Now, most folks chasing returns these days are like moths to a particularly bright, flickering flame – growth stocks, they call ’em. Perfectly reasonable, if you enjoy being singed. But me? I prefer a good, solid bargain. Something overlooked, undervalued, the sort of thing a sensible wizard might find tucked away in the back of a dusty shop. There’s a certain satisfaction in finding value where others see only…well, nothing much at all. And occasionally, a rather handsome profit. I’ve been peering into the crystal ball (a surprisingly unreliable device, prone to showing reruns of cooking programs), and I’ve identified five enterprises that, while not exactly shouting their worth from the rooftops, might just surprise a few people in 2026. It’s a bit like finding a perfectly good broom leaning against a wall – everyone else is busy building flying carpets, and completely missing the point.

Amazon: The River Runs Deep

Amazon. A name that echoes through the digital forests. Most consider it a titan, a behemoth. And that’s precisely why they miss the bargain. It’s become so…expectedly successful that people forget to actually look at the numbers. In 2025, it didn’t exactly set the world alight, did it? A mere 5% rise. But beneath the surface, things were stirring. Several operating segments were showing genuine muscle. It’s a bit like a slumbering dragon – looks peaceful enough, but you wouldn’t want to poke it with a stick.

The market, of course, is often slow to notice such things. It prefers shiny objects and promises of instant gratification. But a business gaining momentum is a powerful thing. Amazon’s stock has had a modest boost in early 2026, but there’s still plenty of room to run. A sensible investor might consider scooping up a few shares before the market finally catches on. It’s like buying a sturdy pair of boots before the rains come – preparation, you see.

Meta Platforms: The Illusionists

Now, Meta Platforms. A company that’s spent the last few years attempting to convince everyone that strapping screens to their faces is a good idea.1 A bold strategy, to say the least. And the market, predictably, is a bit…skeptical. The S&P 500 currently trades at a rather lofty 22.4 times forward earnings, while Meta can be had for a mere 21.1. Why the discount? Because Wall Street believes Meta is throwing good money after bad on artificial intelligence data centers.

But here’s the thing: Meta’s revenue rose an impressive 26% in the third quarter. Their generative AI investments are starting to bear fruit, improving their ad platform. The illusionists are getting better at their craft. If they can maintain that growth, this discount won’t last. A shrewd investor might see this as an opportunity. It’s like finding a slightly tarnished mirror – a bit of polish, and it’s worth a king’s ransom.

1The pursuit of immersive virtual realities is a long and storied one, dating back to the early days of the Guild of Alchemists and their attempts to create ‘pocket dimensions’. Most ended badly, usually involving rogue garden gnomes and a distinct lack of tea.

The Trade Desk: The Brokers of Attention

The Trade Desk operates in a slightly different realm – the digital marketplaces where attention is bought and sold. They’re essentially brokers, connecting ad buyers with the best places to display their messages. It’s a surprisingly complex business, involving algorithms, data streams, and a healthy dose of guesswork. Revenue rose 18% in the third quarter, which is respectable, but Wall Street seems unimpressed. They want more.

But here’s the rub: 2024 was a particularly noisy year, filled with political advertising. A significant chunk of revenue that won’t be repeated in 2025. This temporary headwind will disappear in 2026, allowing The Trade Desk to post better figures. Trading at 18 times forward earnings, it’s a bargain waiting to happen. It’s like a quiet tavern – overlooked by the crowds, but full of character and good cheer.

Adobe: The Masters of Illusion (Again)

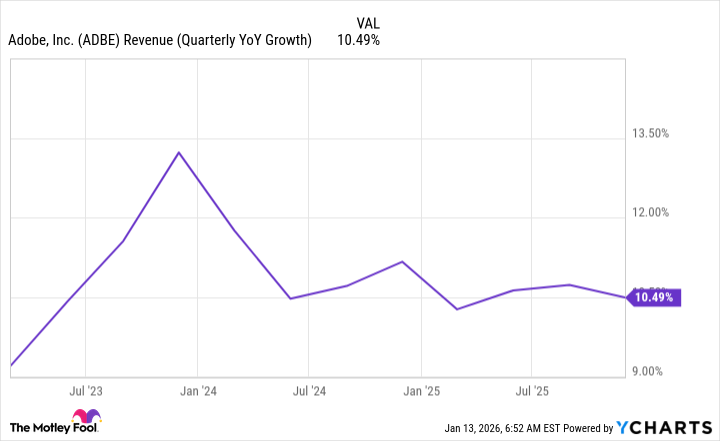

Everyone feared Adobe would be disrupted by generative AI, specifically its image-generation capabilities. A perfectly reasonable concern, given their dominance in the creative software space. But Adobe has proven remarkably resilient, delivering double-digit revenue growth quarter after quarter. They’ve adapted, innovated, and continued to provide valuable tools for artists and designers.

Despite this success, Adobe’s stock is down around 50% from its all-time high. A rather dramatic fall, wouldn’t you say? But it also means their share repurchases are more effective, driving up diluted earnings per share. Trading at around 14 times forward earnings, it’s a steal. It’s like discovering a hidden library – full of forgotten knowledge and untold stories.

PayPal: The Keepers of the Purse

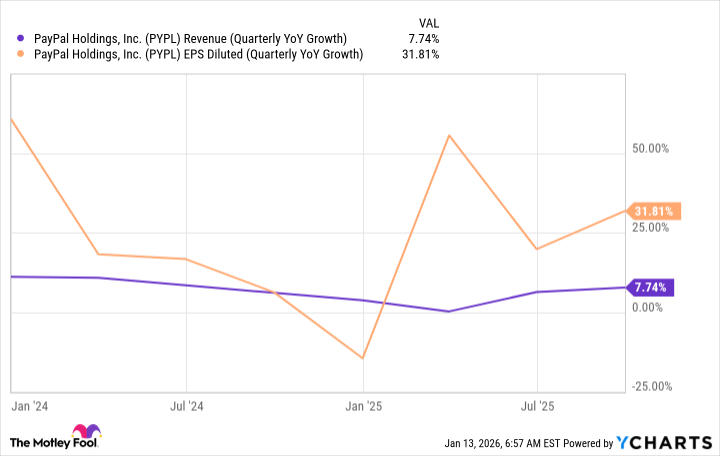

PayPal takes the prize for the cheapest stock on our list, trading at a mere 10 times forward earnings. A truly remarkable valuation. Growth isn’t spectacular, hovering around the mid-single-digit levels, but they’re channeling all their free cash flow into share repurchases, boosting diluted EPS at a double-digit pace. It’s a slow and steady approach, but it’s working.

I suspect PayPal’s stock is due for a rebound in 2026. And with its low price, it won’t even need to trade at a premium to provide a handsome return for investors. It’s like finding a well-maintained treasure chest – not overflowing with gold, but containing enough to make the journey worthwhile.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2026-01-16 16:33