Investors seeking to augment their passive income found promising indicators in the performances of two reliable dividend providers towards the end of 2025. Verizon (VZ) upgraded its projected earnings, while American Express (AXP) surpassed itself by setting a new revenue record during the second quarter.

While a positive quarterly earnings report can be beneficial, it alone doesn’t define a fantastic dividend stock. To identify potential high-yielding stocks for your portfolio, let’s examine the long-term prospects of these businesses and assess which ones are likely to generate substantial income in your brokerage account.

Verizon

Over the past eighteen years, Verizon has consistently increased its dividend distribution, most recently doing so last September. With current stock prices, investing in this leading American telecommunications corporation provides a promising 6.3% return through dividends.

Over the last decade, Verizon’s dividend increases have been steady, yet they’ve not been particularly impressive. To be specific, the quarterly payout has only risen by approximately 19.9%.

Verizon’s mobile phone sector isn’t experiencing rapid growth, however, its broadband segment is making up for it. In the second quarter, wireless service revenue only increased by 2.2% compared to last year, but the company managed to increase its total broadband connections by 12.2%, amounting to 12.9 million.

Although revenue growth isn’t particularly swift, the recent tax reforms will simplify the process of attaining and increasing payouts. At the halfway point of the projected range, free cash flow is anticipated to hit approximately $4.74 per share in 2025. This surplus comfortably exceeds the present dividend obligation of $2.71 per year, enabling both fulfillment and potential increases of the dividend.

American Express

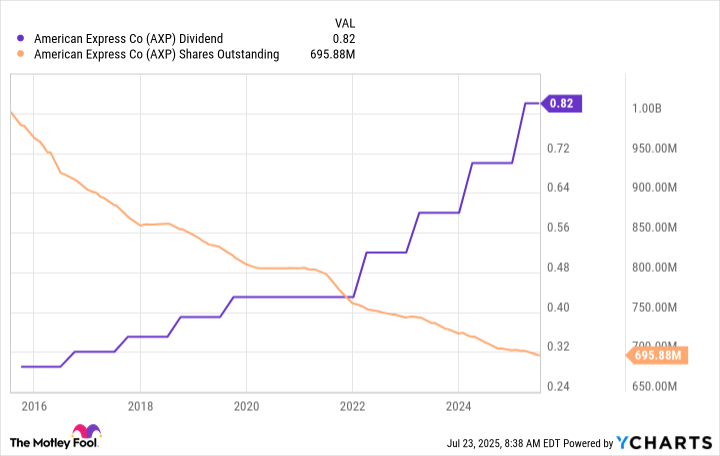

American Express doesn’t increase its dividends as often as Verizon does. However, it compensates for its infrequent changes by providing significant increases when necessary.

Currently, the company running the credit card network provides a very small return of approximately 1.1%. This is significantly less compared to Verizon, but quick cash-outs could potentially increase the return in the future if costs decrease.

In the early part of this year, American Express boosted its dividend distribution by 17%. Over the last decade, this payout has skyrocketed a whopping 183%.

A potential global pandemic might cause American Express to hold off on salary increases for employees, but investors should still anticipate substantial profits through share buybacks. Over the last ten years, American Express has reduced its total shares by nearly 30%. This reduction makes it easier for them to handle pay raise increases like the recent 17% hike.

In terms of its status as one of only four major international credit card payment systems, it’s logical to anticipate consistent growth from American Express. Although credit card network charges might be irritating, they currently aren’t substantial enough to make everyday transactions using cryptocurrencies a financially sound choice. If these fees were to increase significantly, American Express and the other three leading networks could remain competitive by lowering transaction fees.

Recently, American Express made a significant move to solidify its edge in a rapidly evolving digital currency market. In June, they revealed plans for the Coinbase One Card to operate on their network.

The better dividend stock to buy now

The decision between these two stocks hinges on your investment timeline. While American Express has shown exceptional dividend growth over the past ten years, its current yield is relatively low. If we extrapolate the past decade’s dividend growth rate, investors starting an American Express portfolio today could expect a yield on their initial investment to reach approximately 3.6% by the year 2045.

Verizon’s earnings from dividends are gradually increasing, but those who don’t have much time left to wait might find better returns with a high-yield telecommunications stock instead. The growth in its dividend is modest, and since Verizon recently purchased Frontier Communications for $20 billion, the upcoming dividend increases may not be substantial.

Looking ahead at Verizon’s historical trend of increasing dividends over the last ten years, an investor starting a position now might potentially earn a 9.1% return on their investment by the year 2045. This high yield makes it an attractive choice for many income-focused investors.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2025-07-24 13:45