The arrival of commercially usable Artificial Intelligence (AI) systems has led to an increasing demand for substantial computational power. A newcomer in the field, CoreWeave (CRWV), which went public on March 28, has risen to address this need.

The company offers cutting-edge cloud solutions tailored for artificial intelligence applications, primarily utilizing technology from Nvidia (NVDA). This tech giant offers powerful Graphics Processing Units (GPUs) and various AI tools, making them a key player in driving future technological advancements.

CoreWeave or Nvidia?

Nvidia and the rise of AI factories

In this upcoming industrial phase as outlined by Jensen Huang, we’ll need AI manufacturing facilities – these are advanced data centers equipped with top-tier hardware that can meet the high computational needs of artificial intelligence systems.

To stay ahead in the AI industry, forward-thinking organizations are establishing fresh data centers. For instance, Meta Platforms has announced plans for one in Louisiana, which CEO Mark Zuckerberg refers to as “sizeable enough to cover a substantial portion of Manhattan.” Similarly, Oracle is developing a colossal data center that will require three small modular nuclear reactors to keep it running.

As a major supplier of essential hardware, specifically GPUs, Nvidia can gain advantages from the establishment and running of these AI facilities. The demand for chips based on its current GPU design, Blackwell, continues to be robust, and the company is already gearing up for the launch of Blackwell’s successor, the Vera Rubin architecture, in the upcoming year.

Consistently improving its technology has propelled Nvidia’s sales to unprecedented peaks, with revenue soaring by 114% to an all-time high of $130.5 billion during the fiscal year 2025 (which concluded on January 26).

The beginning of Fiscal Year 2026 has been robust, with a first quarter revenue of $44.1 billion – an impressive 69% jump compared to the previous year. Moreover, operating income surged by 28%, reaching $21.6 billion. Nvidia anticipates further sales growth in the upcoming second quarter, estimating a revenue of approximately $45 billion, which is a significant leap from the $30 billion in the prior-year period.

Despite a decrease in Nvidia’s sales to China due to U.S. restrictions on AI hardware exports, the company experienced growth nonetheless. In an attempt to revive its Chinese business, Nvidia is developing a chip that complies with the latest export regulations. This new chip may become available as early as fall.

A look into CoreWeave

The growing demand for AI factories is significantly enhancing the profitability of CoreWeave’s operations. Major tech companies like Meta, OpenAI (the owner of ChatGPT), and Microsoft are leveraging CoreWeave’s cloud infrastructure to expand their own data centers, which has contributed significantly to CoreWeave’s success. This strategic partnership propelled CoreWeave to a staggering $981.6 million revenue in the first quarter, marking a remarkable 420% year-on-year growth.

Despite the uncertainty surrounding potential changes in business IT spending due to President Donald Trump’s fluctuating tariff policies, client demand for our company remains robust and unabated. According to CoreWeave management, we anticipate a significant increase in sales, rising from $395 million in the previous year to approximately $1.1 billion in Q2 of this year.

Earlier this month, CoreWeave revealed plans to purchase Core Scientific, a firm specializing in digital asset mining. While its history includes cryptocurrency mining, this acquisition signifies a departure from its initial focus rather than a reversion to it.

In lieu of this, CoreWeave intends to leverage Core Scientific’s existing IT infrastructure for expansion, thereby accommodating an increased number of clients in search of artificial intelligence processing capabilities. This strategic decision will also result in cost savings for CoreWeave, as it currently leases certain facilities from Core Scientific.

Reducing costs is crucial because creating advanced computing infrastructure doesn’t come cheap. In the first quarter, CoreWeave reported a loss in operation of $27.5 million. This was due to a significant increase in operational expenses, which swelled by nearly five times, reaching $1 billion.

Deciding between CoreWeave and Nvidia stocks

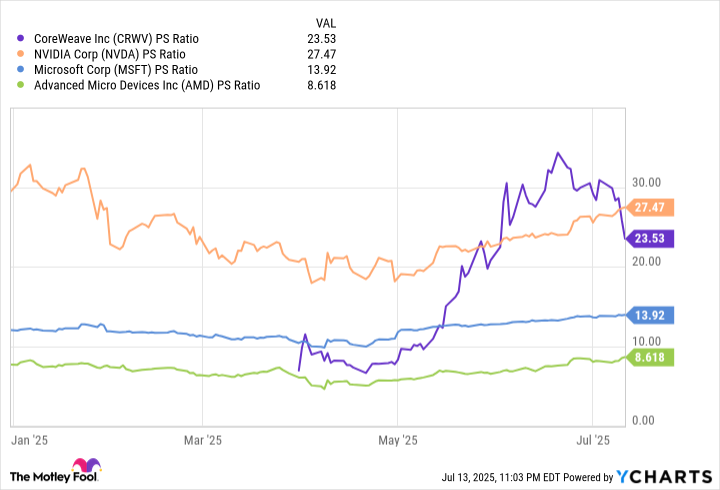

When deciding between CoreWeave and Nvidia as investment options, it’s essential to look at their valuations. Since only one of them is currently profitable, the Price-to-Sales (P/S) ratio can be a helpful tool for comparison. Additionally, this metric allows you to evaluate them alongside other AI-related businesses like Microsoft and Nvidia’s competitor AMD, ensuring a fair comparison.

In the past few months, the Price-to-Sales (P/S) ratios of both companies have significantly increased, surpassing those of Microsoft and AMD. This indicates that their stocks might be overpriced, despite a decrease in CoreWeave’s P/S multiple during July.

In other words, it’s advisable to hold off on buying shares until they are priced more fairly. When such an opportunity presents itself, I would recommend investing in Nvidia.

Choosing Nvidia over CoreWeave is advantageous because it consistently earns profits, plays a vital role in AI industry advancements, consistently enhances its technology, and maintains a broad competitive barrier. On the other hand, CoreWeave’s business model can be easily imitated by competitors, and some of its clients may cease using their services once they establish sufficient data centers of their own.

As a result, Nvidia looks like the superior long-term investment between these two AI businesses.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-19 12:14