As a seasoned analyst with over two decades of experience in the volatile world of cryptocurrencies, I’ve seen trends come and go like the changing seasons. Today, I find myself gazing at Aptos (APT) with a mix of cautious optimism.

In the past day, the value of Aptos (APT) has surged by almost 15%, rebounding vigorously following a $2 billion decline in its market capitalization before a planned token release worth $134 million. Despite some negative indicators like a death cross formation and a 10% price drop, APT appears to be hinting at a possible change in trend direction.

If the positive trend persists for APT, signs such as the Ichimoku Cloud and Exponential Moving Averages indicate a possible rise towards prices around $15. Nevertheless, it’s crucial to remember that the significant support at $13.38 is vital; if APT falls below this level, it might trigger a more substantial downturn.

Aptos Uptrend Is Surpassing Downtrend Indicators

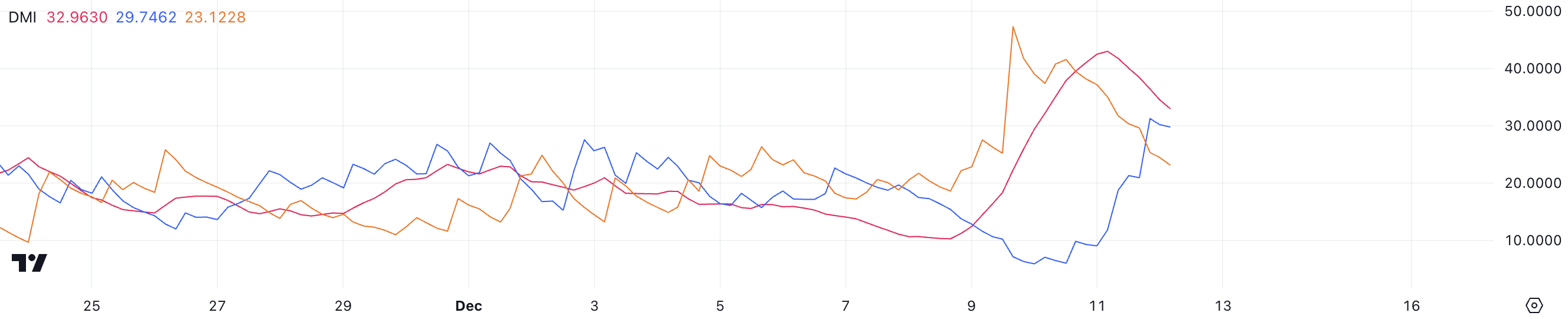

The Aptos DMI graph displays a decrease in its ADX value, now at 32.96 compared to 42 the day before, signifying a decrease in the strength of the ongoing trend. This decrease comes after a substantial correction, hinting that the previous momentum of the trend may be slowing down.

Although the ADX has decreased, it’s important to note that it’s still above the 25-threshold, suggesting that the current trend remains moderately robust, even if it’s currently not as dominant as it was previously.

The Average Directional Index (ADX), in simpler terms, gauges the power behind a market’s trend, whether it’s moving up or down. An ADX reading below 20 signals a weak or absent trend, whereas values exceeding 25 point towards a more robust trend.

After recent market adjustments, the moving indicator D+ has climbed over D-, currently standing at 29.7, while D- is at 23.1. This crossover might indicate an impending change toward bullish trends, implying that APT might experience a temporary price rise if buying activity remains strong.

APT Ichimoku Cloud Shows a Strong Upside

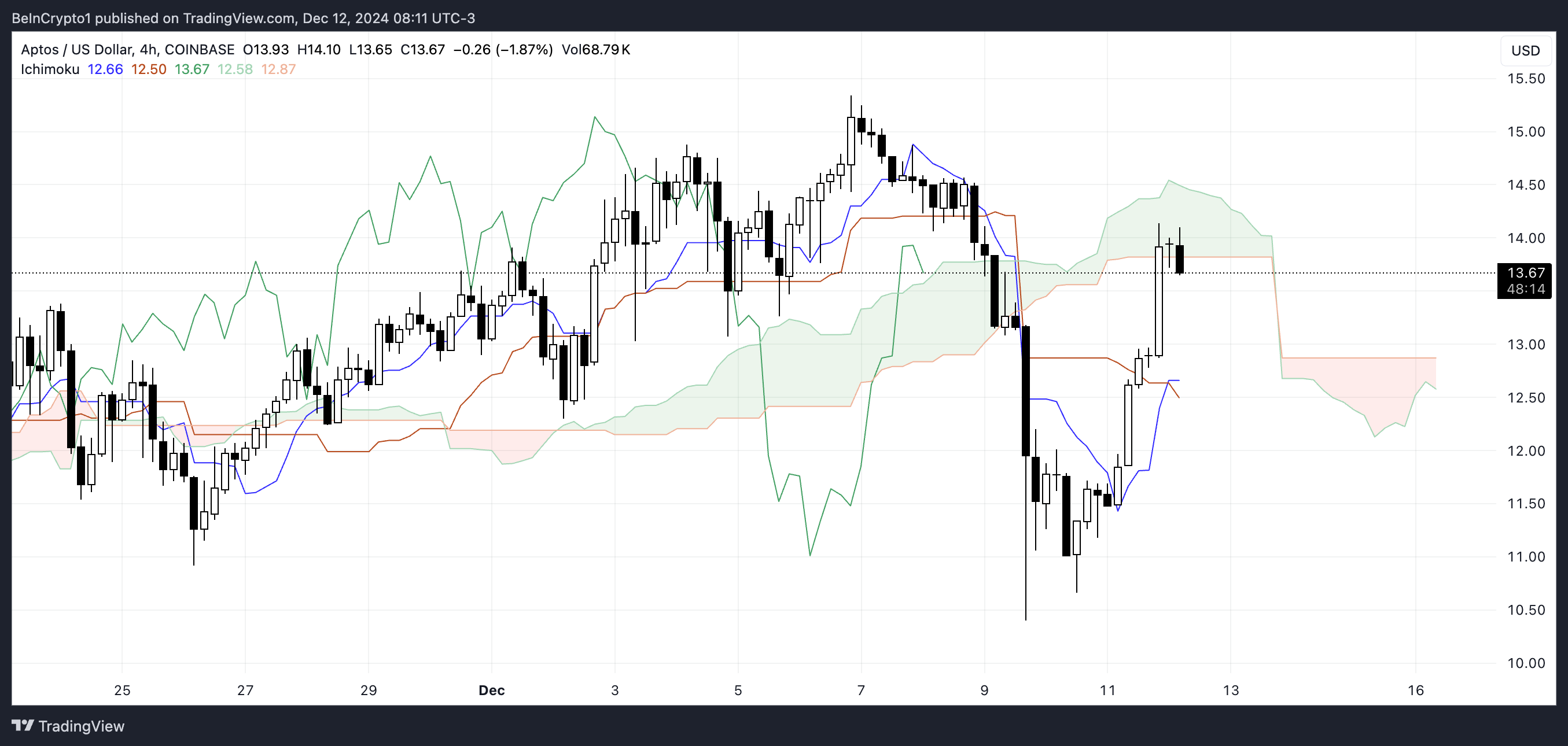

For Aptos, as depicted in the Ichimoku Cloud chart, the current price is hovering marginally above the overall trend, indicating a generally optimistic or bullish outlook. The upcoming green band in the chart could potentially serve as a supportive level. On the flip side, the rather horizontal upper part of the cloud hints at a notable resistance around $14 that may be quite substantial.

On the blue line (Tenkan-sen) and the red line (Kijun-sen), we’re seeing convergence. This could indicate a period of consolidation or even a possible reduction in bullish energy.

If the cost maintains its position above the cloud and the Tenkan-sen line crosses above the Kijun-sen line once more, this might suggest a resurgence of bullish energy, potentially leading to price objectives around $14.5 or even higher.

Should the APT price fall again and return within the cloud, this might signal uncertainty, as the support could be reinforced around $12.5. Breaching the cloud would tilt the trend towards bearish, potentially allowing for another attempt at hitting lower prices.

Aptos Price Prediction: Back to $15 Soon?

As a researcher, I find the setup of APT’s Exponential Moving Averages quite captivating. On December 9, an ominous event transpired: the short-term EMA dipped below the longer-term EMA, a phenomenon known as a death cross. This alignment suggests a potential bearish trend ahead, with market movements possibly leaning towards a downward direction in the coming days.

After this, there was a significant decrease in price by more than 10% that corresponded with the pessimistic forecasts for the crossover. The ‘death cross’ indicated an increased selling force, momentarily overpowering the movement in Aptos’s price.

Despite experiencing some initial setbacks, Aptos has shown signs of recovery lately. The shortest-term Exponential Moving Average (EMA) is nearly crossing above other EMA lines, suggesting a possible bullish crossover. If this happens, it might trigger a robust price surge, with potential targets at around $14.88 or potentially even $15.34.

In other words, if the APT price isn’t able to maintain its present upward trend and drops below the support level of $13.38, there’s a possibility that it might experience a further decline, possibly reaching $12.30.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2024-12-12 23:43