In recent weeks, the esteemed Solana (SOL) has encountered a veritable tempest of price challenges, a debacle of such magnitude that it finds itself in a state of existential crisis.

Ah, the decline! It has stirred the hearts and minds of investors agog with concern, heightened further by a disquieting signal of bearishness. Like anxious ducks facing an approaching storm, one can’t help but ponder if this turmoil might unleash even more despair in the short term.

Solana’s Bearish Revelations

Alas! Solana’s price, in a most theatrical fashion, has slipped beneath the realized price for the first time in nearly three years—a fact that would evoke a sympathetic sigh even from the most hardened optimists. The realized price, which serves as a haunting reminder of the average price at which an asset was last transacted, indicates that the beleaguered holders of Solana are now experiencing net unrealized losses. Oh, the burdens we carry!

This predicament is a veritable clarion call for bearish sentiment; it suggests that a multitude of investors are now perched precariously on a precipice of losses, urging some to sell hastily in order to stave off even greater ruin. A dance of panic selling may soon commence, a waltz of dismay following the price as it flounders below the realized price.

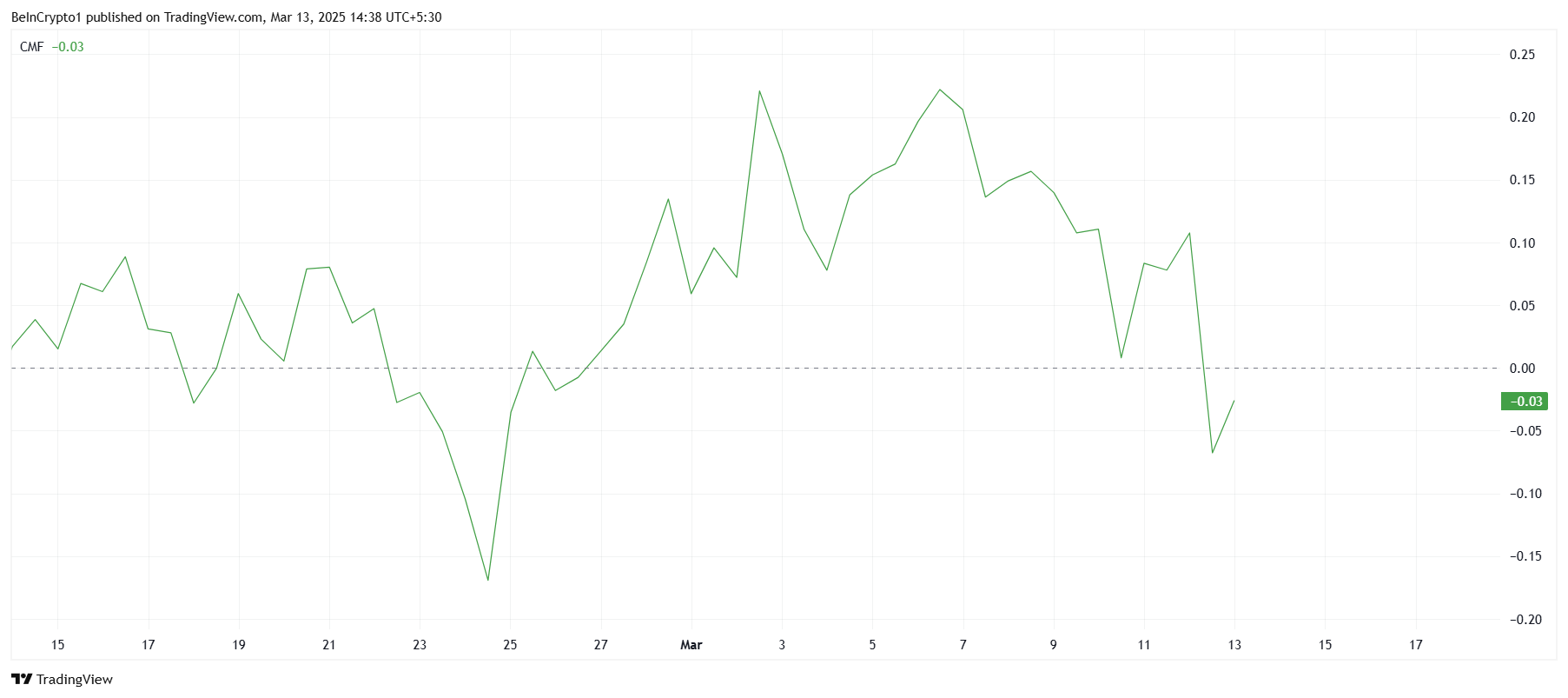

However, looking through the larger lens of the macroeconomic panorama, we observe that Solana is also grappling with weak macro momentum—a reality accentuated by the poignant cries of technical indicators. The Chaikin Money Flow (CMF), that scrupulous arbiter of monetary flow, has witnessed a sharp decline. Currently wallowing below the zero mark, it suggests that outflows are indeed one step ahead, leaving little room for inflows to dance upon the stage.

As the CMF hugs its negative shadow, it becomes evident that Solana’s price recovery may be akin to a mirage—ever distant and elusive. The absence of buyer enthusiasm and the overbearing weight of selling seem certain to restrict any glimmers of upward movement.

The Vulnerability of SOL’s Price

Over the last ten days, Solana has experienced a rather dramatic decline of almost 30%. Currently trading at $125, hovering just beneath the crucial barrier of $126, an ominous atmosphere pervades. Though there was a valiant rebound off the support at $118, the general sentiment remains murky. Like a soap bubble, this recovery may be fleeting, for the shadows of pressure loom large, casting doubt on any chance for resilience.

Should Solana be unable to anchor itself at $126, it risks plunging back to $118—or perhaps even lower, as low as $109, a scenario that would cement the bearish outlook and prolong the agonizing struggle for recovery. Without the embrace of a vigorous rally, more losses remain a certainty in the immediate horizon.

Ah, but if Solana can muster the spirit to break free and transform $126 from a barrier into a bastion of support, it may evoke a buoyant bounce towards $133. Further along, the resistance of $143 awaits, but a successful breach of this threshold would cast aside the current bearish narrative and signal hope for a solid recovery. Should such an event transpire, Solana might reclaim some of the losses it has suffered, offering a morsel of optimism to its weary investors.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-13 16:03