Right then. Let’s talk about wealth. Not the sort that comes with titles or inherited lands, mind you, but the kind you accumulate by… persuading little numbers to move in the right direction. It’s a peculiar magic, this investing business. A bit like alchemy, really, except instead of turning lead into gold, you’re turning patience into profit. And, like all magic, it requires the right tools. These days, those tools often come in the form of Exchange Traded Funds – ETFs. Low maintenance, they are. Which is to say, they don’t require feeding or walking. A definite plus.

Growth ETFs, specifically, are designed to… outperform. A polite way of saying they aim to do better than everyone else. Nobody, of course, can actually guarantee future performance. The market is a fickle beast, prone to tantrums and sudden changes of heart. But one particular fund, it seems to me, has a rather good chance of leaving the venerable S&P 500 trailing in its wake. Not by a little, either.

A Fund with a Pedigree

The Schwab U.S. Large-Cap Growth ETF (SCHG 0.25%) is, shall we say, a rather robust specimen. It holds nearly 200 of those ‘large-cap’ stocks – companies big enough to be considered… stable. Relatively speaking, of course. Stability is a fleeting concept in these times. These are companies positioned for growth, which, in layman’s terms, means they’re expected to earn more than the average bear. Which, incidentally, has nothing to do with actual bears, unless you happen to be investing in bear-related enterprises.1

Large-cap stocks, being the size they are, tend to weather storms better than their smaller, more nimble counterparts. They’re the castles, not the raiding parties. And many of the companies within this ETF aren’t just surviving; they’re thriving. They’ve seen empires rise and fall, recessions come and go, and still they persist. A quality I rather admire, frankly.

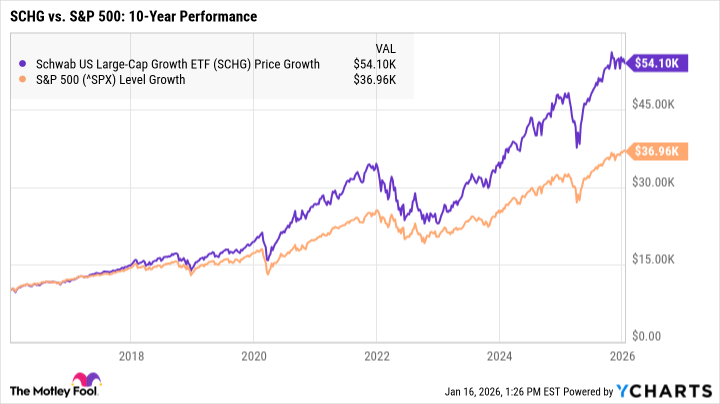

Over the last decade, this particular ETF has delivered total returns of around 441% – as of this writing, naturally. The S&P 500, by comparison, managed a respectable 270%. So, if you’d invested a mere $10,000 a decade ago, you’d be sitting on approximately $54,000 today. The S&P 500 would have given you $37,000. A significant difference, wouldn’t you agree? Enough to acquire a rather decent collection of garden gnomes, at least.

And the best part? It’s remarkably inexpensive to own. The expense ratio is a paltry 0.04%, meaning you’ll pay just $4 per year in fees for every $10,000 invested. A pittance, really. Many other growth funds charge considerably more, effectively skimming a larger portion of your potential gains. It’s highway robbery, I tell you. Pure highway robbery.

Can Lightning Strike Twice?

Now, a word of caution. Past performance, as the lawyers are so fond of saying, is no guarantee of future results. Just because this fund has outperformed the market previously doesn’t mean it will continue to do so. The market is a chaotic system, governed by forces beyond our comprehension.2

However, this ETF’s pronounced tilt toward the technology sector could provide a significant tailwind in the years to come. Roughly half of the fund is allocated to tech stocks, including major players like Nvidia, Apple, and Microsoft. These companies, let’s be honest, are driving much of the innovation happening today. Whether that innovation is beneficial is another matter entirely.

Much of this fund’s growth has occurred in the last five years, coinciding with the surge in tech stocks – particularly those involved in the development of artificial intelligence (AI). Experts predict that AI will continue to grow, and this ETF is well-positioned to benefit. Whether AI will ultimately save us or enslave us remains to be seen.

The Long Game

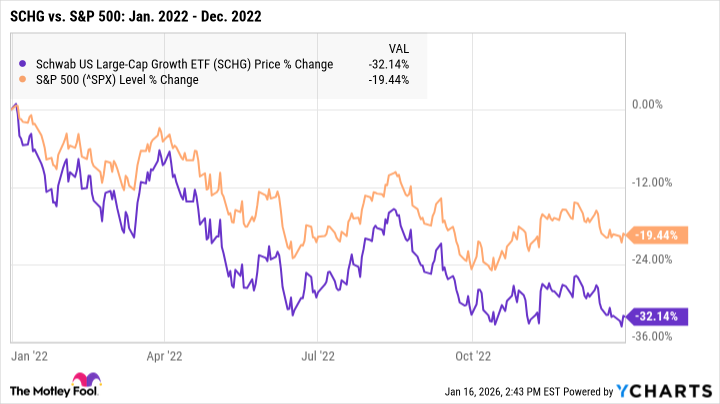

Investing in a growth ETF requires a long-term outlook. These investments can be more volatile during periods of economic instability. If the market takes a downturn, this fund could suffer more than an S&P 500-tracking fund. It’s simply the nature of the beast.

During the bear market of 2022, for example, the Schwab U.S. Large-Cap Growth ETF sank further than the S&P 500. A painful experience, no doubt. But remember, even castles are occasionally besieged.

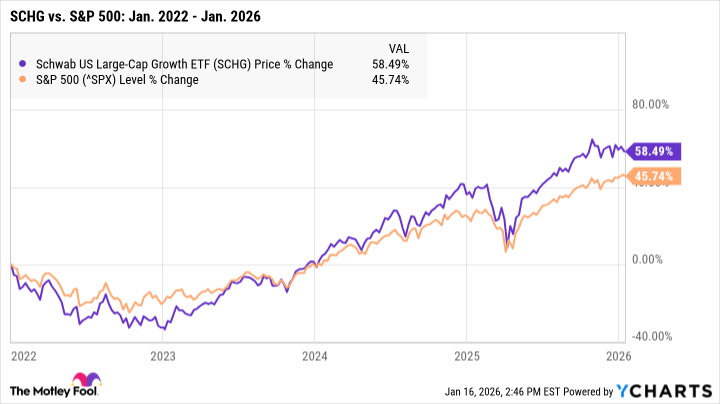

However, between January 2022 and today, the Schwab fund has delivered total returns of over 58% – once again surging past the S&P 500. A testament to its resilience, wouldn’t you say?

The short term can be unpredictable, so be prepared for price fluctuations. But strong investments are more likely to rebound from downturns, and staying invested for at least five to ten years can help mitigate the impact of volatility. Patience, my friend, is a virtue.

Growth ETFs can be fantastic investments for building wealth, but a long-term outlook is crucial. The Schwab U.S. Large-Cap Growth ETF has a powerful stock lineup and a history of beating the market, and with enough time, it has the potential to truly outperform the S&P 500. It’s not a guarantee, mind you. But in the world of finance, a little optimism never hurt anyone.

- Bears, of course, are magnificent creatures. But their financial acumen is questionable.

- Chaos theory, as any seasoned investor knows, is simply a polite way of saying “we have no idea what’s going to happen.”

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-18 22:23