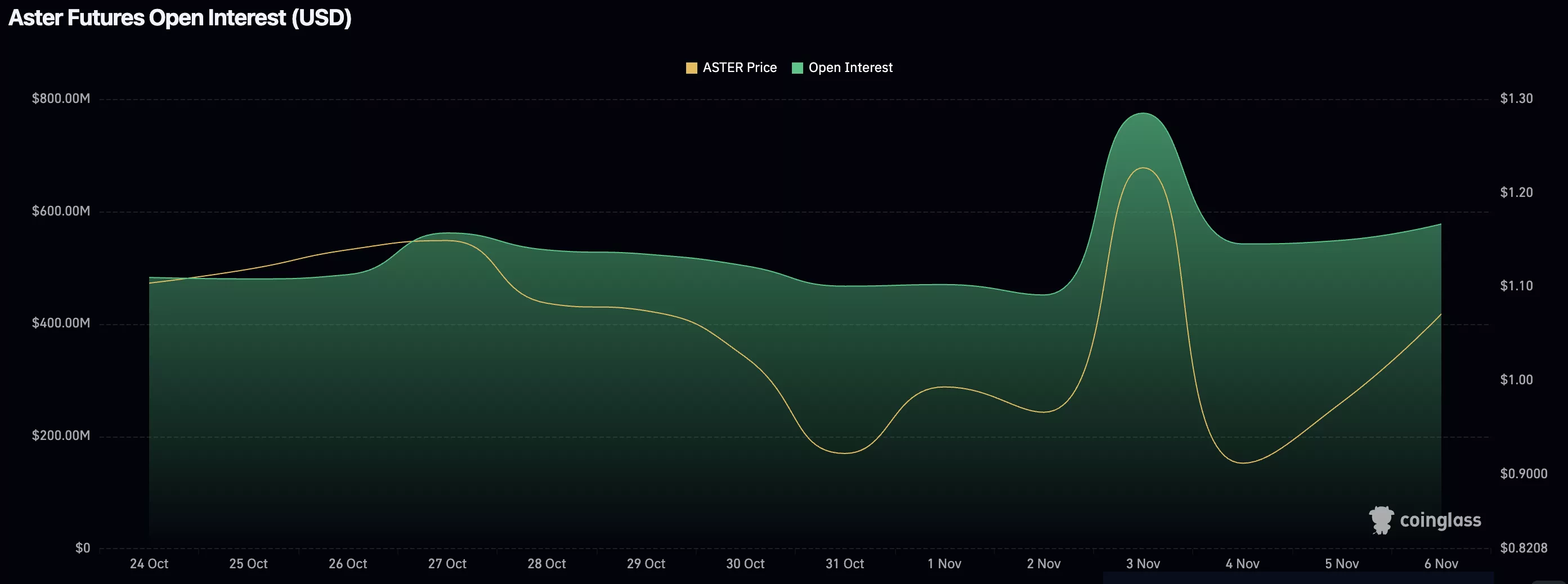

Ah, the glorious Aster, currently lounging above the $1 mark like a wizard on a particularly comfy broomstick. Open interest is climbing faster than a troll up a beanstalk, and the market’s twitching like a cat eyeing a canary. Could volatility be the next uninvited guest at this party? 🥳💥

- Aster’s clinging to the $0.93-$1.00 region like a goblin to its gold, with bullish confluences that would make even a dwarf blush. 💪✨

- Open interest is rising, which means traders are as busy as a hive of bees-and we all know what happens when bees get excited. 🐝🌀

- If it stays above $1, we might see a rally to $1.28, though that’s about as certain as a sober night in the Mended Drum. 🏰🤞

Aster (ASTER), the plucky little coin, has been holding its ground above the $1 psychological level, which is more than can be said for some of us after a night at the pub. Recent volatility has been like a Discworld winter-unpredictable and a bit chilly. But hey, early signs of stabilization are here, and futures open interest is climbing like a climber with a climbing habit. Traders are positioning for a breakout, though whether it’s a breakout of joy or despair remains to be seen. 🤔🎢

With technicals and derivatives aligning like stars over Ankh-Morpork, the next few days could be as exciting as a visit from the Ankh-Morpork City Watch. 🌟👮

Aster’s Magical Price Points:

- Major Support: $0.93 region – includes a bullish order block and the 0.618 Fibonacci level, which is about as magical as numbers get. 🧙♂️✨

- Resistance Target: $1.28 swing high – the key to a bullish continuation, or so the tea leaves say. 🍵🔮

- Market Indicator: Rising open interest, because traders are never short on opinions or positions. 📈🗣️

Technically speaking, Aster’s sitting pretty in the $0.93 to $1.00 support region, a zone so crucial it makes the Unseen University’s library look like a pamphlet stand. This area’s got more confluences than a wizard’s staff has runes, including the 0.618 Fibonacci retracement and a bullish order block. It’s a foundation stronger than a dwarf-built bridge-provided the daily candles don’t go all wobbly and close below $0.93. 🕯️🏗️

The $1 mark is also a psychological barrier, as vital as a hat to a wizard. If Aster keeps its feet above this line, it might just waltz toward $1.28, the previous swing high that’s been playing hard to get. 💃🚪

On the derivative side, the uptick in futures open interest is like a crowd gathering for a public execution-everyone’s watching, and no one’s quite sure what’ll happen. Rising open interest usually means fresh capital’s flowing in, and this time, it’s got a bullish bias. Optimism’s in the air, though we all know optimism can be as fleeting as a sourcerer’s promise. 🤑🌬️

While this could amplify the upside, it also means leveraged positions are stacking up like pancakes at a dwarf breakfast. If Aster loses its $0.93 support, liquidation pressures could kick in faster than a troll’s temper. But as long as it holds, the bulls seem to have the upper hand-for now. 🐂⚖️

What’s Next in Aster’s Grand Adventure?

Aster’s at a crossroads, like a traveler deciding whether to take the safe path or the one guarded by dragons. Holding above $1 could send it marching toward $1.28, while growing open interest suggests a volatile breakout phase is on the cards. But a daily close below $0.93 would turn this bullish tale into a bear’s picnic. So, grab your popcorn and your lucky amulet-this ride’s just getting started. 🍿🐻

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2025-11-06 20:10