Two notable companies leading the AI stock market are C3.ai and Palantir (PLTR). Both are thriving in the AI sector with robust growth that seems unabated. This consistent expansion might make them attractive choices for investors seeking to buy their stocks right now, as they could potentially continue growing in the near future.

But of the two, is there one that stands out as a better buy? Let’s find out.

The business models

Both Palantir and C3.ai offer artificial intelligence (AI)-driven data analysis software designed to deliver valuable insights for decision-making to their clients. Moreover, they enable users to incorporate AI automation via AI agents, thereby enhancing their practicality even more.

Regarding their clientele, both Palantir and C3.ai maintain a substantial influence in both public sector (government) and private sector (commercial) markets. In their most recent financial periods [C3.ai’s Q4 FY 2025 which ended on April 30], there was a fairly balanced distribution between these two categories for each company. For C3.ai, approximately one-third of its contracts were secured by government agencies. Meanwhile, Palantir derived about 55% of its earnings from the government sector.

From my perspective as an observer, it’s clear that Palantir’s unique selling point lies in its adaptability. The Palantir platform empowers users to craft diverse AI solutions, making them applicable in unconventional scenarios. On the other hand, C3.ai primarily concentrates on pre-assembled applications, leaning more towards a plug-and-play approach. The market for these ready-to-use solutions is intensely competitive, with numerous companies offering comparable products to C3.ai. Nevertheless, Palantir’s unparalleled flexibility sets it apart, which I believe gives its business model a distinct edge in the industry.

Winner: Palantir

Growth

Palantir’s exceptional business strategy is propelling significant expansion. In the first quarter alone, its revenue escalated an astounding 39% compared to the same period last year, reaching $884 million. Analysts predict a 38% increase in Q2 as well. However, it’s important to note that Palantir’s management often surpasses their own expectations, so the actual growth rate for Q2 might be slightly higher than this projected figure by a couple of percentage points.

Although C3.ai’s growth isn’t lagging behind significantly, it’s not achieving the same pace as Palantir. In the final quarter of their financial year 2025, their revenue increased by a substantial 26% compared to the previous year, reaching $109 million. However, predictions suggest that their growth might be on a downward trend, with management anticipating only a 20% increase in revenue for the next financial year 2026.

Even though C3.ai is relatively smaller, it can’t keep pace with Palantir’s rapid expansion. Consequently, this once again highlights Palantir’s dominance.

Winner: Palantir

Profitability

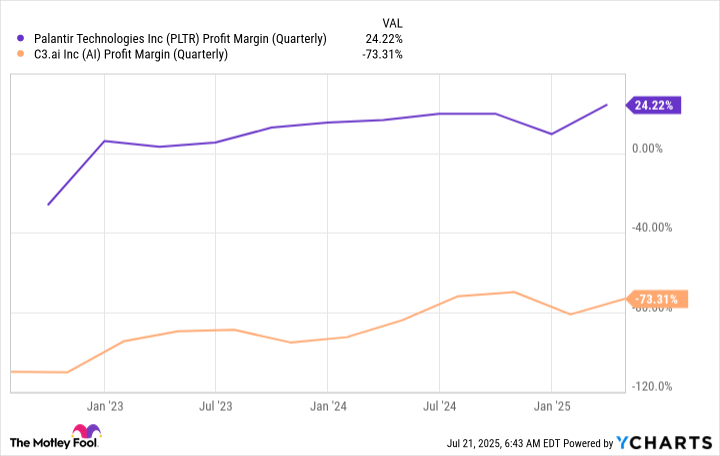

I really only need to put up one chart to declare a winner in the profitability space.

C3.ai is currently operating at a significant loss, with a high rate of cash expenditure. It may take several years of expansion for the company to become even close to profitable. In contrast, Palantir demonstrated a robust 24% profit margin in its latest quarter, signifying their dedication to both growth and profitability.

Winner: Palantir

Valuation

Currently, Palantir leads by three points in this assessment, with no points for the other side. Since this is the final factor I’m considering, it might seem like Palantir will emerge victorious. However, this aspect holds significant weight in Palantir’s current investment case, making it crucial to take it into account carefully before reaching a conclusion.

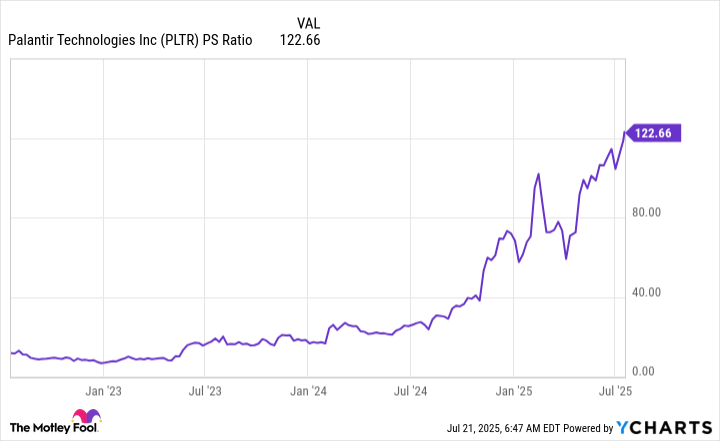

Indeed, Palantir is experiencing significant growth, operating profitably, and boasts an impressive business strategy. Yet, due to its escalating stock price, it’s challenging to generate returns at this point.

In simple terms, Palantir’s stock valuation is extraordinarily high compared to its sales, a level that very few companies reach. This steep valuation is justified given the company’s slow growth trajectory, meaning it will likely be several years before the price looks reasonable again based on current growth rates of approximately 39%.

On the other hand, C3.ai’s stock appears undervalued at 9.5 times sales.

However, it’s deeply unprofitable, so it has earned this cheap valuation.

When it comes to choosing between these two stocks, Palantir seems like the superior company to invest in. However, due to its high price, it might be challenging to realize substantial returns in the future. On the other hand, I am not inclined towards purchasing C3.ai’s stock merely because of its low cost.

Based on my analysis, it seems wiser for investors to explore AI stocks outside of these two companies. There are numerous thriving firms in this sector, but these particular ones might not be the top choices for investment at the moment.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-25 12:28