Investing in the artificial intelligence (AI) sector could be a wise decision considering the tremendous technological promise of AI. Notably, Nvidia Corporation, represented by the ticker symbol NVDA, has skyrocketed to a staggering $4 trillion market capitalization, becoming the first publicly traded company to achieve this remarkable milestone, thanks to its strong focus on AI technology.

D-Wave Quantum, holding a stake of 1.80%, may potentially emerge as a competitor for industry leader Nvidia in the future. They are actively working on quantum computing technology which has the potential to significantly boost AI capabilities by leveraging the principles of quantum physics.

Among these technological pioneers, one might prove to be an excellent long-term investment. However, it’s challenging to determine which one seems to be the more advantageous pick.

A look into D-Wave Quantum

D-Wave has built quantum computers that can tackle intricate issues within minutes, which even the fastest modern supercomputers would require a million years to accomplish. This remarkable technology could propel Artificial Intelligence to unprecedented levels, potentially enabling it to detect people at risk of diabetes-induced blindness more effectively.

This year, D-Wave’s stock prices significantly increased, soaring more than 75% up until the week ending July 11. The surge was primarily fueled by a remarkable year-on-year rise of 509% in first-quarter revenue, which reached $15 million.

In a remarkable turn of events, D-Wave’s total earnings surpassed $8.8 million from all 2024 sales, setting a new record. This extraordinary growth was fueled by the company’s first-ever sale of one of its quantum computers. Notably, the majority of their income usually comes from charges for access to their quantum systems through cloud services.

Towards the close of the first quarter, D-Wave boasted a customer base of 133, which is an increase from 128 a year ago. Notably, this group includes around a dozen government entities. Despite the positive customer growth, it’s worth noting that the company has yet to achieve profitability. In fact, its Q1 financial report showed a net loss of approximately $5.4 million.

Nvidia and the future of AI

Nvidia is renowned as a pioneer in artificial intelligence due to its high-performance graphics processing units (GPUs). These GPUs play a crucial role in powering AI supercomputers globally, including one being constructed for the U.S. Department of Energy with the aim of advancing breakthroughs in fusion energy, materials manufacturing, and other scientific domains.

We’re stepping into a brand-new phase of technological evolution, marked by the capacity to create intelligence on a massive scale. As Jensen Huang, CEO of Nvidia, put it in a June statement, “This is the dawning of a new industrial age.” He anticipates companies upgrading their technology frameworks to accommodate AI, which will lead to increased GPU sales for Nvidia.

So far, the sales have been nothing short of impressive. In the first quarter of its financial year, ending on April 27th, it managed to generate a staggering $44.1 billion in revenue, marking a significant 69% increase over the previous year’s $26 billion. This remarkable performance came after setting a new record with fiscal 2025’s revenue of $130.5 billion, which signified a strong 114% growth compared to the preceding year.

In simple terms, the company saw impressive profits in the first quarter, with net income of approximately $14.9 billion – an astounding 628% rise compared to the previous year. This strong performance suggests that Nvidia’s success is set to endure. Notably, the company is actively investing in quantum computing technology by creating Quantum Processing Units (QPUs).

Quantum Processing Units (QPUs) will team up with Nvidia’s Graphics Processing Units (GPUs) to address the main challenges faced by quantum computers. Since quantum machines are prone to errors because they rely on atomic particles that can be affected even by minor temperature fluctuations, Nvidia’s GPUs can help detect and correct these errors as they occur. This collaboration will increase the efficiency of quantum computers while decreasing the costs associated with error correction.

Weighing whether to invest in D-Wave or Nvidia stock

Both D-Wave and Nvidia boast powerful technologies, but it’s important to note that technical ability alone doesn’t tell the whole story. A significant aspect to take into account is the company’s share price valuation.

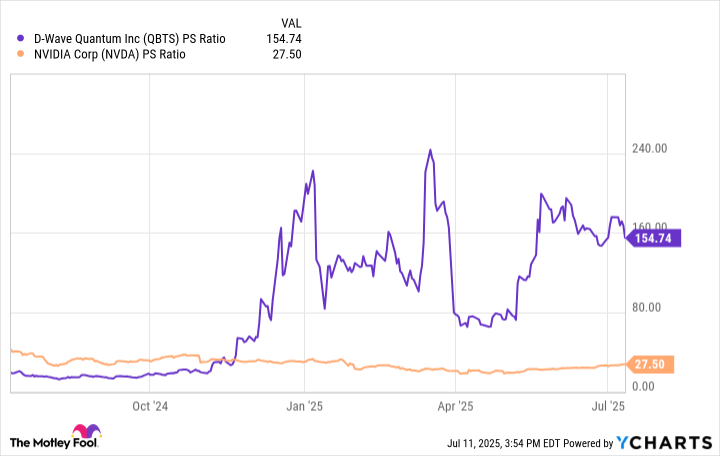

To evaluate these companies, you might want to examine their Price-to-Sales (P/S) ratios. This is a frequently employed measure particularly for companies that are not yet profitable, like D-Wave.

or

For an assessment, let’s consider the Price-to-Sales (P/S) ratio for each company, which is often used when dealing with businesses that aren’t currently profitable such as D-Wave.

The graph indicates that D-Wave’s Price-to-Sales ratio has significantly increased compared to the same period last year, and it surpasses Nvidia’s. This implies that D-Wave stocks might be overvalued, suggesting it may not be advisable to purchase them at this time.

Moreover, it’s intriguing to consider how artificial intelligence might advance with quantum computing, but it’s crucial to remember that such progress might be delayed significantly. In fact, some predictions within the industry suggest that we may not witness a fully operational quantum computer on a large scale until beyond 2040.

Throughout this period, various corporations might emerge as pioneers in the field of quantum computing. Major tech players like Microsoft are already developing their unique approaches to tackle this challenge.

In this context, Nvidia’s approach of merging Quantum Processing Units (QPUs) with Graphics Processing Units (GPUs) provides a safe route for companies to venture into quantum computing. This strategy allows these businesses to easily integrate Nvidia’s QPUs into their quantum computers, mirroring how they already use GPUs in their artificial intelligence (AI) systems. These aspects make Nvidia a more attractive choice for investing in AI compared to D-Wave.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2025-07-16 21:12