Here’s our initial take on ASML‘s (ASML -9.00%) fiscal 2025 second-quarter financial report.

Key Metrics

| Metric | Q2 2024 | Q2 2025 | Change | vs. Expectations |

|---|---|---|---|---|

| Net sales | 6.2 billion euros | 7.7 billion euros | 24% | Beat |

| EPS | 4.01 euros | 5.90 euros | 47% | Beat |

| New units sold | 89 | 67 | -25% | n/a |

| Net bookings | 5.6 billion euros | 5.5 billion euros | -2% | n/a |

ASML Management Is Unsure About 2026 Growth

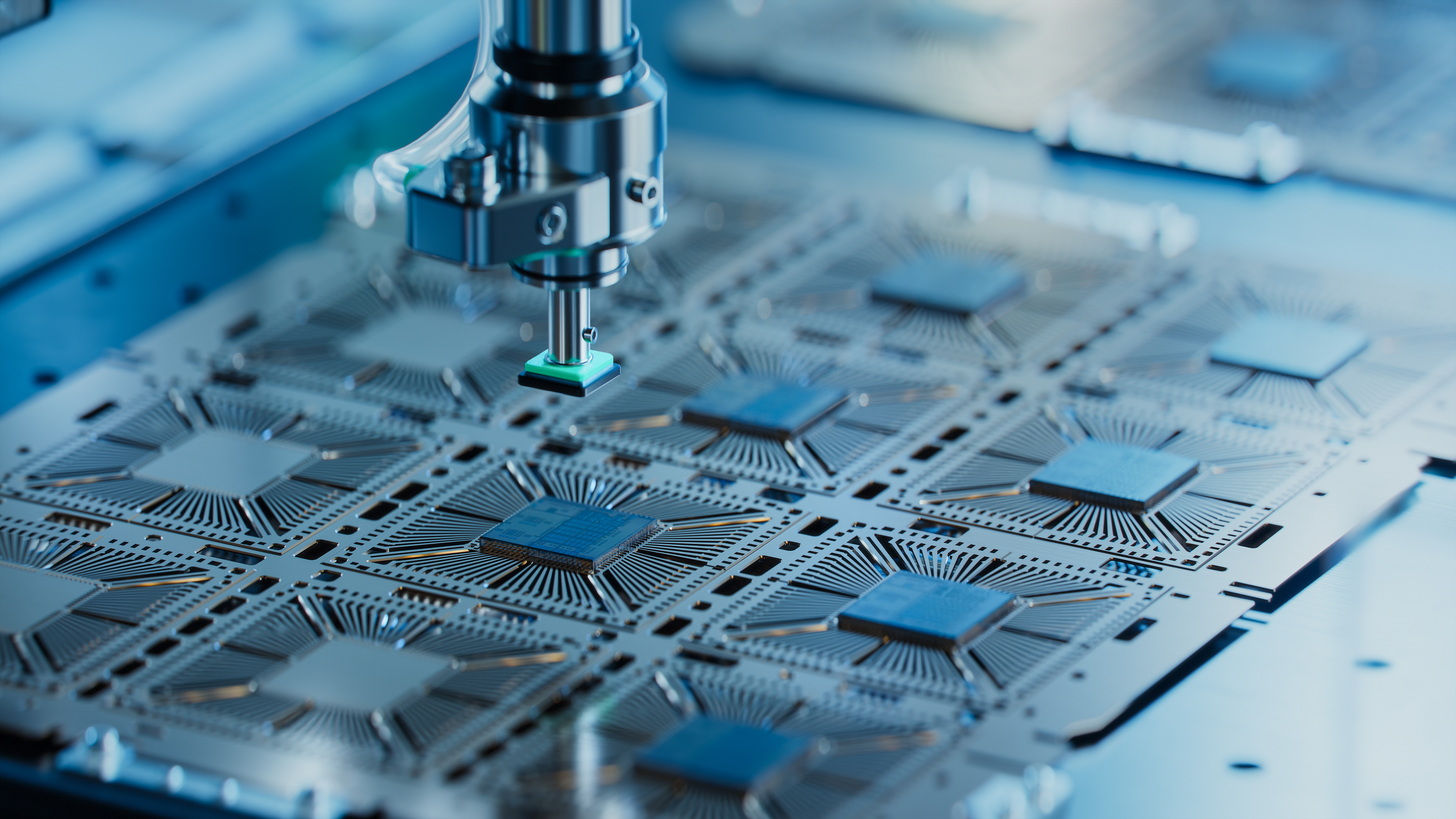

ASML is the leading global supplier of advanced lithography equipment essential for microchip production, with some of their top systems costing approximately $400 million each. The company could greatly benefit from the surge in AI technology, as it increases the need for more chips and the machinery to produce them. However, due to the high cost of these systems, there can be significant fluctuations in profits on a quarterly basis.

Despite reporting a decrease in the number of systems sold this quarter, ASML managed to increase revenue by 24% and earnings by 47% year over year. This suggests that there’s strong demand for their advanced, high-tech lithography equipment, as prices for these devices can vary significantly based on their complexity. In fact, the company booked 5.5 billion euros in total sales this quarter, with approximately 2.3 billion euros coming from orders for more sophisticated systems.

The company generated a gross margin of 53.7% in the quarter.

However, the company expresses concerns about potential stormy conditions ahead, as ASML’s semiconductor clients are grappling with increased uncertainties stemming from trade limitations and tariff regulations. This, in turn, raises doubts regarding future orders up until 2026.

In simpler terms, CEO Christophe Fouquet stated that the foundations of AI customers continue to be robust, however, ASML is encountering growing uncertainties due to economic and political events on a global scale.

Fouquet mentioned that as ASML is yet to fully prepare for expansion in 2026, they can’t guarantee it just yet.

Immediate Market Reaction

Instead of concentrating on the Q2 outcomes, investors paid particular attention to the discussions regarding 2026. Prior to the opening of the New York Stock Exchange, ASML’s shares experienced a decrease of 8% in pre-market trading.

What to Watch

Despite ASML’s conservative outlook for 2026 causing some investor concern following their earnings report, their long-term growth narrative remains robust. As a crucial provider in the supply chain of a critical component within the global economy, the company stands to benefit significantly from ongoing AI investments and digital advancements. Given that spending on semiconductors and the machinery required to manufacture them is expected to persist for years to come, there appears to be a strong demand horizon for ASML’s products.

The geopolitical landscape is swiftly evolving. As recent as this week, the U.S. has lifted a restriction on Nvidia (NVDA) selling its H20 chips in China. In an interview published on ASML’s website along with their earnings report, their Chief Financial Officer, Roger Dassen, mentioned that tariffs had a “less detrimental” effect than expected during the second quarter, partially contributing to the positive results.

If that trend continues, ASML’s caution about 2026 could prove to be overly conservative.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

2025-07-16 21:10