Ah, Cathie Wood and her merry band at ARK Invest-no need to dawdle for dusty regulators to blink. They simply plunge, clasping $23.5 million as if it were some wild creature, thrown between BitMine Immersion Technologies and that restless crypto circus known as Bullish. In the tempest of fickle markets, they tighten a grip so firm it almost sings-if you listen closely.

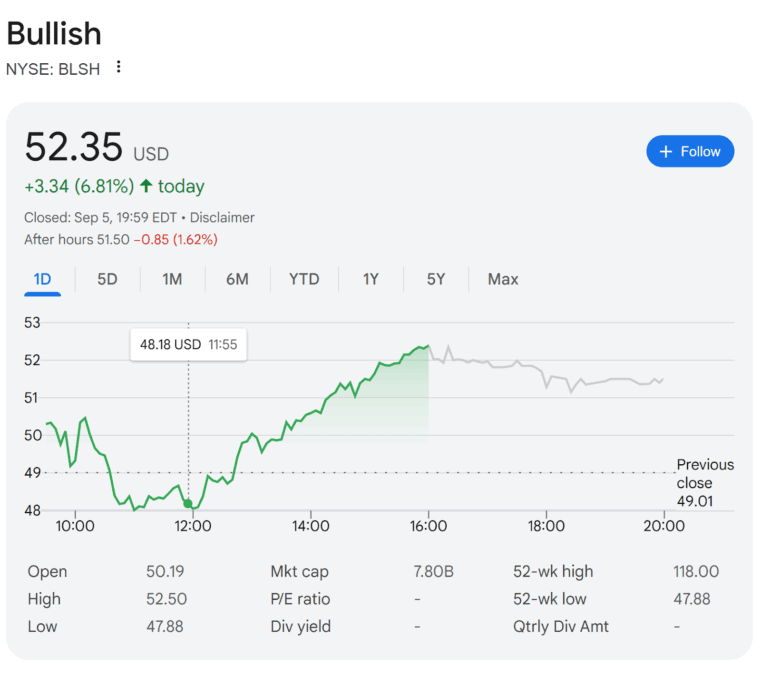

On a day not unlike any other, Friday whispered its secrets in trade disclosures: ARK’s grand trifecta-ARKK, ARKW, ARKF-happened upon a buffet, devouring 387,325 shares of BitMine, about $16 million’s worth, and 143,906 slices of Bullish pie, all tender at $7.5 million. ARKK, the ostentatious heavyweight, claimed the lion’s share, proudly puffing up its chest.

Another sip from Bullish’s potent cup

Not satisfied, ARK had already guzzled $172 million when Bullish debuted its IPO-a debut so bold it might have startled even the old Wall Street lions. With $1.1 billion raised and shares exploding by 83.8%-a fireworks show for the digital age-it’s the kind of headline that makes analysts reach for coffee and aspirin in equal measure.

Bullish, the proud owner of CoinDesk and self-appointed ruler of crypto exchanges from Hong Kong to the UK, dropped their failed 2021 SPAC dreams like yesterday’s newspaper. They chose the venerable old-fashioned doorway to the public market, proving that sometimes, the long route is the scenic one. Institutional money warms to such tales-the swift alchemy of confidence turning cool crypto whispers into roaring Wall Street cheers.

BitMine’s stealthy conquest of Ethereum’s realm

While Bitcoin grabs the spotlight, BitMine plays a quieter symphony, stacking Ethereum like a master collector hoards rare books. Last Thursday, under a cloak of subtlety, they snapped up $65 million in ETH in six smooth OTC moves, brokered by Galaxy Digital, swelling their treasury to a formidable 1.5% of all ETH in the wild.

This isn’t a reckless leveraged high-wire act; it’s cold, hard cash poured into a vault. A daring, almost stubborn hymn of faith in Ethereum’s future worth, while others fumble with derivatives and dreams. BitMine doesn’t just clutch ETH-they parade it center stage, daring the market’s skeptics to blink first.

What the puppeteers really whisper

ARK’s lavish plays on crypto-native warriors broadcast a clear, brash message: while the cautious ETFs twiddle thumbs awaiting regulators’ nod, the real game is already aflame. Equity stakes in crypto, free of bureaucratic chains, are being written into the ledger.

BitMine, wearing Ethereum’s colors, echoes MicroStrategy’s boldness but with a fresh twist of decentralized gold. Bullish, shedding past blemishes like a phoenix sheds old feathers post-SPAC, claims its throne in the hall of regulated champions.

No, this crypto stock love affair might not hog headlines like the elusive spot ETF approvals, but listen close-there’s thunder in the quiet. For those with eyes wide open, ARK’s ballet isn’t a frantic dance for hype. It is the poised breath before the next great leap, a chess master’s gambit on the chessboard of tomorrow’s financial fantasia.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ETH PREDICTION. ETH cryptocurrency

- Why Nio Stock Skyrocketed Today

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Games That Faced Bans in Countries Over Political Themes

2025-09-06 21:30