In the vast expanse of Asia, nations like Vietnam, Singapore, and Thailand are striding forth, like hopeful farmers tilling the soil for a bountiful harvest, crafting a legal framework for the burgeoning crypto sector.

With a swelling tide of users and a clearer sky of regulations, Asia is not just a whisper in the wind; it’s a roaring river, promising to be a fertile ground for the crypto industry come 2025. 🌊

Overview of Crypto Regulations in Asia

Countries such as Malaysia, Thailand, Japan, South Korea, and Vietnam are not just sitting on their hands; they are busy reviewing and issuing policies like a baker perfecting his recipe. Hong Kong and Singapore are at the forefront, laying down the law to attract investment and innovation like moths to a flame. 🔥

In a recent flurry of activity, Vietnam is racing against time to finalize its legal framework before the month’s end. Talk about pressure! ⏳

Specifically, the Monetary Authority of Singapore (MAS) has been busy granting “Major Payment Institution—MPI” licenses to 30 companies, ensuring that innovation doesn’t trample on consumer protection. It’s a delicate dance, but someone has to lead! 💃

Meanwhile, Hong Kong is not lagging behind, issuing “Virtual Asset Trading Platform Licenses” to 10 companies. In mid-2023, they decided to shake things up by amending their legal framework for cryptocurrency exchanges, handing the reins to the Securities and Futures Commission (SFC) to vet and license. Talk about a power move! 💪

And let’s not forget Vietnam, which has urgently requested the Ministry of Finance to finalize a pilot resolution to regulate virtual and tokenized assets before March 13, 2025. No pressure, right? 😅

“Complete the pilot resolution dossier to manage activities related to virtual assets and tokenized assets, and report to the Standing Government before March 13, 2025,” an official statement from the Vietnam government announced.

In a twist of fate, Thailand has recently given the green light for USDT to be traded domestically. New regulations to enhance flexibility for digital asset businesses will take effect on March 16, 2025. It’s like a party, and everyone’s invited! 🎉

“USDT is officially approved in Thailand,” Tether’s CEO stated in an announcement.

Asia’s Potential in The Crypto Sector

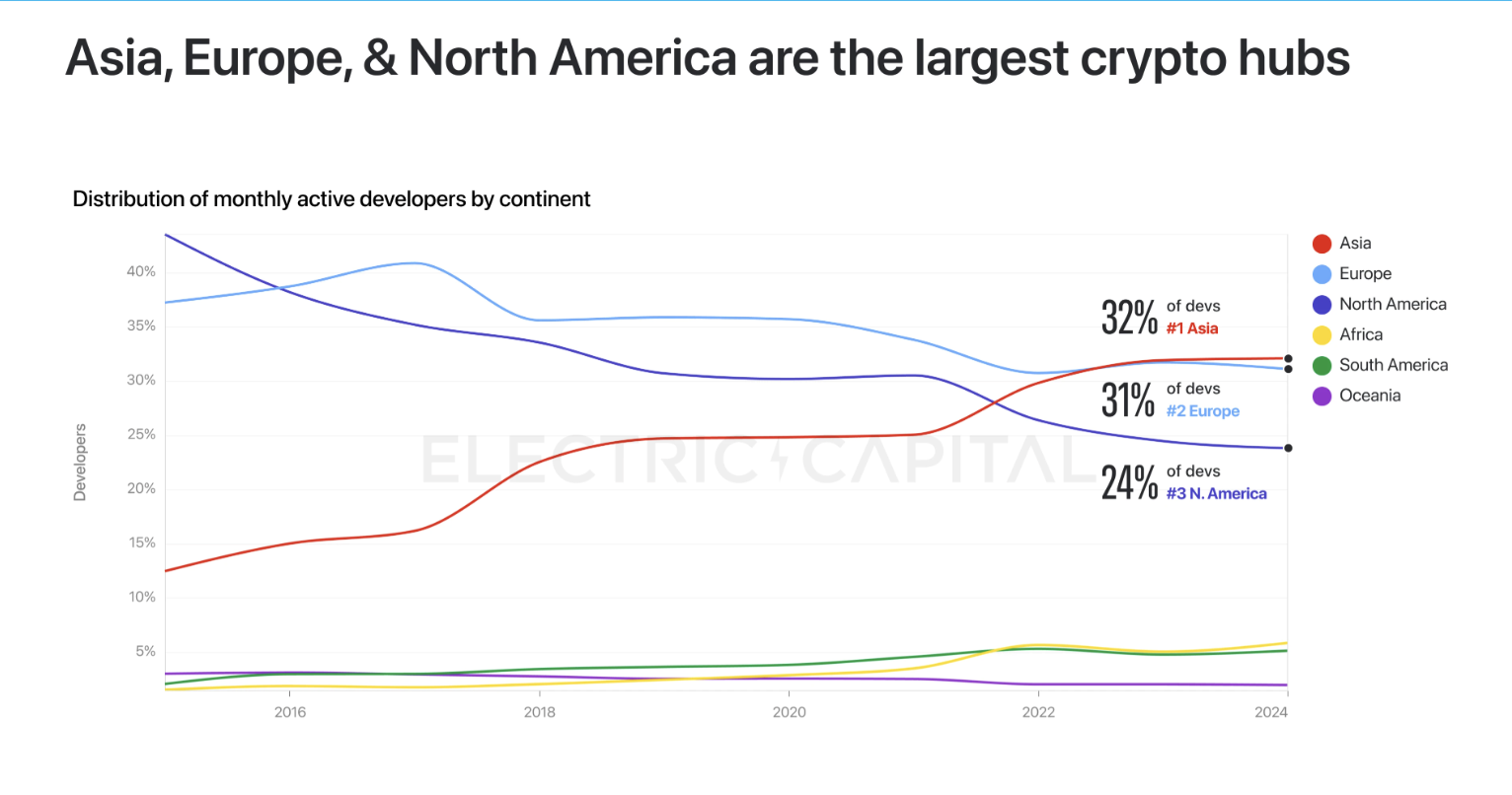

According to Electric Capital data, Asia is the reigning champion when it comes to crypto developer share. North America has taken a tumble from the top spot to third place. The United States still holds the crown with a 19% crypto developer share, down from a whopping 38% in 2015. Ouch! 😬

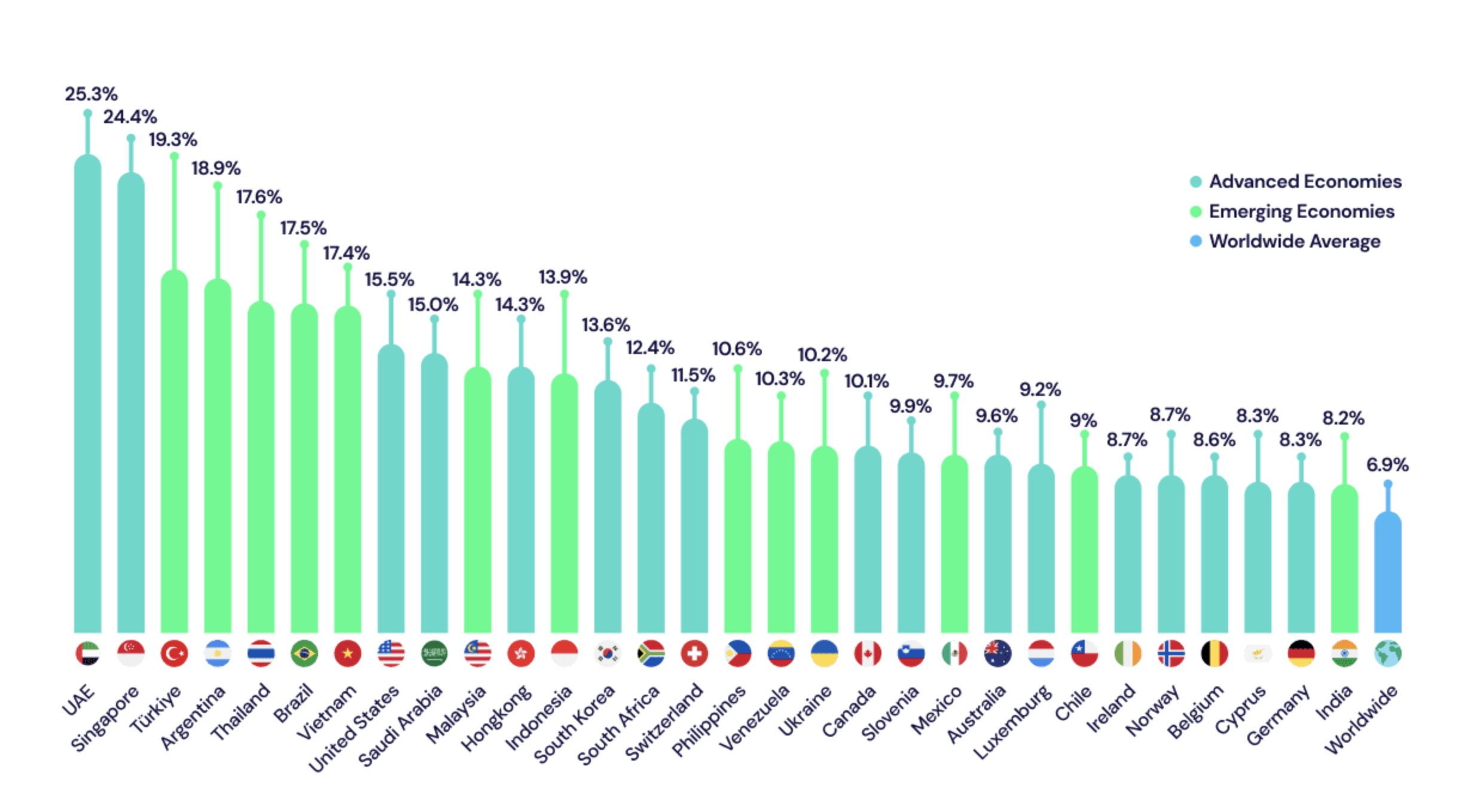

Data from Triple-A reveals that several Asian countries are leading the charge in cryptocurrency ownership rates. Singapore is at the top of this list, followed closely by Thailand, Vietnam, Malaysia, Hong Kong, and others. It’s a crypto race, and everyone’s trying to cross the finish line first! 🏁

While Singapore and Hong Kong are making strides, some countries are still fumbling in the dark without a unified legal framework. This lack of cohesion is like trying to herd cats, making regional cooperation a challenge and leaving the door open for illegal activities like money laundering. 🐱

A clear legal framework would be the golden ticket, attracting global companies to Asia. Just look at El Salvador, where Tether relocated its headquarters to bask in the glow of favorable legal corridors. 🌟

However, a fully developed legal corridor can also create barriers for smaller or less transparent projects. Projects like Pi Network (PI), which Bybit CEO Ben Zhou has criticized as “more dangerous than meme coins,” raise eyebrows and concerns about transparency. Singapore’s Interior Minister is even warning citizens to steer clear of cryptocurrencies. Yikes! ⚠️

If Asia plays its cards right, it could leapfrog the United States and Europe to become the global cryptocurrency hub, all thanks to progressive regulations and a market that’s as dynamic as a rollercoaster ride! 🎢

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-11 14:36