Australia is reportedly preparing for an influx of Bitcoin ETF launches. Major issuers like VanEck and BetaShares are looking to list their spot Bitcoin ETFs on the Australian Securities Exchange (ASX), according to Bloomberg’s report published on April 28. The ASX is expected to approve the first spot Bitcoin ETFs before the end of 2024.

Australia is preparing for an anticipated increase in the number of Bitcoin exchange-traded funds (ETFs) being launched, as success has been achieved with such offerings in the US and Hong Kong markets.

Based on a Bloomberg report published on April 28, significant entities such as Van Eck Associates Corp. and BetaShares Holdings Pty are preparing to introduce Bitcoin spot ETFs for listing on the Australian Securities Exchange (ASX). The ASX manages most of Australia’s equity trading.

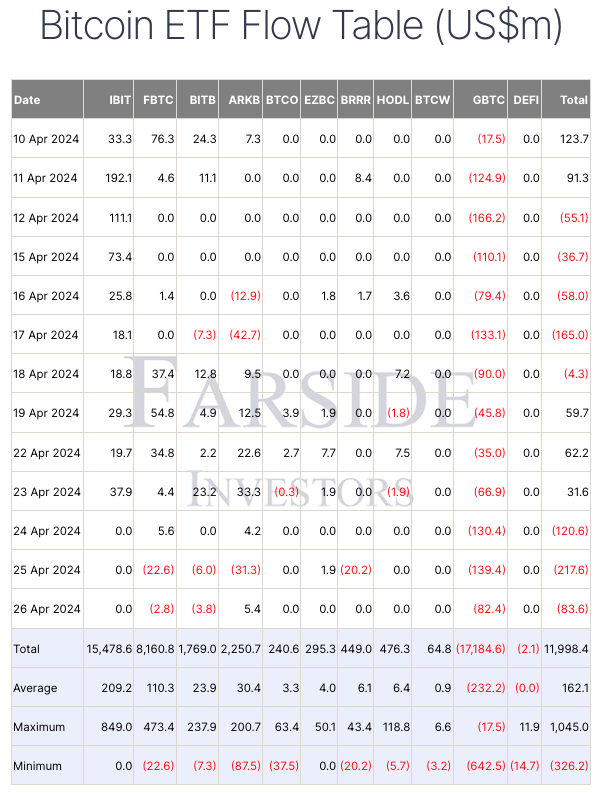

As a crypto investor, I’ve heard from reliable sources that the Australian Securities Exchange (ASX) is planning to approve the first spot Bitcoin Exchange-Traded Funds (ETFs) for its main board by the end of 2024. This decision follows the significant inflows into U.S. spot Bitcoin ETFs this year, with major players like BlackRock Inc. and Fidelity Investments leading the way.

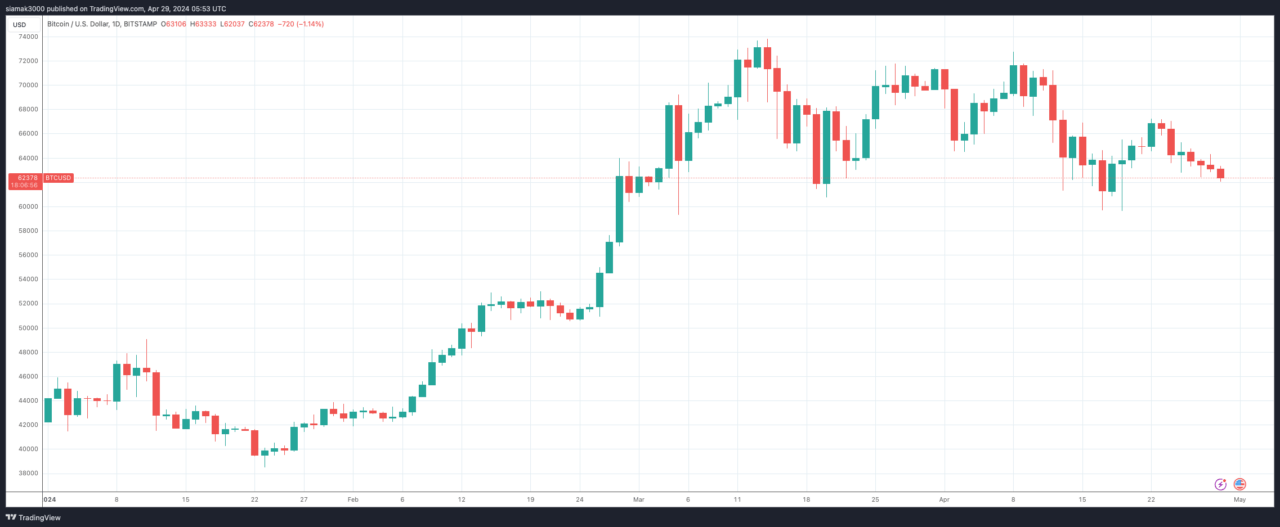

Eager issuers are looking to take advantage of the latest surge in the cryptocurrency market, where Bitcoin hit an all-time peak of almost $74,000 just last month.

According to Bloomberg’s report, BetaShares, a Sydney-based firm, is actively preparing to introduce a new product on the ASX, as confirmed by one of their spokespersons. DigitalX Ltd., another local company, mentioned in their half-year results that they had already submitted an application, while VanEck, which currently offers similar ETFs in the U.S. and Europe, re-submitted its application in February.

Justin Arzadon, the digital assets chief at BetaShares, underscored the importance of US investments, pointing out that they serve as evidence that “digital assets have a permanent place in the financial market.” The firm has reportedly secured ASX tickers for upcoming Bitcoin and Ether Spot ETFs.

The Bloomberg analysis indicates that Australia’s $2.3 trillion pension sector is projected to contribute substantially to the investment in emerging ETFs. Approximately 25% of the nation’s retirement savings are managed through self-managed superannuation schemes, enabling individuals to select their preferred investments. This large and diverse market consisting of self-managed super funds, brokers, financial consultants, and digital platforms represents a lucrative target for crypto ETF offerings, as suggested by Jamie Hannah, deputy head of VanEck Australia’s investment and capital markets division.

The current surge in Bitcoin ETF applications in Australia represents a second attempt at listing these products, having first emerged on CBOE Australia, the nation’s smaller exchange, two years ago. Previous fund launches by Cosmos Asset Management and Global X 21Shares have faced challenges such as limited inflows or delisting. Nevertheless, issuers continue to express confidence in the potential of ASX-listed Bitcoin ETFs.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All 6 ‘Final Destination’ Movies in Order

- 10 Shows Like ‘MobLand’ You Have to Binge

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

2024-04-29 09:06