The aviation industry, like any other, operates on a simple principle: things break. And when things break, someone profits. Two companies, FTAI Aviation and Hexcel, offer a glimpse into this reality, though their approaches differ. While both present opportunities for investment, a closer examination reveals a fundamental distinction. It is not a question of choosing between them, but understanding where each fits within the larger, often opaque, workings of the aircraft supply chain.

The Logic of Spare Parts

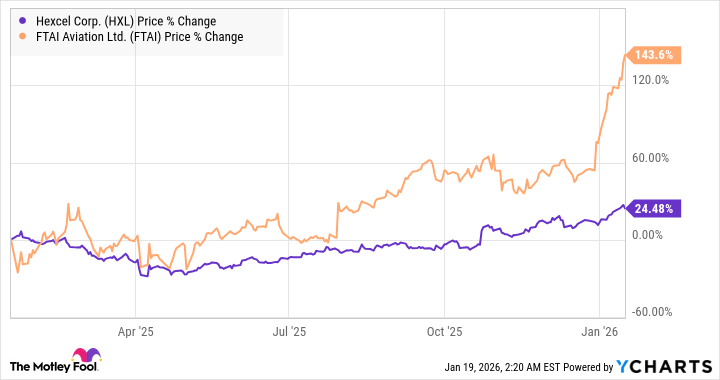

FTAI Aviation concentrates on the ‘aftermarket’ – the business of keeping existing aircraft flying. Hexcel, conversely, supplies materials to manufacturers for new builds. This division of labor is significant. An investor might assume a rising tide of aircraft production benefits all involved. And it does, to a point. But the industry is rarely so straightforward. Delays in new aircraft deliveries – a persistent ailment afflicting both Airbus and Boeing – do not halt the need for maintenance. Quite the opposite. Older aircraft remain in service longer, increasing demand for spare parts and repair services. FTAI, therefore, benefits from the very problems plaguing its counterparts in the original equipment market.

This dynamic is mirrored in the performance of GE Aerospace, a company adept at extracting value from both sides of the equation. FTAI, in many ways, is both a competitor to, and a beneficiary of, GE’s long-term service agreements. It owns, leases, and repairs aircraft engines, focusing on the CFM56 – a workhorse powering countless Airbus A320s and Boeing 737s. While GE Aerospace secures long-term contracts, FTAI steps in when those contracts expire, offering maintenance and repair services. A convenient arrangement, perhaps, but hardly a sign of a healthy, competitive market.

The Allure of Artificial Intelligence

Recently, FTAI’s stock has experienced a surge, fueled by its venture into converting retired CFM56 engines into power turbines for data centers. This pivot towards supplying energy for the burgeoning artificial intelligence industry is presented as an exciting development. It is, undeniably, a clever maneuver, leveraging existing assets to capitalize on a new demand. Similar initiatives, such as GE Vernova’s aeroderivative turbines, demonstrate that repurposing aerospace technology is not uncommon. However, the enthusiasm surrounding this venture should be tempered with a degree of skepticism. It is a diversification, certainly, but it does not fundamentally alter the core business of keeping aging aircraft aloft.

The Future Lies in Materials

Hexel, in contrast, focuses on the materials that constitute the aircraft themselves. Advanced composites – stronger and lighter than traditional aluminum and steel – are increasingly crucial in modern aircraft design. Each new generation of aircraft incorporates a greater proportion of these materials, offering airlines the promise of improved fuel efficiency and reduced emissions. This is not merely a technological trend; it is a necessity, driven by both economic and environmental pressures.

The Boeing 737 provides a stark illustration. While older models utilize a mere 5% composites by weight, the 737 MAX incorporates 15%. This translates to a significant revenue stream for Hexcel, with each aircraft representing a shipset value of $0.2 to $0.5 million. As the aerospace supply chain normalizes and aircraft production ramps up, Hexcel is well-positioned to benefit. It is not simply riding the wave of increased production; it is providing the materials that enable that production in the first place.

The aviation industry is undergoing a transition. The immediate focus has been on resolving supply chain bottlenecks and increasing production. The next phase will be characterized by a shift towards efficiency and sustainability. Hexcel, with its focus on advanced materials, is the logical choice for investors seeking to capitalize on this trend. It is a company that is not merely patching up the existing fleet, but building the future of flight. The choice, therefore, is not between FTAI and Hexcel, but between profiting from the consequences of delayed production and investing in the materials that will define the next generation of aircraft.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-01-24 00:22