Those of us who remember the last time atoms were fashionable – a period historians now refer to as ‘The Slightly Glowing Years’ – might recall a certain… apprehension. It wasn’t so much the physics, you understand, as the general air of ‘things going horribly, horribly wrong’. The Cold War, Chernobyl, and a distinct lack of reassuring public relations all conspired to give nuclear power a rather bad name. A bit like trying to sell insurance to a dragon.

Times, as they are wont to do, have shuffled on. And investors, bless their optimistic souls, are forever searching for the next big thing. The current refrain of a ‘nuclear renaissance’ is, admittedly, a bit overused – it’s bandied about like a particularly enthusiastic goblin with a shiny bauble. But there’s a kernel of truth to it. Nuclear isn’t just a ‘clean’ energy source – a term that feels suspiciously like rearranging deckchairs on the Titanic – it’s become absolutely vital to the current mania for Artificial Intelligence.1 Turns out, all those servers need a lot of power. Who knew?

The Exchange Traded Fund industry – a collective of alchemists and venture capitalists if ever there was one – has, naturally, seized upon this opportunity. Today, the market is awash with funds dedicated to nuclear energy or the companies that dig up the stuff that makes it go boom. One of the more intriguing is the Range Nuclear Renaissance Index ETF (NUKZ +5.03%).

Apt Ticker, Significant Returns

From a marketing perspective, someone deserves a bonus. ‘NUKZ’ is memorable, which is more than can be said for most ETF tickers. But a clever name doesn’t explain why this relative newcomer – barely two years old – has amassed over $808 million in assets under management. That’s a significant sum, even in a world where money seems to multiply like gremlins after midnight. It’s not backed by one of the usual behemoths of the fund management world, which makes its success all the more… interesting.

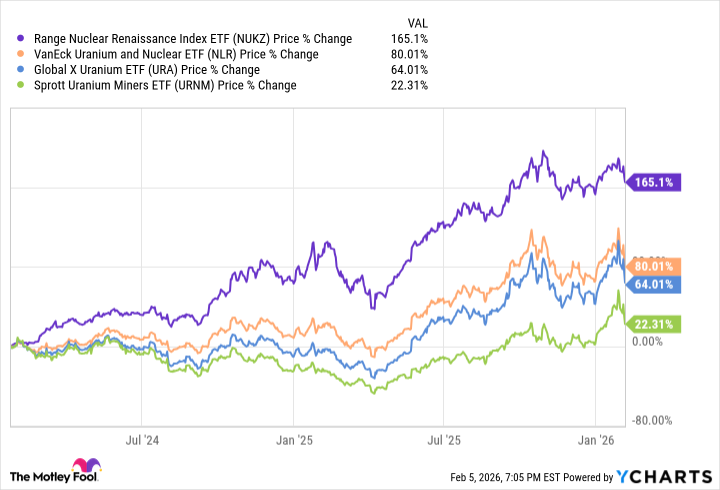

Fortunately for those who took a punt, the Range ETF has been rewarding their faith, easily outperforming several of its more established rivals. Which begs the question: what’s their secret? Is it a team of highly-trained squirrels managing the portfolio?2

Knowing an ETF is doing well is only half the battle. Understanding why it’s doing well is the crucial bit. In this case, it’s an index fund, so active management isn’t the answer. The composition of the Range Nuclear Renaissance index, however, sheds some light on its success. It’s not simply a bet on uranium prices, it’s a surprisingly nuanced play on the entire ecosystem.

At the sector level, this ETF is heavily weighted towards energy stocks (13.20% versus a category average of 2.14%). But the real surprise is its nearly 55% allocation to industrial stocks – more than double the average. This isn’t a pure commodities play, it’s a bet on the companies building the future of nuclear power.

This fund isn’t as exposed to raw material price fluctuations as some might expect. Instead, it’s deriving upside from some rather unexpected names. For example, GE Vernova (GEV +5.58%) and Lockheed Martin (LMT +2.28%) probably aren’t the companies most investors would associate with a nuclear ETF. But they make the cut for the Range ETF, and that’s been a positive for its owners. It seems someone realized that building the reactors, and the things that go in the reactors, is just as important as the fuel itself.

Geographic Diversification, Defensive Posture

This ETF has other perks worth noting. It’s a global fund, with over a third of its holdings in companies based outside the U.S. This might appeal to investors who want some domestic exposure while capitalizing on opportunities elsewhere. It’s a sensible approach, given that the pursuit of atomic power isn’t limited by national borders.

Then there’s the fund’s moderately defensive positioning, with an almost-28% allocation to the utilities sector. This is more than double what you find in competing funds, and could provide some protection if the recent tech sell-off continues. It’s a bit like having a sturdy brick wall around your more volatile investments.

The one drawback is the 0.85% expense ratio. It’s not cheap, by ETF standards. But if this ‘atomic renaissance’ truly takes hold, this ETF might be worth paying a premium for in the long run. After all, a little extra cost is a small price to pay for a potentially explosive return.

1

The demand for energy from AI is, frankly, terrifying. We’re talking about powering entire digital worlds, and the electricity bills alone could bankrupt a small kingdom.

2

We’ve investigated this theory, but the squirrels remain uncooperative.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-08 14:53