As a seasoned crypto investor with a knack for spotting promising projects, I find myself intrigued by the recent developments surrounding Avalanche (AVAX). The successful $250 million fundraising round led by reputable firms like Galaxy Digital, Dragonfly, and ParaFi Capital is a testament to the confidence investors have in Avalanche’s potential.

The Avalanche Foundation secured $250 million in funds through a privately organized token sale that was primarily managed by Galaxy Digital, Dragonfly, and ParaFi Capital. Subsequently, following the announcement, AVAX prices experienced a surge of approximately 9%, trading at $52.80.

After Bitcoin‘s rise to surpass $100,000, causing the crypto market to pause, Avalanche appears to be preparing for an upward trend.

Avalanche Raises Funds Ahead of Upcoming Network Upgrade

As a proud investor in Avalanche, I’m thrilled to share that more than 40 prestigious investment firms have joined forces in a significant $250 million funding round, an exciting development announced by the Avalanche Foundation. This announcement comes hot on the heels of the launch of Avalanche9000 testnet, which took place on November 25. I’m eagerly looking forward to witnessing the growth and potential this partnership brings to our crypto journey!

The Avalanche9000 update is set to be activated on the primary network on December 16th. This update is designed to decrease deployment costs on the blockchain by an astonishing 99.9%, enable inter-network communication, and unleash approximately $40 million in incentives for developers.

According to a post by the Avalanche Foundation on platform X (previously known as Twitter), Avalanche9000 is pioneering the future of L1 blockchains that are highly scalable and specifically designed. Currently, more than 500 such L1 chains are under construction in various sectors such as tokenization of real-world assets, loyalty programs, gaming, payment systems, and institutional initiatives.

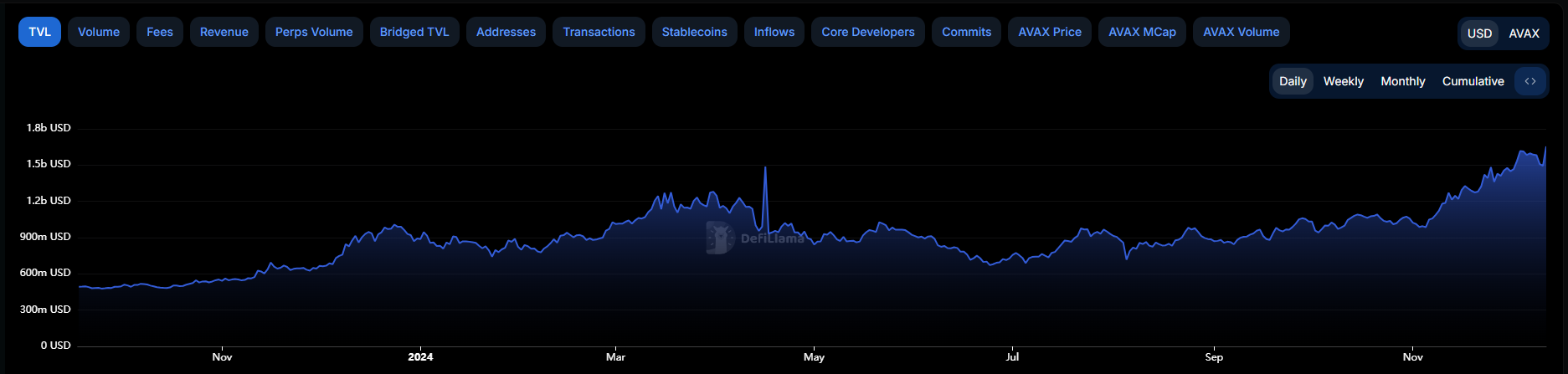

As a crypto investor, I’m excited to share that the Avalanche blockchain has reached yet another significant achievement. The Total Value Locked (TVL) on our network has surpassed $1.65 billion, marking its highest point in nearly two years. This impressive growth underscores the allure of Avalanche within the decentralized finance (DeFi) market, potentially drawing in fresh users and substantial capital.

Over the past month, there’s been a substantial increase in the value of the native token for blockchain called AVAX. Currently, its price stands at $52.80 following a 50% rise since then.

In early December, the token reached over $50, but since it couldn’t sustain its position above $54 on the 9th, it seems to have plateaued around $52. If the positive momentum following the announcement continues, AVAX could potentially surpass $60 and regain its previous peak prices.

Based on the Relative Strength Index (RSI) reading of 62, it seems there’s potential for further price increase before reaching the overbought territory. This notion is also supported by the Bollinger Bands analysis, suggesting that Avalanche (AVAX)’s price movement is becoming more volatile. The widening of these bands following a compression pattern typically indicates an impending breakout.

Although Santiment data indicated that AVAX’s overall sentiment was negative, potentially posing challenges for the token, the substantial trading volumes observed in the last 24 hours suggest a high demand for the cryptocurrency.

At the current moment, it’s shown that about 80% of the AVAX addresses were yielding a profit, while approximately 16% were experiencing losses. This implies that a majority (about 84%) of AVAX holders are currently in a profitable position. If the demand for AVAX increases and its price rises further, those who are in the red now could potentially see their investments turn into profits or reach the break-even point.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-13 02:58