Crypto ETFs, with all the subtlety of a well-timed quadrille, delivered a week of midweek grandeur, though Friday’s frothy tempest did little to dampen their spirits. Bitcoin and ether ETFs, the toast of the market’s drawing rooms, led the dance, while XRP and Solana, ever the quiet wallflowers, extended their modest charm.

Exchange-traded funds (ETFs), much like the January assemblies of Bath, told a tale of sharp rotations, fervent convictions, and a resilience that would make even Mr. Darcy blush. Though the finale was as volatile as a debutante’s nerves, institutional appetite remained steadfast, as if the market had just sipped a calming infusion of lavender and reason.

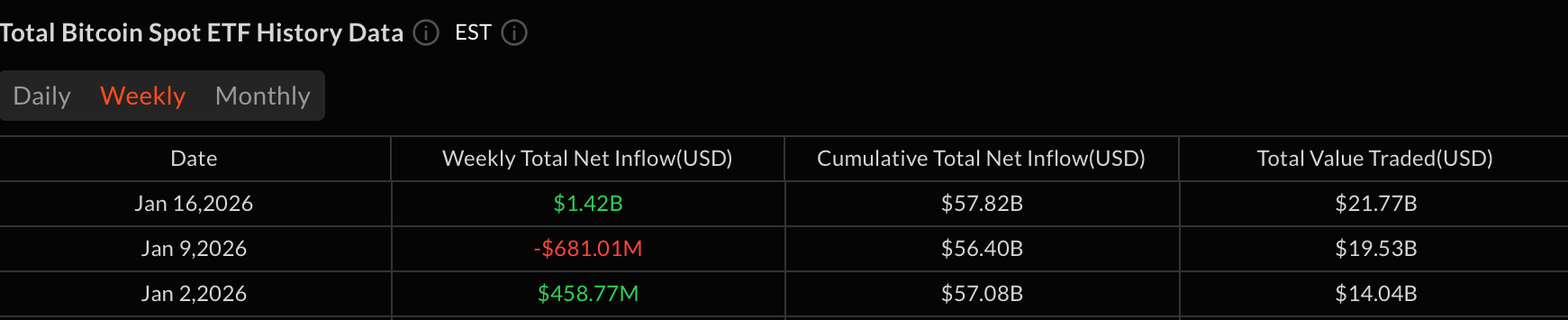

Bitcoin ETFs, with a net inflow of $1.42 billion, proved themselves the paragon of midweek vigor. Blackrock’s IBIT, the undisputed belle of the ball, secured $1.03 billion in inflows, its Jan. 14-15 grand entrance so grand it rendered Friday’s selling a mere hiccup in the opera. Fidelity’s FBTC, though slightly red-faced on Friday, managed to close with $194.40 million, a feat that would have impressed even the most fickle of financiers. Grayscale’s GBTC, meanwhile, remained as flat as a well-baked soufflé, while Ark & 21Shares’ ARKB and Bitwise’s BITB clung to marginal positivity with the tenacity of a lady determined to outlast the season’s gossip.

Ether ETFs, with $479.04 million in inflows, danced into the week’s spotlight, their $7.74 billion trading volume a spectacle fit for Pemberley itself. Blackrock’s ETHA, the undisputed leader of the evening, waltzed in with $219.05 million, setting the tone with the grace of a seasoned hostess. Grayscale’s Ether Mini Trust and ETHE, ever the steady companions, added $123.38 million and $76.74 million respectively, while Fidelity’s FETH, after a midweek flourish, closed slightly positive, much to the relief of its more anxious patrons.

XRP ETFs, with $56.83 million in inflows, proved that even the quietest guests can command attention. Grayscale’s GXRP, the unsung heroine, contributed $23.75 million, while Bitwise’s XRP and Franklin’s XRPZ added their modest but charming support. Alas, Friday’s volatility, like a sudden chill at a summer ball, cast a shadow over their otherwise elegant performance.

Solana ETFs, with $46.88 million in inflows, tiptoed into the week’s narrative, their $209.13 million volume a testament to their understated charm. Bitwise’s BSOL, the ever-reliable confidante, led with $32.23 million, while Fidelity’s FSOL and Grayscale’s GSOL added their quiet contributions, even as Friday’s profit-taking threatened to dim the glow.

The week’s tale, much like a well-crafted novel, reinforced the market’s January theme: short-term volatility, though a tempest in a teacup, has done little to shake the institutions’ convictions. Dip-buying behavior, as steadfast as a gentleman’s loyalty, ensures the ETF’s continued prosperity. One might say the broader structure remains “constructive” as the market glides into late January, much like a carriage ride through the countryside-smooth, if occasionally punctuated by the occasional pothole 🚗💨.

FAQ📈

- Why did crypto ETF flows remain positive despite late-week selling?

Heavy midweek inflows, particularly from institutions, proved as fortifying as a hearty stew, easily counteracting Friday’s fleeting panic. - Which crypto ETFs led inflows this week?

Bitcoin and Ether ETFs, led by BlackRock’s IBIT and ETHA, commanded the dance floor with the poise of seasoned hosts. - How did XRP and Solana ETFs perform during the week?

Both extended their momentum with the subtlety of a well-placed compliment, though Friday’s volatility threatened to spoil the harmony. - What does this signal for crypto ETF sentiment in January?

The data, much like a well-turned phrase, suggests sustained institutional confidence and a penchant for dip-buying that would make even the most skeptical observer reconsider their stance.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-19 16:08