently offering relatively fewer services compared to larger platforms, is gearing up for expansion in the near future. New features such as digital wallets are on the horizon, and they aim to break into new markets too. Their trajectory suggests significant growth ahead, hinting that their journey is just beginning to take off.

As a financial observer, I find SoFi aggressively implementing its cross-selling and upselling strategy to draw in new clients while strengthening its existing ones. The financial services sector is spearheading this effort, with revenue nearly doubling over the past two quarters compared to the same periods last year. Notably, SoFi has introduced cryptocurrency trading on its platform and plans to launch a blockchain-based global remittance service through its app. With these moves, SoFi aspires to rise among the top 10 U.S. banks and is making steady progress toward that goal.

Valuation and expectations

Despite a comparable second-quarter trajectory, it appears that the market values Robinhood’s growth significantly over SoFi’s. Keep in mind, though, this observation is based on a single moment; throughout the previous year, Robinhood demonstrated higher revenue growth compared to SoFi.

SoFi, being relatively small, could potentially offer greater possibilities. However, both firms share an expansive potential for growth as they innovate in financial management solutions.

Robinhood’s innovative characteristics could make it more alluring in today’s market, yet these same qualities represent its biggest potential threat. On the other hand, SoFi maintains a traditional bank-like appearance, whereas Robinhood’s platform caters to riskier financial endeavors.

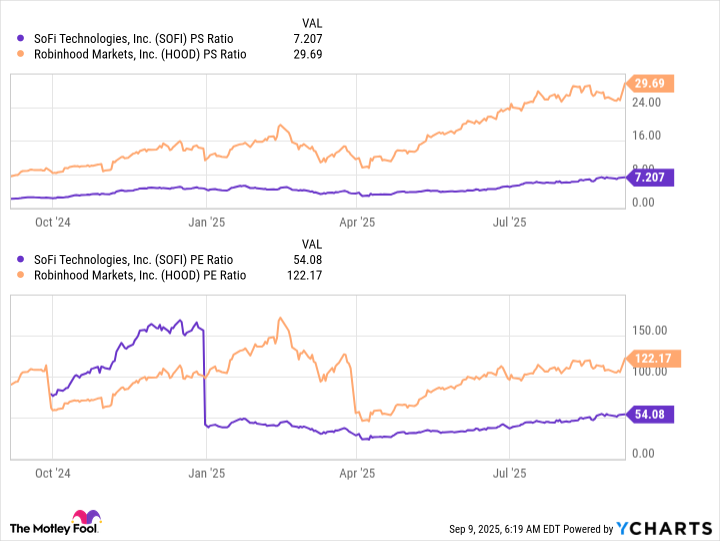

This also shows up in the stocks’ valuations.

SoFi stock isn’t cheap, but it’s much cheaper than Robinhood stock.

It’s possible that some investors might conclude, based on Robinhood’s significant rise in value over the past year, that they should invest in it. However, I can’t say whether its future growth is already reflected in the stock price. What I can say is that the current trading price suggests a high premium, meaning there’s not much wiggle room for potential mistakes.

For those with a moderate risk appetite and primarily focused on long-term investments, SoFi’s stock could be an excellent fit. This seems applicable to many individual investors. On the other hand, more adventurous investors who can handle higher risks might find Robinhood appealing at the moment.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-12 13:51