Oh là là! MetaMask Users Being Hacked Daily – The Crypto Farce Unveiled! 🎭💰

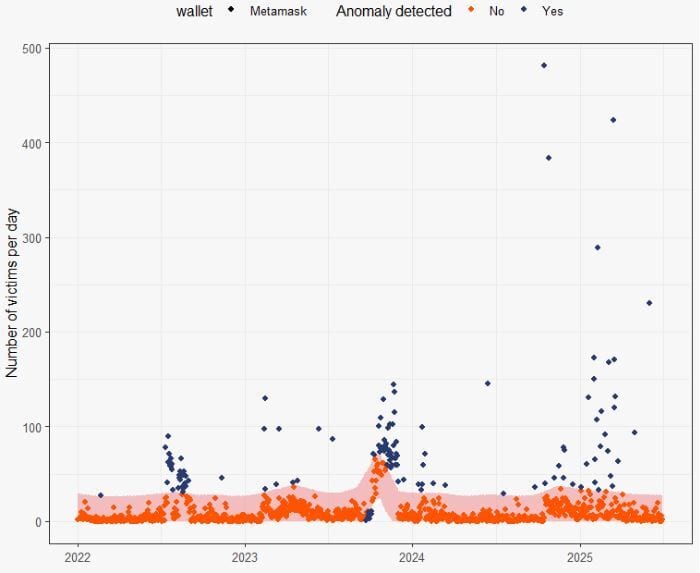

Our pièce de résistance is none other than the audacious heist of Bybit, pilfered by our finest friends from the DPRK — a spectacle of $1.5 billion stolen! Not to be outdone, the charming gents from Chainalysis inform us that our dear MetaMask is not spared from this melodrama, with nearly 500 poor souls falling victim to daily attacks. Sacré bleu!