The shares of AST SpaceMobile (ASTS 7.33%)—a company attempting to lasso the very heavens for bandwidth—experienced a rather pronounced descent today. A curious phenomenon, perhaps, but hardly unprecedented in the capricious ballet of market valuations. The proximate cause? The announcement by Blue Origin—Jeff Bezos’s other, rather ambitious, preoccupation—of its own foray into orbital communications, christened ‘TeraWave.’ The ripple effect, predictably, dampened the enthusiasm for both AST SpaceMobile and its competitor, EchoStar, though one suspects the latter was already comfortably numb.

As of 2:25 p.m. ET, the stock had relinquished 13.4% of its value. A sum, incidentally, that could purchase a rather respectable collection of antique telescopes—or, failing that, a moderately sized asteroid.

Blue Origin’s Orbital Overture

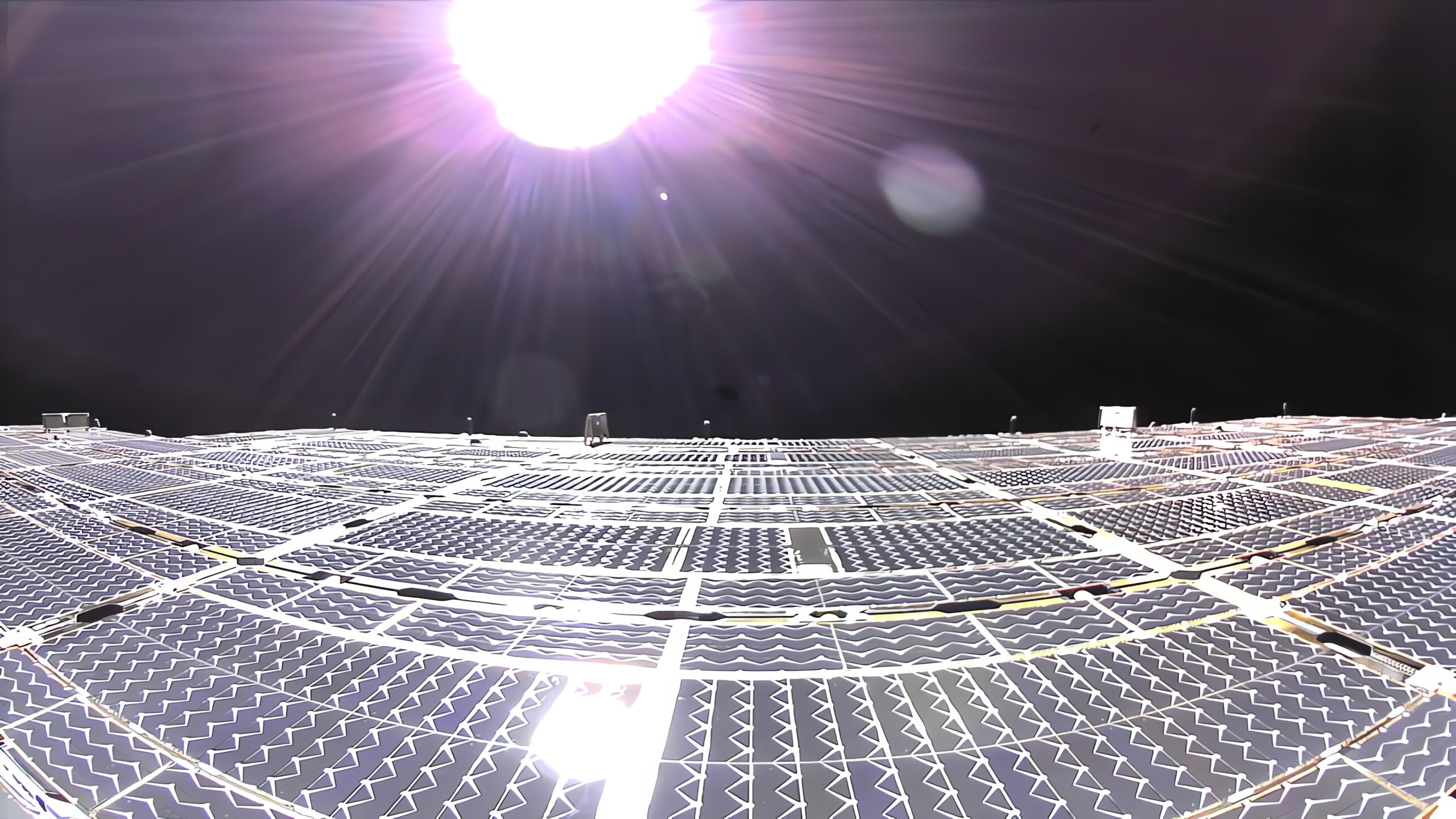

Blue Origin, in a press release redolent of technological hubris, unveiled TeraWave—a network promising 6 terabytes per second (Tbps) of bandwidth, delivered by a constellation of 5,408 optically interconnected satellites. The sheer scale of the undertaking is, admittedly, impressive—a digital nervous system woven across the firmament. They envision supporting tens of thousands of users, spanning enterprises, data centers, and governments—a veritable panopticon of connectivity. One wonders if they’ve considered the aesthetic implications of such a dense orbital tapestry.

Deployment, should all go according to plan, is slated to begin in the fourth quarter of 2027. A date, I observe, conveniently far enough in the future to allow for a generous margin of optimistic projection.

The Implications for AST SpaceMobile

AST SpaceMobile, having recently commenced monetization—a modest $14.7 million in revenue during the third quarter—anticipates a revenue surge to $35-$50 million in the fourth. A respectable ascent, certainly, though hardly a launch into the stratosphere. The company has, it must be said, attracted a valuation on Wall Street that is…generous. Investors, it seems, perceive a substantial potential in space-based internet connectivity—a vision that, while not entirely fantastical, appears to have been seasoned with a rather potent dose of wishful thinking.

The competition, of course, is already considerable. Elon Musk’s Starlink looms large, a constellation of satellites already casting its shadow across the digital landscape. Another contender—Blue Origin—is hardly a cause for immediate panic, though its emergence warrants a degree of circumspection. The market, after all, has a peculiar fondness for punishing exuberance.

The current pullback, I suspect, is less a reaction to the competitive threat and more a recalibration of expectations. Blue Origin’s satellites, after all, will not be operational for nearly two years—a timeframe that allows ample opportunity for unforeseen complications—or, indeed, for AST SpaceMobile to demonstrate tangible progress. The stock, however, is currently trading at a price-to-sales ratio of roughly 200, even assuming AST achieves its ambitious 2026 revenue target of nearly $200 million. A figure that, while impressive on paper, suggests that a considerable degree of optimism is already baked into the valuation. Volatility, therefore, is likely to remain a persistent companion.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 23:23