Dear reader, let us ponder the grand spectacle of Bitcoin’s price, a tale of two continents locked in a frenzied tango of wallets and willpower! According to the sages of CryptoQuant, Asia stirs the pot like a witch in a cauldron, while U.S. institutions sip tea and decide if the party deserves a encore. 🧙♂️🍵

And lo! The rise of spot ETFs-those glittering goldfish of finance-threaten to tip the scales. America and Hong Kong, like two drunkards at a buffet, shovel money into Bitcoin with the enthusiasm of a man who’s forgotten his umbrella in a monsoon. 🌧️💸

Asia: The Spark That Ignites the Inferno 🔥

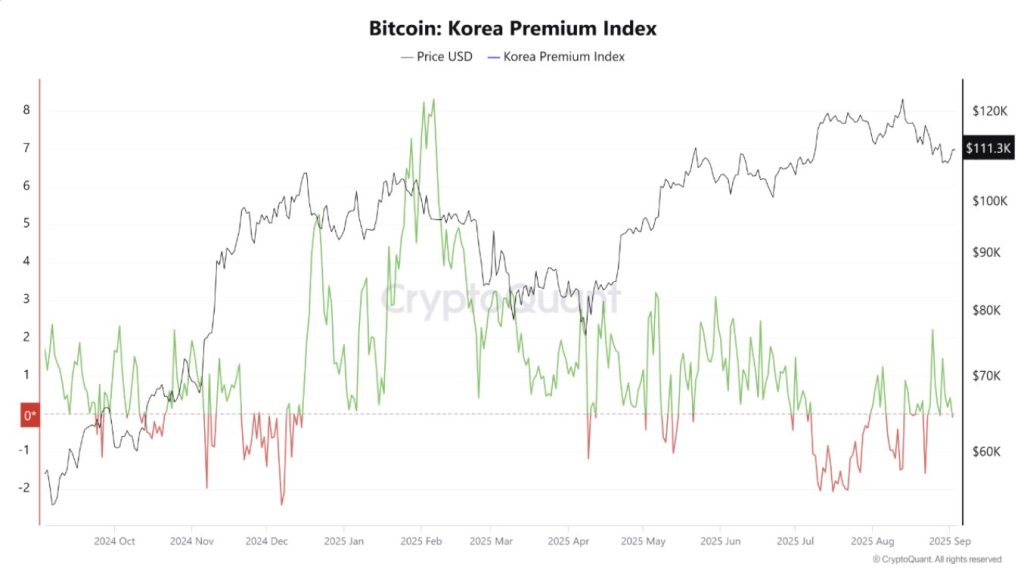

Behold, the Korean traders! They are the mad alchemists of the Kimchi Premium, a phenomenon where Bitcoin’s price soars like a drunken goose, paying 1% to 3% more than the rest of the world. A healthy appetite, yes, but when it leaps above 5%, dear reader, it’s time to grab your buckets and buckets of water-overheating is nigh! 🦆💧

Recent trends whisper that Korea, with its frenzied clicks and clacks, still leads the charge. Asia, you see, is the matchstick; the U.S. is the bonfire. 🔥

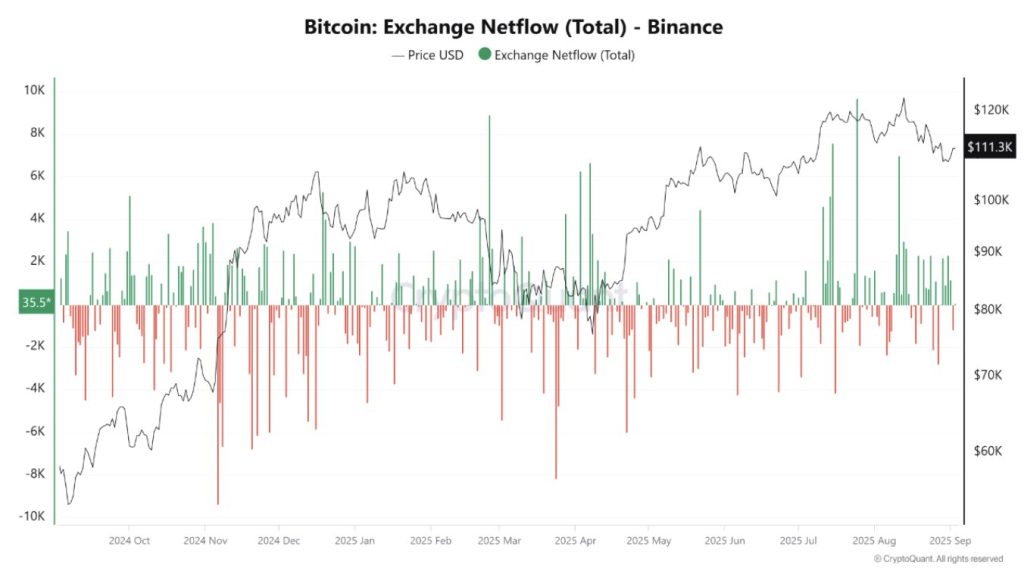

Binance netflows, those telltale signs of retail madness, reveal that Asian traders are like flocks of sparrows-flitting in and out, buying dips like they’re discount soup. 🐦🍲

U.S. Institutions: The Stoic Philosophers of Bitcoin 🧘♂️

Across the pond, U.S. institutions sit like ancient turtles, slow and wise. Coinbase Prime, that noble fortress, sees outflows as if whispering, “Come, dear investor, let us store your Bitcoin in a vault guarded by three dragons.” 🐉

The Coinbase Premium Index, a barometer of American dominance, glows like a lighthouse when U.S. demand reigns. Binance, meanwhile, squirms like a fish on a hook, its netflows a chaotic ballet of retail panic and greed. 🐟

U.S. ETFs: The Glittering Goldfish of Finance 🐠

Spot Bitcoin ETFs! In Q3 2025, they gobbled $118 billion like a gluttonous pig at a feast, with BlackRock’s IBIT hogging 89% of the crumbs. These ETFs now hoard 1.29 million BTC-7% of the world’s Bitcoin! Their daily trades outshine even the grandest exchanges, like a parrot mimicking a stockbroker. 🐤📈

Hong Kong: The Late Bloomer in the ETF Garden 🌸

Hong Kong, that sly fox, has now joined the fray with spot ETFs from Bosera, Harvest, and ChinaAMC. Their debut? A meager $12.7 million-like a toddler’s first attempt at a soufflé. But lo! It signals Asia’s growing hunger for crypto, served with a side of regulation. 🧑🍳

Bitcoin: The Unstoppable Jester 🎭

Whether Asia or the U.S. holds the reins, Bitcoin dances to its own mad tune. A hedge against inflation, a plaything for the wealthy, it marches toward $200,000 by 2025, like a parade of clowns on a unicycle. Currently trading at $110,871, it wobbles slightly but remains bullish-after all, who needs stability when you’ve got chaos? 🤹♂️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-04 12:57