The market, as far as anyone can tell, is still attempting to go upwards. The S&P 500, in the first couple of weeks of 2026, has managed a 1.5% ascent, which, statistically speaking, is roughly equivalent to a particularly enthusiastic snail completing a marathon. Goldman Sachs, those arbiters of financial probability, anticipate further gains – a further 12%, in fact – driven by a resilient economy, a frankly alarming amount of spending on artificial intelligence (AI) infrastructure, and the vague possibility of the Federal Reserve deciding to be nice. Tech stocks, naturally, are expected to lead the charge. It’s always the tech stocks, isn’t it? (One wonders if they have a secret pact with the laws of physics.)

Apparently, these “hyperscalers” – entities whose scale defies any reasonable attempt at comprehension – increased capital spending by 70% last year. Seventy percent! That’s almost enough to buy a small country. And they’re planning to increase it further. This explains the prevailing bullishness regarding the tech sector, a sentiment currently reflected in the Nasdaq-100 Technology Sector index, which is, as of this writing, 3% ahead of the S&P 500. Which, let’s be honest, is a bit like saying one particularly shiny pebble is ahead of a rather large pile of pebbles. Still, it’s a lead.

So, the stage is set for tech stocks to outperform. And that brings us to Arm Holdings (ARM +0.64%). Not to be confused with a limb, of course. (Although, one could argue that a processor is the central nervous system of the digital world. A slightly paranoid analogy, perhaps.)

Arm Holdings’ Solid Growth: A Modest Opportunity

Arm Holdings has been experiencing a bit of a wobble lately, despite posting impressive revenue and earnings. Shares took a tumble in December 2025, fueled by concerns about valuation and the ability to capitalize on the AI semiconductor boom. It’s a classic case of expectations exceeding reality, or, as the ancient philosophers might have put it, “the universe occasionally reminding us that nothing is ever quite as straightforward as it seems.”

The share price is down 40% since hitting a 52-week high. A significant drop, certainly. But, upon closer inspection, it might just present an opportunity for those seeking a growth stock. Arm designs and licenses chip architectures. They don’t actually make the chips, you see. They’re more like the architects of the silicon world, sketching out the blueprints for the processors that power everything from smartphones to data centers. They get paid for the licenses, and then a royalty on every chip built to their design. (It’s a remarkably efficient business model, really. Like selling the idea of a building, rather than the bricks and mortar. Though, naturally, someone still has to lay the bricks.)

Their IP is everywhere. Smartphones, cars, data centers, consumer electronics… almost all smartphone processors are based on Arm’s architecture. And they’re gaining ground in fast-growing areas like networking and cloud computing. Their share of the cloud computing market has increased by 11 percentage points in three years, reaching 20% at the end of fiscal 2025. (Which ended in March, last year. Time, as they say, is a flat circle. Or, at least, a somewhat irregular ellipse.) And major hyperscalers are designing custom chips using their IP.

Furthermore, their latest AI-focused architecture, Armv9, commands a higher royalty than the previous version. This explains why royalty revenue from the data center business doubled year-over-year in the second quarter of fiscal 2026. Overall revenue jumped 34% year-over-year, with earnings increasing by 30%. (These numbers, while impressive, should be viewed with the customary trader’s skepticism. Numbers, after all, are merely representations of reality, and reality is notoriously unreliable.)

Analysts Expect Solid Upside (Possibly)

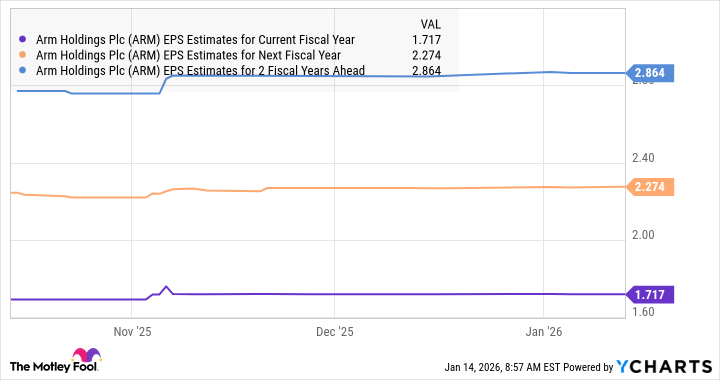

Despite the recent pullback, Arm stock trades at a rather extravagant 138 times trailing earnings. A high multiple, certainly. However, the forward earnings multiple of 47 is more reasonable, suggesting an expected acceleration in earnings. Given the anticipated growth driven by Armv9, the forward multiple seems justifiable. Analysts, in their collective wisdom, are generally upbeat, with a median price target of $180, implying potential gains of 67% from current levels. (Analyst price targets should be treated as educated guesses, not prophecies. The future, as anyone who’s tried to predict it will tell you, is a remarkably slippery concept.)

Arm could indeed deliver such gains, by exceeding Wall Street’s expectations. It’s a top growth stock to buy right now, before it… well, before it does whatever it is that growth stocks do. (Usually, it involves going up. But one should never assume anything.)

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 00:03