Now, listen closely, because this is a story about a company called Berkshire Hathaway. For years, it was run by a fellow named Warren Buffett – a bit of a wizard with numbers, some might say. But old Buffett has passed the reins to a chap named Greg Abel, and that, my friends, is where things get interesting. It’s like handing a perfectly good lollipop to someone you’ve barely met – you hope they don’t lick it backwards!

They’ve been tidying up, you see. Getting rid of some shares in Kraft Heinz – a rather soggy biscuit of an investment, if you ask me. But don’t let that bother you. It’s merely sweeping the crumbs off the table before something truly scrumptious arrives.

The real story isn’t about what they’re selling, it’s about what they’re sitting on. A mountain of money, a hoard, a positively preposterous pile of cash.

A Cash Pile Big Enough to Baffle a Dragon

As of the last count, they had over $381 billion stashed away. That’s enough to buy a small country, or perhaps a very large collection of rubber ducks. And it’s growing! Profits from their various businesses – everything from railroads to ice cream – are adding to the heap. Some say it could top $400 billion by the end of the year. Imagine the possibilities! It’s like giving a child an unlimited supply of sweets – the temptation to do something wonderfully mischievous is almost overwhelming.

This isn’t just a safety net, you understand. It’s a financial fortress, protecting them from any nasty economic storms. It might even, just might, persuade them to share some of the wealth with shareholders. Though old Buffett was famously tight-fisted, so don’t hold your breath. He preferred to hoard it, like a grumpy gnome guarding his treasure.

But the real magic is what Greg Abel intends to do with all this loot. He’s got a chance to reshape Berkshire Hathaway, to invest in exciting new ventures. Nobody’s complaining about Buffett’s track record, of course – he’s a legend. But perhaps a bit of fresh thinking is exactly what’s needed. Maybe even a flutter on some of those fast-growing tech companies – those peculiar contraptions that seem to rule the world these days.

A Decent Company at a Reasonable Price (For Now)

Regardless of which direction Abel takes, Berkshire Hathaway remains a world-class company. And Buffett, the old fox, is still around as chairman, keeping an eye on things. He’s like a slightly grumpy guardian angel, ensuring everything doesn’t go completely topsy-turvy.

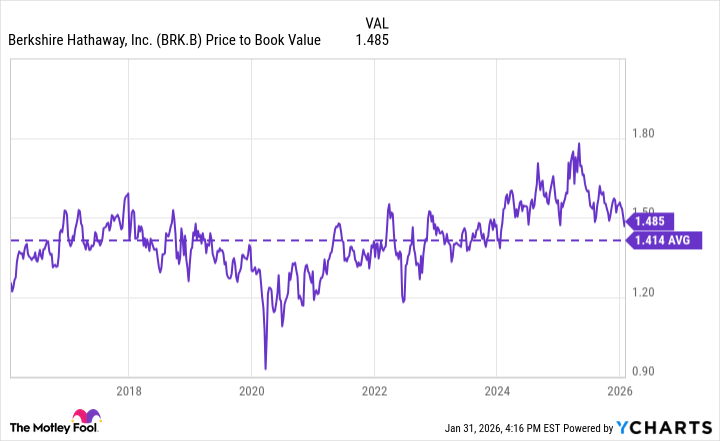

Now, the stock is trading at 1.4 times its book value – slightly below its average over the past decade. That means it’s a decent price. Not a steal, mind you, but a fair one.

As the old saying goes, it’s sensible to buy a good company at a fair price. Investors might be a little hesitant, wondering what Abel will do with his new toy. But he spent years learning from Buffett, so it’s reasonable to give him the benefit of the doubt.

That mountain of cash just keeps growing. It might seem boring to some, but it could be a game-changer as the new leadership starts putting it to work. It’s like a coiled spring, ready to unleash a burst of investment. And that, my friends, is a sight worth waiting for.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

2026-02-04 00:52