Coinbase, the leading U.S. cryptocurrency trading platform, is contemplating making it possible for American users to purchase tokenized versions of their COIN company stocks via their Ethereum Layer-2 system called Base.

This action might merge conventional stock markets with blockchain tech, potentially making Coinbase a leader in financial advancements.

Regulatory Clarity Key to Coinbase’s Tokenized Shares Rollout in the US

Jesse Pollak, the main programmer at Base, disclosed that Coinbase is currently delving into this project at an initial phase. He admitted that ensuring regulatory compliance poses the biggest challenge for them at present.

Pollak underscored the fact that Coinbase is dedicated to tackling these issues to guarantee a safe and compliant launch of tokenized assets.

At this stage, we’re delving into the exploration process, trying to figure out the necessary steps for compliance and safety, with a focus on the future, so that tokens such as $COIN can be securely integrated into our platform,” Pollak explained.

As a crypto investor, I’ve recently discovered that tokenized shares of COIN are only accessible to international users via decentralized platforms. According to Pollak, the key to broadening this access within the United States lies in more transparent regulatory guidelines. Furthermore, these developments could potentially pave the way for blockchain-based financial systems to reach a wider audience.

In the meantime, Pollak suggested that COIN stock tokens might be just the beginning of several similar offerings on the Base platform. Over the last year, the Ethereum Layer-2 network has grown rapidly and made a big impact, with more than $3.84 billion worth of value locked (TVL) in it.

As a researcher, I share the conviction of Pollak that our platform has the capacity to amass $1 trillion in managed assets. In his view, attaining this figure would solidify Base’s position as a vital centerpoint for cutting-edge financial services tailored for the next generation.

A sum of one trillion dollars worth of assets is about to be transferred to Base, and this process may take place quicker than people anticipate,” Pollak further explained.

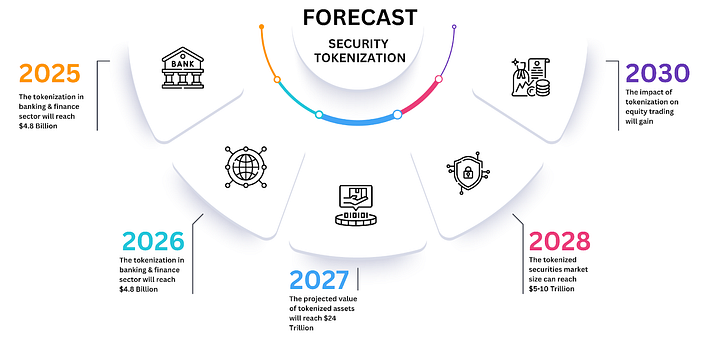

In light of the fast-paced development of the sector in the past year, it’s not unexpected that Coinbase is venturing into tokenization. Key figures in the industry, like Bitwise CEO Hunter Horsley, anticipate that tokenization could fundamentally transform equity markets, making the capital market more equitable and accessible.

Horsley pointed out that tokenization might provide a means for small-scale enterprises to tap into equity markets, something they’ve previously struggled to do due to the large size typically needed for public offerings.

Today, approximately 4,600 U.S. firms are eligible to trade on the stock market. The NAIC estimates there are more than 200,000 companies in the United States with annual revenues exceeding $10 million. Not every company chooses to go public, as it often demands substantial size. However, many businesses find themselves unable to do so due to this requirement for large scale. Tokenization, a novel approach to capital markets that promotes equal access, offers a solution, according to Horsley’s statement.

Coinbase is the first American cryptocurrency exchange to go public, boasting a market value of approximately $70 billion. Austin Campbell, an adjunct professor at Columbia Business School, has commended the company for its significant stand against what he deemed as excessive regulatory interference in the U.S. crypto sector.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-06 03:04