It is a truth universally acknowledged, that a market in possession of a thriving AI sector, must be in want of a suitable investment. The past three years have witnessed the artificial intelligence (AI) megatrend dominate with such vigor, that one might suppose it to be the sole object of financial contemplation. Two such entities, Palantir (PLTR) and Nvidia (NVDA), have emerged as paragons of success within this domain, though their paths diverge as distinctly as the roles of a host and guest at a grand assembly.

Though neither is the direct competitor of the other, their positions within the AI value chain are as different as the roles of a pianist and a composer. Nvidia, with its prowess in hardware, provides the instruments upon which AI models are built, while Palantir, with its software, offers the symphony of data analytics. Both have rewarded their long-suffering investors handsomely, yet the question remains: which shall prove the more advantageous companion in the years to come?

Business Model

Nvidia, the discerning provider of graphics processing units, holds a prominent position in the realm of AI, its wares being the preferred choice for those seeking to power and train such models. Yet, as with all matters of fashion, competition is ever encroaching-AMD and Broadcom, with their own offerings, threaten to disrupt this equilibrium. Moreover, the fervor of AI infrastructure development, though currently unrelenting, shall not endure eternally; a time will come when the need for new computing capacity wanes, and replacement becomes the order of the day.

Palantir, in contrast, offers its clients a suite of artificial intelligence-powered data analytics platforms, its services sought after by both commercial and governmental entities. Its software empowers decision-makers with timely insights, while its automation tools delegate menial tasks to AI agents, thus liberating human labor for pursuits requiring original thought. Even as the initial fervor of the AI revolution subsides, the utility of such tools shall only expand, ensuring Palantir’s continued relevance.

Thus, while Nvidia’s fortunes may wax and wane with the tides of technological demand, Palantir’s subscription-based model ensures a steady stream of revenue, rendering its business more resilient. A most admirable trait, one might say, in the face of uncertainty.

Winner: Palantir

Growth Rates

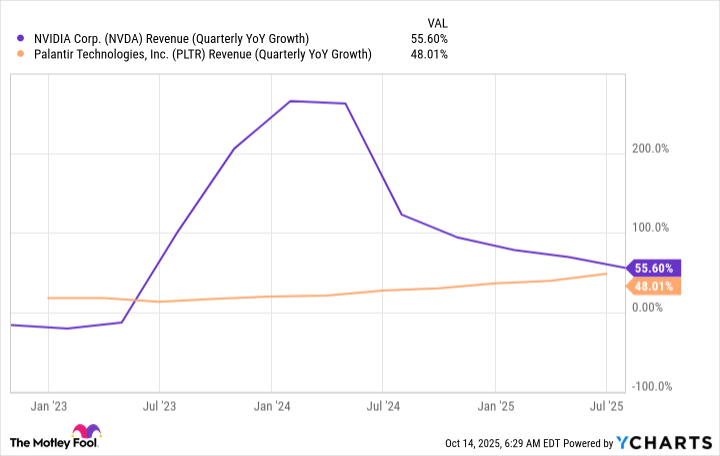

Both companies exhibit growth, though the pace differs. Nvidia’s sales, once brisk, have begun to slow, while Palantir’s continue to accelerate, as if propelled by an unyielding ambition. Yet, whether this momentum shall translate into supremacy remains to be seen. The demand for AI services, though vast, may not sustain such rapid expansion indefinitely, and thus, the contest remains balanced.

For now, the two stand as equals, their trajectories intersecting in the grand design of the market. A most intriguing spectacle, one might observe, for the outcome shall hinge upon the subtleties of time and circumstance.

Winner: Tie

Valuation

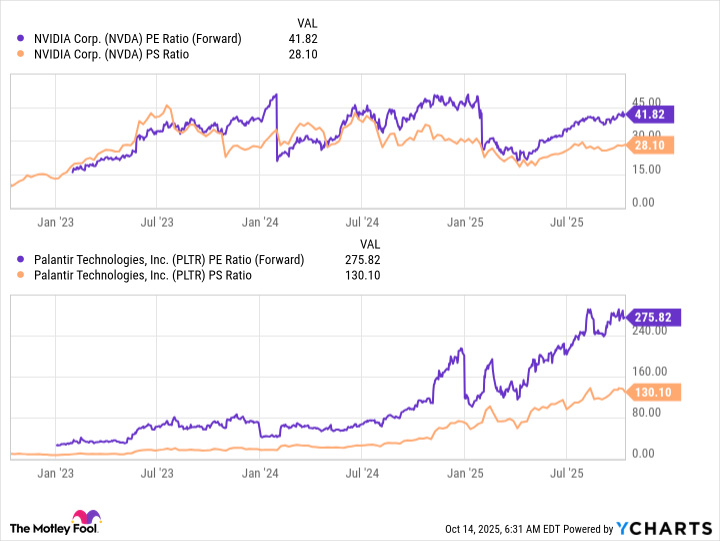

When it comes to valuation, the disparity between the two is as stark as the difference between a modest cottage and a gilded palace. Palantir’s stock, having ascended to lofty heights, carries with it an air of extravagance, its price inflated beyond reason. Nvidia, by contrast, remains grounded, its valuation of 42 times forward earnings a testament to prudence.

To equate the two would be as absurd as comparing a well-mannered debutante to a lady of the night. Should Palantir’s valuation remain so elevated, it must deliver sustained growth to justify its price, a feat requiring not mere effort, but a veritable miracle. Nvidia, with its more reasonable valuation, enjoys a five-year head start, a boon in an era where AI spending is projected to surge.

Thus, while Palantir’s business model may be more appealing, its overvaluation renders it a less prudent choice. The market, ever fickle, favors those who offer both promise and prudence. Hence, despite the allure of Palantir’s innovations, one must conclude that Nvidia, with its measured approach, remains the more suitable match.

Overall winner: Nvidia

📈

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-18 14:21