Is Pi Token’s Record Low the Calm Before a Major Comeback?

Since its release in February 2025, the value of PI coin – the cryptocurrency for the Pi network – has been steadily decreasing. Today, it hit a new low of $0.13 during trading.

Since its release in February 2025, the value of PI coin – the cryptocurrency for the Pi network – has been steadily decreasing. Today, it hit a new low of $0.13 during trading.

The forecasts speak of growth, of course. Numbers dance across the screens – fifty percent annual increases, a tripling of investment by the decade’s end. But these are merely the outward signs. Beneath them lies a fundamental shift, a re-ordering of the digital terrain. Taiwan Semiconductor Manufacturing speaks of demand, Cathie Wood of trillions. These are not simply financial projections; they are the echoes of a new world taking form. It is as if the very soil of computation is quickening, preparing for a harvest unlike any seen before.

The divestment, it should be noted, coincided with a period of peculiar volatility for Tencent Music. The stock, a creature of habit and expectation, dipped nearly 25% during that quarter, a fall that likely prompted a reassessment of risk-reward ratios. One imagines portfolio managers, those meticulous gardeners of wealth, compelled to make difficult choices, perhaps with a sigh and a glance at the quarterly reports. The subsequent rally, a 37.2% ascent over the year—a performance that rather outstripped the S&P 500 by a comfortable 25.05 percentage points—only complicates the narrative. Was this a vote of no confidence, or simply a demonstration of disciplined portfolio management?

Bitmine, unlike some of its brethren, didn’t chase the gold rush of Bitcoin. It sought a different vein, a path paved with the potential of Ethereum. And they began to buy, hand over fist, amassing a significant portion of the outstanding tokens – over three percent, to be exact. A bold move, costing some $16.3 billion at the time, predicated on an Ether price of around $3,800. Now, that price is halved, and Bitmine’s holdings feel less like a fortune and more like a weight.

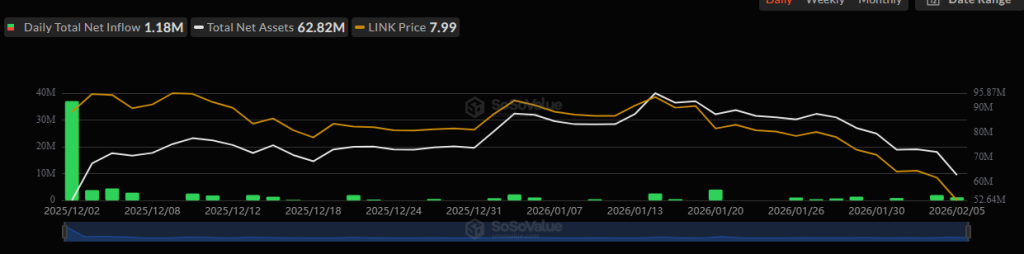

The Chainlink Reserve, that indefatigable juggernaut, marches onward, its coffers swelling to a princely 1.9 million LINK. Funded by the toil of off-chain enterprises and the whispers of on-chain usage, it stands as a monument to long-term sustainability-a beacon of hope in a sea of speculative despair. Yet, let us not forget its true nature: not a siren luring liquidity, but a silent architect of infrastructure.

The shares have diminished by nearly twenty percent since the commencement of trading this week, a figure corroborated by data from S&P Global Market Intelligence. This is not merely a correction; it is a demonstration of the market’s growing discomfort with the inherent contradictions within Iren’s operational structure. The company persists in deriving the vast majority – ninety percent, as of December 31, 2026 – of its revenue from Bitcoin mining, a practice increasingly viewed as…peripheral to its stated ambitions. It is a foundation of sand upon which a digital palace is being constructed.

‘Wanted: Dead’ puts you in the shoes of Lt. Hannah Stone, a member of an elite Hong Kong police unit called the Zombie Unit. Over one week, she investigates a huge corporate conspiracy in a futuristic, dangerous version of Hong Kong. The game, created by Soleil and published by 110 Industries, combines fast-paced, close-combat fighting with third-person shooting. It’s known for being challenging and features exciting, over-the-top action reminiscent of classic hack-and-slash games.

Developed by PlatinumGames and published by Nintendo, ‘Astral Chain’ is a game made specifically for the Switch. Players take on the role of a police officer in a futuristic city who fights threats from other dimensions using a living weapon called a Legion. The game is known for its innovative combat system, allowing players to control two characters at once. While critics praised its graphics and complex gameplay, it hasn’t received as much attention as some other popular Nintendo games.

The current rally appears linked to broader trends within the semiconductor sector, specifically the anticipated capital expenditures of major cloud providers. Amazon (AMZN 6.44%), for instance, has announced a substantial $200 billion spending plan for 2026. Such figures, however, are often presented with a degree of optimism that does not always translate into concrete gains. It is prudent to examine where precisely these funds will be allocated.

One observes such episodes with a certain detached amusement, for history is replete with these phantom menaces, these fleeting anxieties. The market, that capricious beast, is ever prone to fits of hysteria, mistaking shadows for substance. Yet, to dismiss it entirely would be folly. For even the most preposterous rumour can, in the hands of a sufficiently excitable populace, become a self-fulfilling prophecy. And so, Nvidia tumbled, a spectacle for the vultures and the bargain hunters.