I’ve always found the stock market’s euphemisms amusing. When my broker says “market correction,” what they really mean is “brace yourself for the financial equivalent of tripping over a garden hose in front of the Queen.” August, apparently, was a month of hose-related trauma for three S&P 500 companies who decided to channel their inner clowns. The index itself kept its winning streak going like a particularly determined Bingo caller, but not everyone got to dab.

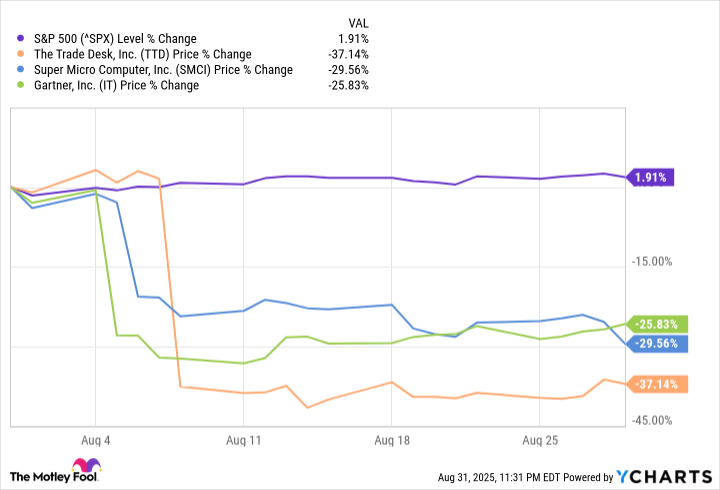

The Trade Desk (TTD) lost 37% of its value-roughly the same percentage of my faith in humanity that evaporated during my last family Zoom call. Revenue growth slowed to 19%, which sounds decent until you realize their previous CFO had held the job since the Obama administration. The new hire started on August 21st, which feels like trying to learn the alphabet while being chased by wolves. Meanwhile, stricter privacy rules loom like a neighbor who won’t stop borrowing your hedge trimmer and returning it broken.

Super Micro Computer (SMCI) deserves credit for consistency: they missed earnings estimates with the same reliability my cat misses the litter box when we have guests. Their 2026 revenue guidance dropped from $40B to $33B, which is like telling your kid they can have a pony, then a goldfish, then just a sticker. Investors weren’t thrilled-they’d been pricing SMCI like a Michelin-starred restaurant when it turns out they’re a gas station hot dog stand.

Gartner (IT) delivered the corporate equivalent of showing up to a job interview with mismatched socks. Total contract value increased a meager 4.9%, which I suppose is better than negative growth but not by much. They cut 2025 guidance while insisting everything’s fine, darling-sort of like when my sister claims her third divorce was “mutually beneficial.”

Investing in these stocks this August felt like buying a “Get Rich Quick” seminar on a whim. Sometimes you just have to laugh, though I’d settle for not crying into my spreadsheet cells. 📉

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-04 17:23