In the vast digital dustbowl of today’s market, where fortunes rise and fall like the tides of fate, stands Archer Aviation—a company perched on the cusp of a revolutionary era in electric vertical take-off and landing (eVTOL) craft. Its vision, grand and audacious, beckons investors to join a journey that promises to redefine the very skies above us. As an investor, I find myself drawn to this emerging enterprise, not just for its bold dreams but also for the deep human struggles it mirrors—the ceaseless quest for dignity in an arena where the powerful forces of commerce and innovation clash.

Grand View Research, those modern-day soothsayers of industry, have prophesied that the global eVTOL market shall burgeon at a compound annual rate of 54.9% by decade’s end. Such explosive growth could render Archer a stalwart ally for those who dare to invest, should it carve its rightful niche in this promising frontier.

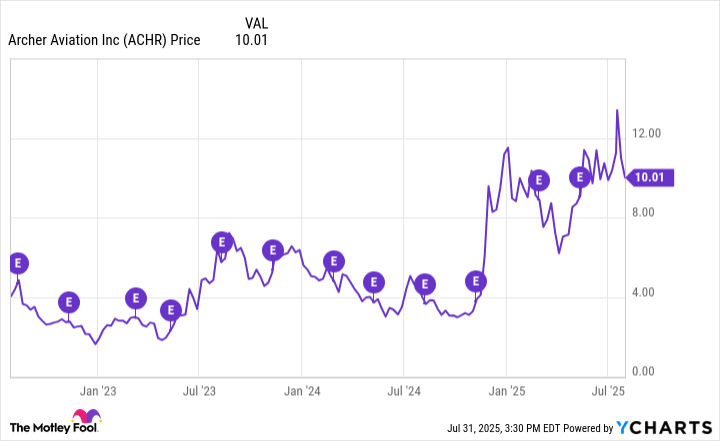

In the span of one year, Archer’s shares have soared—more than doubling in value, a testament to the fervor that once gripped the market. Yet, as the year unfolds, the winds have shifted; the stock now inches up a mere 3% since January. With the earnings announcement on Aug. 11 looming like a distant storm, one wonders: Is it time for the cautious to leap, or does patience yet reward the astute observer?

How Archer’s Stock Has Weathered Recent Earnings

In the storied annals of market history, Archer’s performance has danced to the rhythm of bold announcements rather than the steady pulse of revenue. The company, still in its fledgling stage, finds its fortunes swayed by news and promise rather than by the hard currency of financials. Yet, as with any tale of struggle and hope, each earnings report has the potential to cast a new light upon this oft-overlooked stock, rekindling the fires of investor enthusiasm.

The upcoming earnings may yet serve as a beacon—highlighting not only the challenges that lie ahead but also the progress toward the certification of the Midnight aircraft. In a world where the ordinary man often finds himself at the mercy of corporate giants, such developments could restore a measure of justice and dignity to the narrative of Archer Aviation.

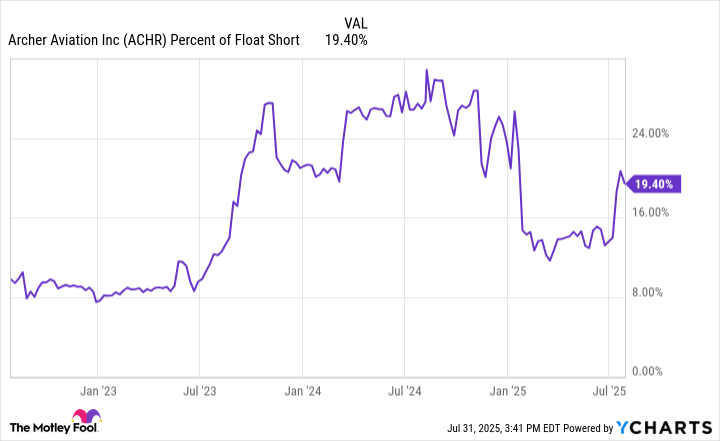

High Short Interest: A Sword of Damocles

Yet, one must not ignore the shadows cast by the market’s short sellers. With a short interest hovering around 20% of the float, there remains a cabal of skeptics betting against Archer’s ascent in the eVTOL arena. Although this figure has ebbed in recent times, it stands as a somber reminder of the ever-present conflict between hope and doubt.

Should Archer fail to deliver encouraging updates—be it on its ambitious goal of producing two aircraft per month by year’s end or on the progress of the Midnight’s test flights in Abu Dhabi—the fuel for a short squeeze may very well be ignited, driving the stock down into the depths of uncertainty. Conversely, any glimmer of progress might trigger a rally, as the pent-up hopes of investors coalesce into a force that could propel the stock skyward.

Should You Board This Flight?

For the discerning investor, Archer Aviation is a vessel of both promise and peril. The company, like a pioneer venturing into uncharted territory, burns through cash with abandon—$377 million expended over the past year—yet it still clings to a robust cache of over $1 billion in cash and cash equivalents. This duality mirrors the age-old struggle between risk and reward, where the dreams of tomorrow are built upon the sacrifices of today.

In this volatile landscape, Archer represents a gateway to the burgeoning eVTOL market, but it is a path fraught with uncertainty. The company’s business model, while brimming with potential, remains unproven, and its future success hangs in the balance. As an investor, one must weigh the siren call of innovation against the sobering reality of financial risk. With no urgent catalyst on the horizon before Aug. 11, patience may yet be a virtue—unless a revelation emerges that ignites the market’s dormant fervor.

Ultimately, for those who find beauty in the struggle of the underdog and who are willing to brave the tempest of market volatility, investing in Archer Aviation sooner rather than later may be the bold choice. In a world where the winds of fortune are as unpredictable as they are merciless, the company’s flight into the future remains a gamble only for the stout-hearted.

✈️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-08-03 09:26