Okay, let’s be real. Finding a stock that isn’t priced like a unicorn’s tears in this market is…challenging. Everyone’s convinced the next big thing is just a TikTok away, and valuations have gone full-on aspirational. But I’ve been poking around, and I’ve found a few companies that seem to have been accidentally left off the hype train. Which, frankly, is a good sign. It means they might actually be…affordable. I’m talking about stocks that could legitimately have a bull run, if people would just stop looking for disruption and start looking at, you know, numbers. So, here’s my watchlist. Don’t tell anyone I told you.

Meta Platforms

Remember when Facebook changed its name to Meta and everyone lost their minds over the metaverse? It was like a corporate midlife crisis. They spent a fortune building digital worlds that, let’s face it, most of us have no desire to inhabit. It was a beautiful distraction, though. While everyone was fixated on avatars and virtual real estate, the actual social media business kept chugging along, quietly funding the whole endeavor. It’s like a magician doing a flashy trick with one hand while pickpocketing you with the other.

Now they’re pouring money into AI, which, if you’ve been paying attention, is everything right now. It’s the new kale. The new avocado toast. The new…well, you get the idea. They’re building data centers like they’re trying to win a digital arms race. And unlike the metaverse, there’s actual evidence that this AI stuff is working. People are spending more time on their platforms, and ads are actually converting. Progress! Wall Street is hyper-focused on the spending, which is fair, but they seem to be missing the fact that Meta is, shockingly, making money while doing it.

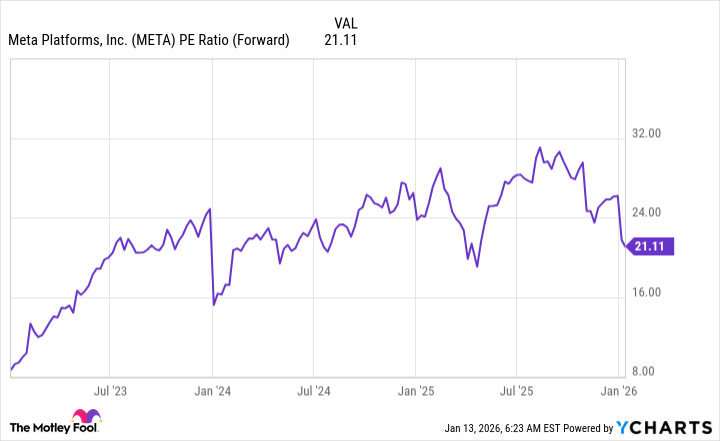

At 21 times forward earnings, it’s a relative bargain compared to its big tech peers, who are trading at a premium because…reasons. And it’s cheaper than the S&P 500. It’s not a screaming buy, but it’s a solid company trading at a reasonable price. Which, in this market, feels like a revolutionary concept.

Adobe

Everyone’s convinced that generative AI is going to kill Adobe. That image generation is so good, graphic designers are going to be out of a job. It’s the plot of every sci-fi movie ever made, except with pixels instead of robots. But here’s a radical thought: what if Adobe embraced the AI revolution? What if they integrated it into their products to make designers more powerful?

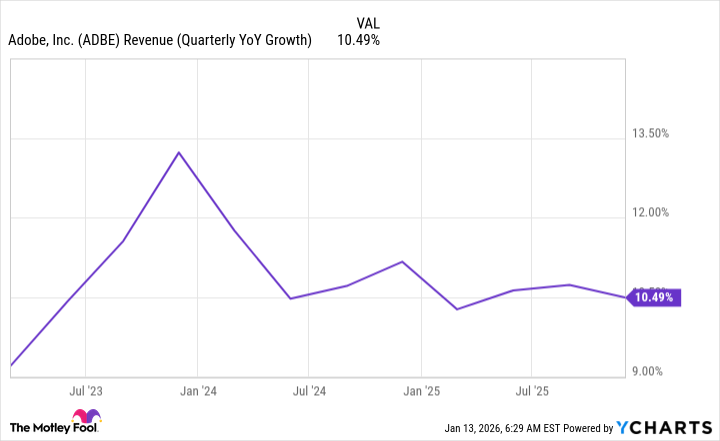

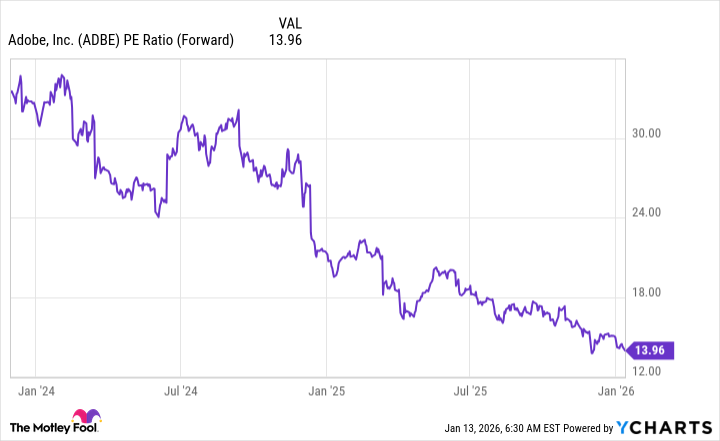

Turns out, that’s exactly what they’re doing. And their revenue growth hasn’t even hiccuped. It’s still in the low double digits. The market, apparently, hasn’t noticed. They’re still waiting for the apocalypse. As a result, Adobe is trading at a dirt-cheap valuation. It’s like they’re giving it away. If Adobe can keep growing, this is a stock that could really take off. Which, let’s be honest, feels like a fairly safe bet.

The Trade Desk

The Trade Desk had a rough 2025. It was one of the worst-performing stocks in the S&P 500. But I’m betting on a comeback in 2026. They operate a buy-side ad platform, which basically means they help businesses find the best places to put their ads online. It’s not glamorous, but it’s essential. Revenue growth has slowed, but it’s still a solid 18%.

Yet, the stock trades at less than 18 times earnings. That’s ridiculously cheap. If they can deliver high double-digit growth at a reasonable premium to the market, this stock could really outperform. It’s not a guaranteed win, but it’s a value play that I’m willing to make. And in this market, finding anything that resembles value feels like finding a unicorn. A reasonably priced unicorn, at that.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2026-01-17 20:22