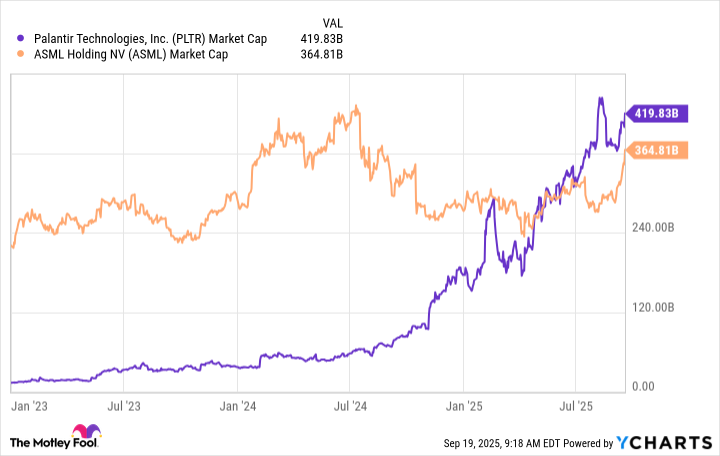

Behold, dear reader, a most curious spectacle: a stock market farce wherein Palantir Technologies (PLTR), that sprightly upstart, has leapt onto the stage with such exuberance that its valuation now swells to $420 billion. Yet beneath this grand pantomime lies a truth as plain as Molière’s The Miser-a truth that ASML (ASML), the unassuming Dutch artisan, shall one day render in ironical relief. Three years hence, when the curtain falls, the sage investor shall marvel not at Palantir’s fireworks but at ASML’s quiet mastery.

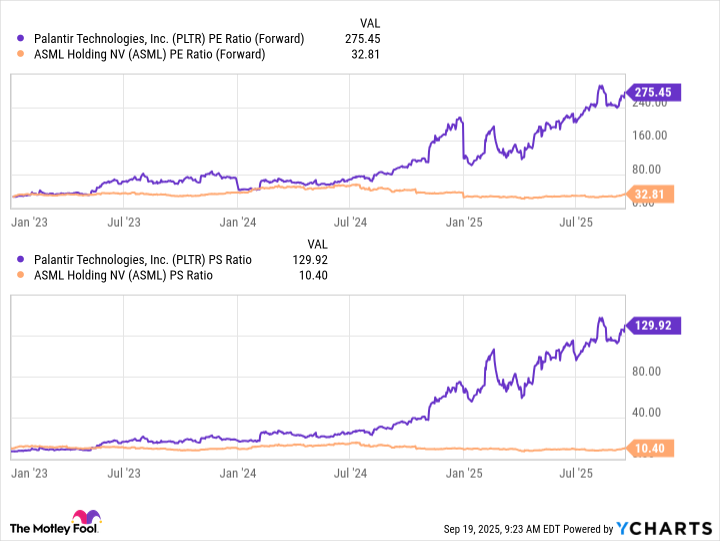

ASML, that unsung architect of the silicon age, crafts machines so wondrous they etch the very fabric of artificial intelligence into silicon. Yet its stock, like a poet in a court of jesters, languishes at $365 billion. Palantir, by contrast, struts about with a market cap inflated by 130 times sales and 275 times forward earnings-a jest in earnest, a delusion dressed in numbers. One might call it The Imaginary Invalid of equities, propped up by fevered hopes and quarterly revenue gains that, while spry (48% year-over-year), fall far short of justifying such celestial valuations.

Act I: The Delusion of Per-Share Prestige

“But lo!” cries the novice investor, “Palantir’s shares trade at $170, while ASML’s approach $900! Is this not proof of superiority?” Ah, noble spectator, you mistake the gilded trinket for the treasure itself. A company’s true worth lies not in the price per share but in its market cap-the sum of all shares, a metric as immutable as the laws of comedy. Palantir’s recent ousting of ASML from its perch is but a fleeting scene, sustained by the same irrational fervor that once made tulips the objects of mania.

Observe this chart, where Palantir’s ascent resembles a courtier’s rise on flattery alone. Yet when the music stops, the dancers must sit. ASML, with its monopoly on extreme ultraviolet lithography machines, holds the plot’s secret: without its EUV printers, the AI models of Palantir and all its ilk would be but philosophical musings. A technological deus ex machina, ASML’s machines are the unsung chorus of this drama.

Act II: The Monopoly of Prudence

Palantir’s folly is its overreliance on ephemeral hype, while ASML, like a Molière protagonist, wields the sword of prudence. Its management forecasts a 44-60 billion euro market by 2030-a conservative estimate, to be sure, yet one that eclipses its current 32.2 billion euro revenue. The Dutch company’s valuation, modest for a firm with a technological moat deeper than the Rhine, hints at a role reversal: the jester’s crown shall pass to the sage.

And so the moral of this farce unfolds: to build wealth, one must discern between the courtier’s bluster and the artisan’s quiet genius. Palantir’s stock, overvalued as a nobleman’s estate in a comedy of errors, faces a reckoning. ASML, the unseen hand shaping the future, shall inherit the stage. Three years hence, the market shall bow to the silent triumph of silicon. 🎭

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-21 12:02