For six decades, Mr. Warren Buffett presided over Berkshire Hathaway, transforming it from a modest textile concern into a financial behemoth. Now, at a venerable age, he has relinquished the reins. One detects a certain amount of hand-wringing amongst the more excitable investors, a predictable display. Berkshire, as of recent calculations, boasts a valuation exceeding a trillion dollars. A considerable sum, certainly, but one that seems to inspire more anxiety than admiration in the current climate.

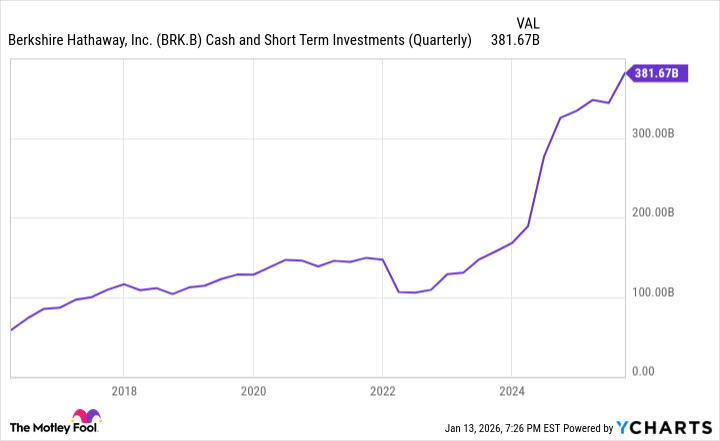

The succession, naturally, is the source of these tremors. However, to suggest that Berkshire’s future hinges solely upon the whims of a single man is to misunderstand the nature of the enterprise. There are, as it happens, some $382 billion reasons to remain, if not optimistic, at least… resigned to continued prosperity.

The Designated Heir

Mr. Greg Abel, the chosen successor, is a name largely unknown outside the confines of Omaha. A deliberate obscurity, no doubt. He has, one gathers, spent the better part of three decades within the Berkshire structure, managing the energy and non-insurance holdings. Whether this constitutes sufficient preparation for navigating the complexities of a multinational conglomerate is a question best left to the market to answer. Mr. Buffett, however, has indicated his approval, and in matters of capital, that is rarely a negligible endorsement.

Buffett’s long-term strategy has always been to build a self-sustaining engine, not a personality cult. He appears to have succeeded, though one suspects the transition will be observed with a degree of morbid fascination by those who prefer a more dramatic narrative.

A Treasury of Prudence

The aforementioned $382 billion, accumulated at the end of the third quarter, represents a truly remarkable hoard. Enough, one notes, to dwarf the combined market capitalization of several currently fashionable, yet demonstrably frivolous, enterprises. Robinhood Markets, Spotify, and Adobe, for instance, pale in comparison. It’s a sum that suggests not merely wealth, but a rather unsettling degree of preparedness for… well, anything.

This vast reserve serves a dual purpose. Firstly, it generates a not inconsiderable income from short-term Treasury bills. Even at a modest rate of return, the yield is substantial. Secondly, and more importantly, it provides Berkshire with the flexibility to exploit opportunities when they arise. The acquisition of GEICO, and the stake in American Express, are testament to this patient, opportunistic approach. One trusts Mr. Abel will maintain this discipline, resisting the temptation to engage in reckless speculation.

The possibility of a dividend, after decades of abstinence, is, of course, a fanciful notion. Berkshire’s history suggests a preference for reinvestment, a far more sensible course. Though one can always dream.

Beyond the Stock Portfolio

Berkshire Hathaway is not merely a collection of stocks and bonds. It is a sprawling conglomerate, encompassing a diverse range of businesses. GEICO, Burlington Northern Santa Fe, and Berkshire Hathaway Energy are but a few examples. These subsidiaries operate with a degree of autonomy, largely unaffected by the comings and goings of the executive suite.

- GEICO: A leading provider of insurance, and a reliable source of revenue.

- Burlington Northern Santa Fe (BNSF): One of the largest rail networks in the country, and a vital component of the American infrastructure.

- Berkshire Hathaway Energy: A major player in the energy and utility sector, providing essential services to millions.

These enterprises, along with a host of manufacturing, retail, and service businesses, generate a steady stream of cash flow. The stock portfolio attracts the headlines, but it is the underlying businesses that provide the true foundation of Berkshire’s strength. It is a diversified, resilient structure, and one that is likely to endure long after the current anxieties have faded into obscurity.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-17 17:54