One ought not to follow the counsel of any investor, however esteemed, without due consideration. Yet, the actions of such figures often merit scrutiny, for they may reveal hidden truths. Thus, the recent acquisition by Berkshire Hathaway of a Dividend King steelmaker warrants our attention, though not necessarily our blind acquiescence.

What does Berkshire Hathaway do?

Berkshire Hathaway, though classified as a financial entity, is in truth a grand conglomerate, its interests sprawling across industries with the breadth of a well-managed estate. Its portfolio, a collection of steadfast holdings and opportunistic ventures, reflects the prudence of its steward. The recent reduction of certain positions, however, suggests a mind ever vigilant to the shifting tides of fortune.

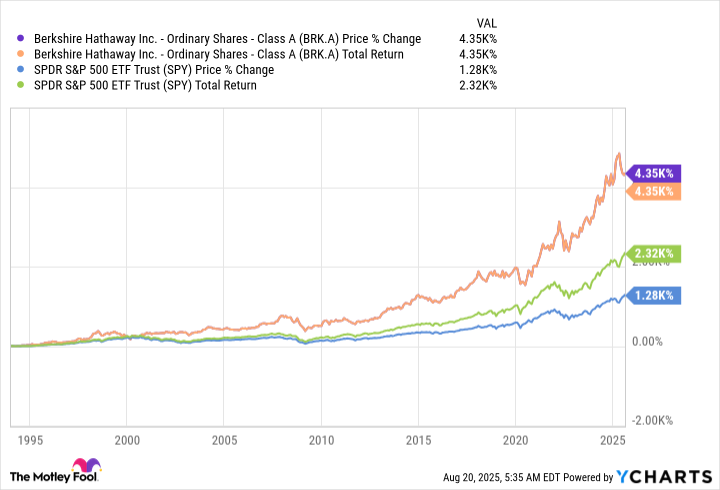

The essence of Berkshire Hathaway lies in its stewardship, a testament to the sagacity of its leader. Its performance, though lauded, must be weighed against the broader market, for even the most astute may falter when the world turns against them. Mr. Buffett’s approach-buying sound enterprises at fair prices and holding them-sounds simple, yet in practice, it demands a fortitude few possess.

Should one find this philosophy intriguing, the recent addition of Nucor to Berkshire’s portfolio might merit contemplation. A steelmaker of considerable repute, it is said to possess the flexibility of its operations, a trait as valuable in industry as it is in society.

Why is Nucor attractive?

Nucor, a titan among North American steelmakers, employs methods that allow it to adapt with the ebb and flow of demand. Such versatility, while commendable, does not guarantee prosperity in an industry as fickle as the weather. The current softness in steel prices has led to a decline in its stock, a state that, while disheartening, may yet present an opportunity for the discerning investor.

The steel cycle, a phenomenon as predictable as the seasons, dictates the fortunes of its makers. To purchase during a downturn, however, requires a confidence in the enterprise’s resilience-a virtue not all possess. Nucor’s status as a Dividend King, though a mark of stability, should not blind one to the perils of its trade.

Its business strategy, centered on growth and reinvestment, is admirable, yet one must question whether such plans are as robust as they seem. The current $3 billion investment in 2025, while ambitious, may be more a reflection of confidence than a sure path to prosperity.

Nucor has an attractive goal

To invest in Nucor is to court volatility, for its fortunes are as mercurial as the market itself. Yet, its long-term aim-to achieve higher highs and lows-suggests a vision that, if realized, might yield dividends. However, one must not be swayed by such promises without due diligence.

Though Berkshire Hathaway’s endorsement may lend it a certain cachet, one should not follow the crowd without reason. Nucor’s current state, while undeniably challenging, may yet prove a stepping stone to greater things. Yet, as with all investments, the path is fraught with uncertainty.

In conclusion, while Nucor’s prospects are not without merit, one must approach them with the caution of a lady navigating a ballroom-aware of the dance, yet mindful of the steps. 📈

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-08-24 15:09