At the end of each calendar quarter, institutions managing over $100 million must submit Form 13F to the SEC. These filings reveal the stocks that professional investors are buying or selling, offering a rare glimpse into where capital is being deployed.

Warren Buffett’s name carries weight in financial circles. Under his leadership, Berkshire Hathaway has become a symbol of consistent market outperformance. Its latest 13F filing shows a new position in UnitedHealth Group (UNH), a company that has seen its stock decline 40% since August 18.

This move raises questions. Why would a value investor like Buffett target a stock under pressure? Let us examine the reasoning behind this decision, while considering whether it aligns with long-term strategic interests.

1. UnitedHealth Aligns with Buffett’s Preferred Sectors

Buffett has long favored insurance companies, citing their ability to collect premiums upfront while deferring claims. This model creates a stable cash flow, a trait shared by health insurers. UnitedHealth, as a major player in this sector, fits this framework.

However, the industry’s structure is not without risks. Consolidation has left a few dominant firms, but UnitedHealth’s recent struggles suggest vulnerabilities that may not be fully priced into its valuation.

2. Buffett’s Emphasis on Economic Moats

Berkshire’s holdings-Apple, Coca-Cola, Visa-share a common trait: enduring competitive advantages. In health insurance, such moats are reinforced by market concentration. Yet UnitedHealth’s brand, while large, shows signs of erosion, creating a potential entry point for investors willing to assess long-term fundamentals.

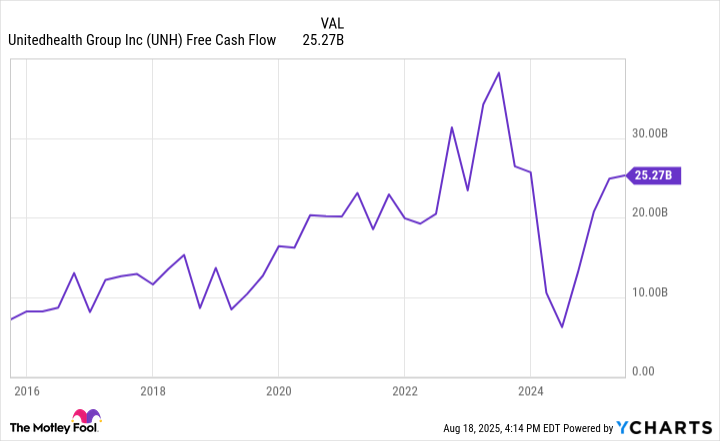

3. Cash Flow and Brand Equity

UnitedHealth’s vertically integrated model generates substantial cash flow. This aligns with Buffett’s preference for businesses with predictable earnings. However, recent performance suggests that growth may not materialize as swiftly as anticipated.

The company’s ability to sustain this cash flow depends on its capacity to navigate regulatory and operational challenges. For now, the numbers remain robust, but the future is uncertain.

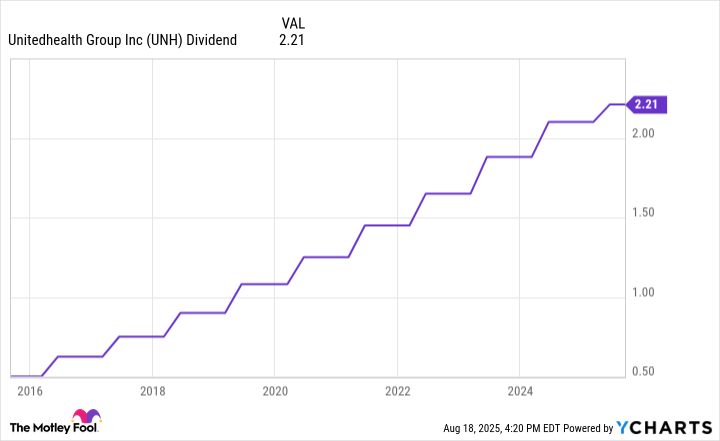

4. Dividends as a Signal

UnitedHealth’s dividend policy reflects a commitment to returning capital to shareholders. Buffett values this discipline, as it rewards long-term holding. Yet dividends alone do not guarantee resilience in a volatile market.

The question remains: Will these payments continue if the company’s fortunes shift?

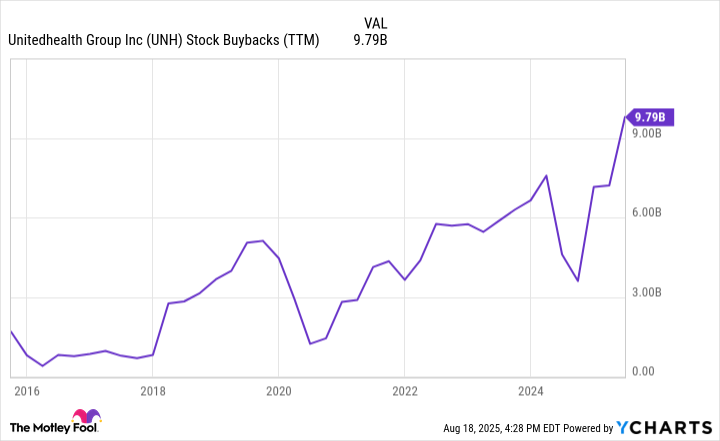

5. Share Buybacks and Insider Activity

UnitedHealth’s buyback program signals management’s belief in undervaluation. When combined with insider purchases, this reinforces confidence in the company’s trajectory. However, such actions can also mask underlying issues.

Insiders’ recent investments suggest they view the stock as a bargain, but this does not eliminate the risks associated with the broader healthcare sector.

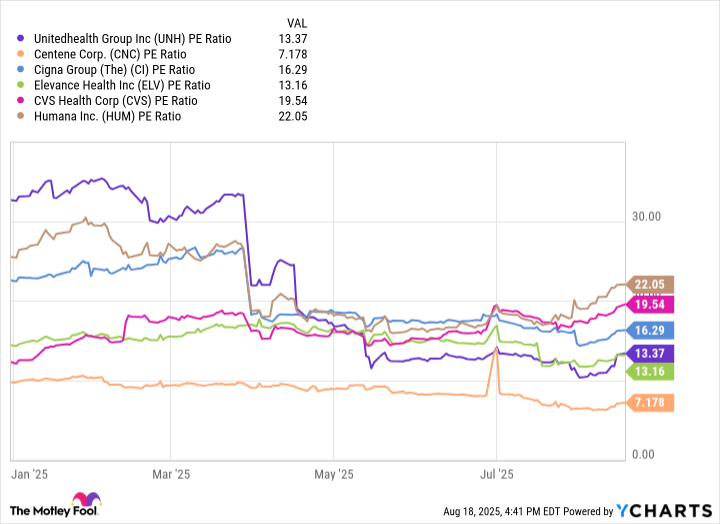

6. Valuation and Market Perception

UnitedHealth’s P/E ratio of 13x earnings places it in the middle of its peers. Yet its stock price has fallen to five-year lows, reflecting a disconnect between its intrinsic value and market sentiment.

This discrepancy may indicate that the market is overestimating risks while underestimating UnitedHealth’s long-term potential. Buffett, known for his contrarian approach, may see this as an opportunity.

UnitedHealth remains a complex entity. Its fundamentals are sound, but the path to recovery is fraught with uncertainties. For investors, the decision to follow Buffett’s lead requires careful consideration of both risks and rewards.

Whether this bet proves wise will depend on how well the company adapts to evolving challenges. For now, it stands as a case study in the interplay between market sentiment and intrinsic value.

📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Banks & Shadows: A 2026 Outlook

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-21 17:24