The name Berkshire Hathaway hums like a low, resonant chord in the symphony of markets. It is not a stock, but a testament-a bridge between the old world of paper mills and the new dawn of algorithmic finance. Warren Buffett, the man who once steered this leviathan through fog and tempest, now steps back, leaving behind a legacy etched in the slow, deliberate growth of a redwood. To invest in Berkshire today is to cast a vote in a ballot older than most nations, a vote that whispers: *Patience is not a virtue, but a necessity.*

Buffett’s departure is not an ending, but a season’s turn. The old oak sheds its leaves to make way for saplings-Todd Combs and Ted Weschler, chosen not for their youth, but for their quiet mastery of numbers. They are gardeners in a vast orchard, pruning branches that once bore the weight of a single master’s gaze. Yet the roots remain deep, sunk into soil rich with decades of compounding.

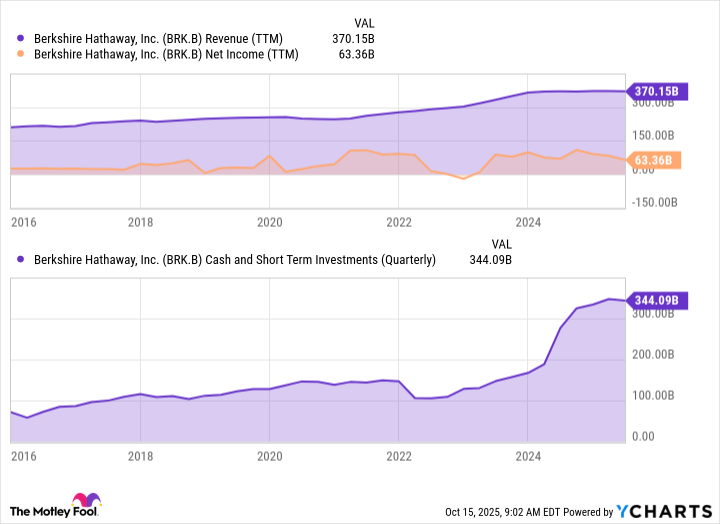

Berkshire is a mosaic of industries, each tile a story of survival. GEICO, the railroad that rumbles like a heartbeat, and the energy enterprises that hum with the rhythm of the earth-these are not businesses, but chapters in a novel written in the vernacular of resilience. Its cash reserves? A river swollen with the rains of time, waiting to carve new valleys in the landscape of opportunity.

Float, that peculiar alchemy of insurance premiums and delayed claims, is Berkshire’s secret spring. It flows at $171 billion, a current that nourishes the roots of its investments. Treasury bills, like daffodils in early spring, bloom with modest returns until the next frost of claims arrives. What remains is not gold, but the quiet assurance of a well-stocked larder.

The succession plan is no mere transfer of keys, but a dance of trust. Combs and Weschler, once hedge fund navigators, have charted courses through storms few remember. Their decision to embrace Apple-a fruit once shunned for its thorned reputation-is akin to a painter daring to use a new hue. The canvas, now vibrant with billions, hints at a future where tradition and innovation are not adversaries, but allies.

With $340 billion in reserves, Berkshire is less a company and more a cathedral of capital. Its spires reach into railroads, utilities, and the digital ether. The new stewards, armed with the same patience that built cathedrals, may yet reshape its arches. One wonders if the market, that fickle muse, will grant them the same reverence it once gave to Buffett’s quill.

To ponder whether Berkshire can set you up for life is to ask if a seed can become a forest. At 11% annual returns, $10,000 planted today would grow into a sapling of $80,623 in two decades, then a towering tree of $228,923 by the third. But markets are not gardens; they are wild and capricious. Even the most fertile soil requires rain, and not all storms are gentle. Yet Berkshire’s soil is loamy with diversification, its roots entwined with the pulse of the economy.

The company is a mirror to the investor’s soul. To allocate a portion of your portfolio to it is to stake a claim in the unknown, to believe that the architects of tomorrow’s wealth will inherit the wisdom of yesterday. Buffett’s lieutenants, if they prove as shrewd as their mentor, may yet compose a new sonnet in the long epic of Berkshire’s rise. After all, the market is not a ledger-it is a poem, and every line must be read with both reason and wonder. 🌱

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-17 13:51