Now, I’ve seen a good many booms and busts in my time, and this here fuss over ASML (ASML +1.64%) reminds me of the gold rush, only instead of digging in the dirt, folks are chasing after silicon. The market, bless its fickle heart, seemed a bit bewildered by their latest earnings report, which is not surprising, considering the general state of things. A five percent jump in pre-market trading, only to vanish quicker than a politician’s promise? That’s Wall Street for you, always eager to get ahead of itself, then trip over its own feet.

Folks were scratching their heads, wondering what it all meant for ASML. But let me tell you, a clear head can see this report wasn’t about one company; it was a sign of the times, a whisper of what’s brewing in the whole semiconductor industry. It’s a bullish sign, plain and simple.

ASML’s Place in the Grand Scheme

You see, ASML sits at the very headwaters of this here chip stream. They don’t make the chips, no sir. They make the machines that make the machines that make the chips. Think of it like this: they sell the picks and shovels to the miners, and when the miners strike gold, well, somebody’s gotta profit, doesn’t they? Taiwan Semiconductor, that behemoth, buys these contraptions, and so do a good many others. Therefore, what ASML’s order books look like is a pretty good indicator of what’s happening downstream. And right now, those books are overflowing.

Bookings jumped from 5.4 billion euros to a whopping 13.2 billion in just one quarter! And the full year? A 48% increase to 28 billion euros. That’s a heap of money, even for those high-tech wizards. Revenue grew a respectable 16% to 32.7 billion euros, but bookings are growing faster, which means they’re anticipating even bigger things. Christophe Fouquet, the CEO, noted a “notable increase and acceleration of capacity expansion planning.” Sounds like everybody’s bracing for a stampede.

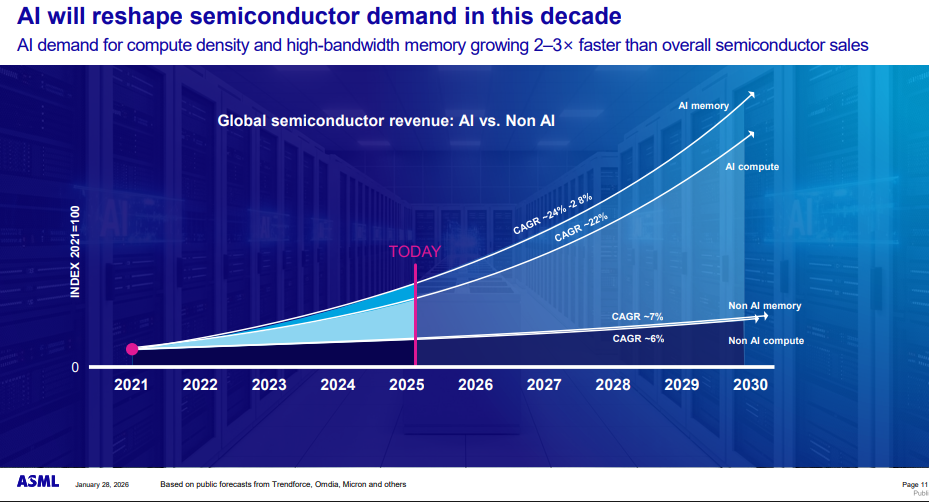

They even shared a chart, showing how this AI business is gaining momentum. Take a look:

As you can plainly see, we’re still in the early innings of this AI game, both for computing power and memory. And both of those segments are expected to grow considerably in the next five years. It’s a sight to behold, if you can stomach the speed of it all.

Why This is Good News for the Chip Folks

These machines ASML sells don’t come cheap. We’re talking tens, even hundreds of millions of dollars apiece. Their customers aren’t going to drop that kind of money on a whim. They need to see demand for those chips, and that’s exactly what’s happening right now. There’s a shortage of memory chips, and other corners of the chip world, especially those tied to AI, are stretched thin.

More advanced chips require more advanced equipment, creating a virtuous cycle that should benefit the entire semiconductor sector. Now, there’ll always be naysayers, folks warning about a bubble. But ASML’s demand is real, driven by a genuine thirst for AI computing power. It’s a good, honest demand, unlike some of the speculative nonsense I’ve seen in my day.

So, if you’re looking for a right smart investment, one that’s tied to something more substantial than hot air, you might do well to keep an eye on ASML. It’s a company that’s building the future, one silicon wafer at a time. And that, my friends, is a sight worth seeing.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2026-01-29 23:32