This year has posed challenges for investors, especially those with a preference for growth stocks. Most sectors have experienced some kind of influence due to the new tariff measures implemented by President Donald Trump.

As I observe the ongoing effects of these import taxes, it appears that the technology sector, in particular, has been battling unusually strong headwinds for some time now. Interestingly enough, my recent experiences with the AI market have shown that investing here doesn’t seem to guarantee the substantial returns it once did – a trend not seen for almost three years.

Despite the widespread panic-selling in the AI sector this year, quantum computing has been an exception. As of today (July 17), the Defiance Quantum ETF has achieved a 17% increase this year – nearly twice the growth recorded by both the S&P 500 and Nasdaq Composite indices.

Given that quantum computing stocks are outperforming the general market, it could be beneficial to examine their current value and compare it to past times when there was increased excitement about the sector.

What is a stock market bubble, and what are some examples?

A common error that investors often fall into is judging a company’s worth by its share price alone. This means that a company with a lower share price could be incorrectly perceived as a bargain or “affordable” (while the opposite may also hold true for higher-priced shares).

Shrewd investors know that beyond just the stock price, numerous other factors are crucial in establishing a company’s worth. These include fundamental financial indicators like revenue, gross margins, profitability, free cash flow, cash reserves, and debt levels. Considering these aspects is essential when evaluating a company’s overall financial health.

Later on, it’s crucial for investors to compare these data points and their rate of increase with those of similar companies as a point of reference, so they can understand how the specific business stacks up within its competitive environment more clearly.

Rather than conducting thorough research on a company’s fundamentals, some investors often opt to invest based on market trends (momentum). Regrettably, this approach may result in overvalued stock prices that don’t align with the actual financial health and operations of the business.

In simpler terms, when a company’s value is artificially inflated for too long, people eventually realize this and start selling their shares rapidly. This sudden drop in price is often referred to as a “stock market bubble burst,” where the initial overvaluation was essentially an illusion.

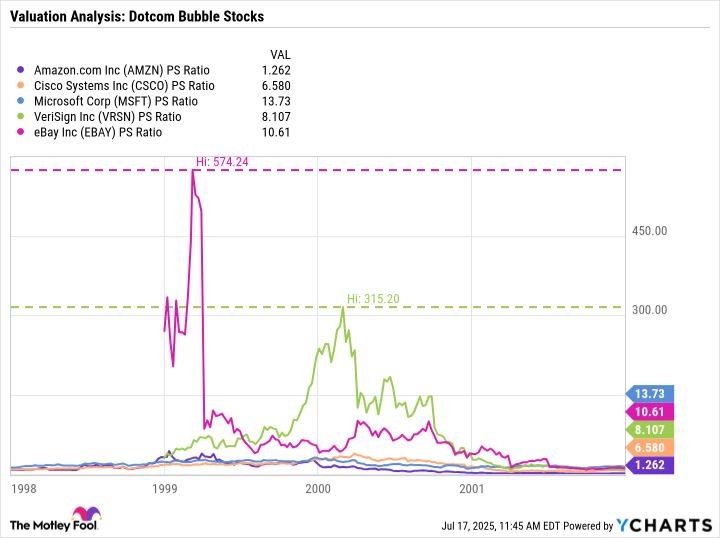

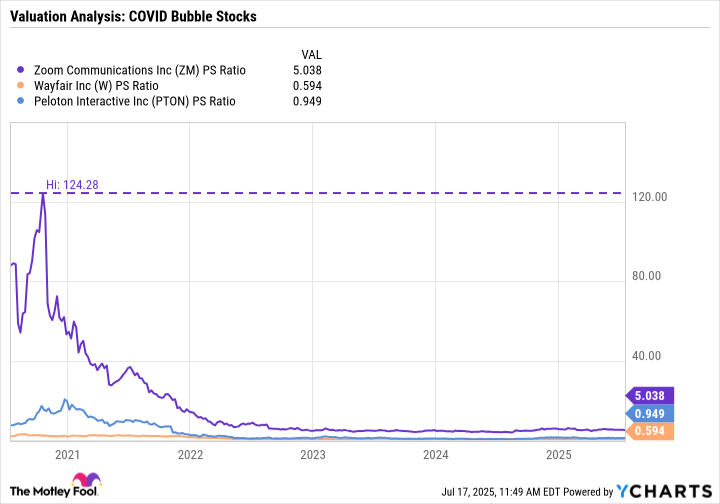

The diagrams provided showcase the evolution of valuation patterns during two significant periods of stock market inflation.

The graph shows the price-to-sales (P/S) ratios for several popular internet companies from the late 1990s dot-com bubble. It’s evident from this data that these firms now have more typical valuation levels, which is significantly lower than their peak values during the internet boom era.

During the height of the COVID-19 pandemic, investors observed a familiar pattern in inflated valuations. Companies like Zoom Communications, Wayfair, and Peloton experienced an unusual surge in demand for their products due to the widespread adoption of remote work.

It’s clear from the patterns we’ve observed that the rapid growth these stocks experienced during the pandemic wasn’t sustainable in the long run. Nowadays, these COVID-related stocks are no longer viewed as promising growth investments, and their significantly reduced values serve as a stark warning about the consequences of bubbles popping.

How do quantum computing stocks compare to the valuations above?

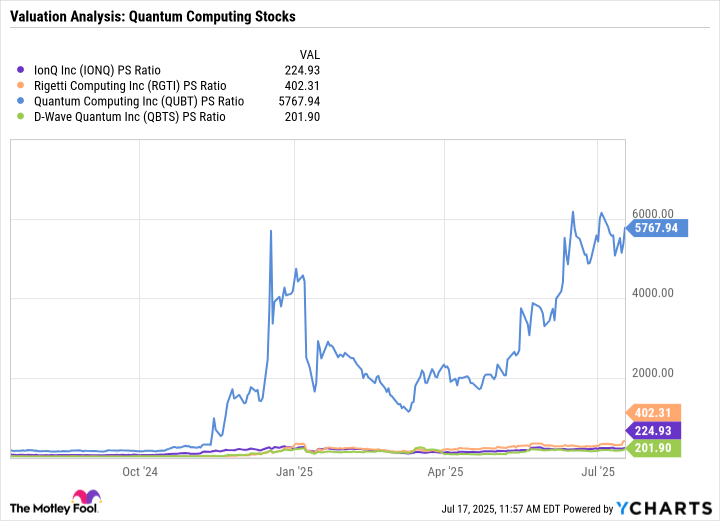

Over the past year, companies like IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing have become well-known and played significant roles in driving forward the quantum computing revolution.

Observing the graph, it’s evident that the minuscule Quantum Computing enterprise stands out significantly, with a Price-to-Sales (P/S) multiple exceeding 5,700. Remarkably, competitors like Rigetti, IonQ, and D-Wave also display impressive or comparable P/S ratios, figures often associated with the high-flying stocks of the dot-com era and the COVID bubble.

Are we in a quantum computing stock bubble?

The stocks associated with quantum computing that were mentioned earlier are quite speculative, possibly even more so than the high-flying stocks from the internet era. In contrast to those times, today’s leading tech companies, such as Amazon, Microsoft, eBay, and Cisco, have developed into advanced platform businesses with a variety of interconnected systems.

Offering this degree of freedom in terms of scale and finances enables them to delve into burgeoning areas like quantum computing. Compared to smaller entities such as IonQ, Rigetti, D-Wave, Quantum Computing, these larger competitors are currently grappling with stiff competition from tech giants, a situation that was absent during the dot-com era.

Based on the assessment of stock valuations we’ve examined, it appears that several highly regarded quantum computing stocks are currently trading at exceptionally high and seemingly unrealistic values compared to historical norms. In light of this information, I believe companies like IonQ, Rigetti, D-Wave, and Quantum Computing might be experiencing a speculative bubble phase.

It’s worth noting that several prominent tech firms within the “Magnificent Seven” are currently examining potential applications of quantum technology. These companies tend to have more moderate valuations compared to others. Although I’m not completely convinced that the overall quantum computing market is experiencing a bubble, I suggest investors approach this sector with care and discernment when choosing which quantum computing stocks to invest in.

Instead, optimal selections often lean towards pragmatic generalists who have modest aspirations but consistent income sources.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-20 19:08