On September 5, S&P Global announced that AppLovin, an advertising technology company, would join the S&P 500 index this month. This marks a significant step for a firm that, three years ago, seemed to teeter on the edge of irrelevance.

AppLovin’s business model revolves around helping clients promote and monetize mobile applications, particularly video games. Yet, three years ago, its performance was unremarkable. At one point, management appeared ready to abandon the effort, even proposing an unsolicited merger with Unity Software-a deal that would have ceded control to Unity’s leadership.

Unity rejected the offer, though it may now regret the decision. Since AppLovin’s proposal, Unity’s stock has fallen 13%, while AppLovin’s has surged 1,480%. The contrast is stark, if not entirely surprising.

This article examines how AppLovin transformed from a struggling firm to a high-growth stock, whether its momentum can continue, and what its S&P 500 inclusion signifies.

How AppLovin got here

AppLovin once operated its own mobile games. Its aim was to gather data for developing artificial intelligence models. After sufficient data collection, it launched Axon 2 in mid-2023, which became a catalyst for growth.

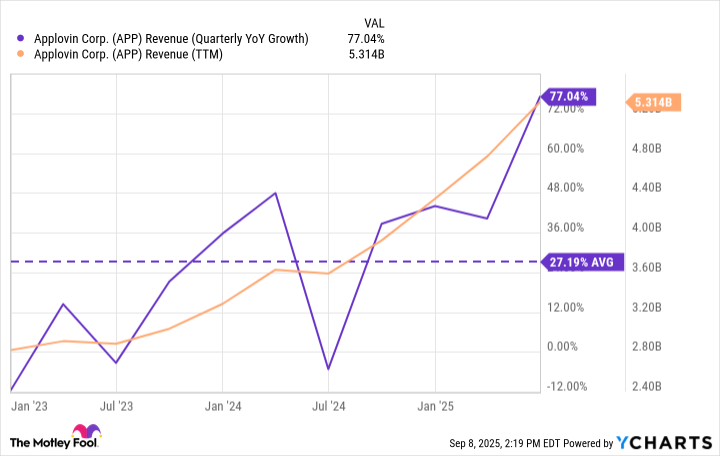

The chart below illustrates AppLovin’s revenue growth and a year-over-year increase of over 27% since Axon 2’s launch.

CEO Adam Foroughi states that AppLovin earns revenue only when clients’ ad campaigns meet specific goals, not through impressions or clicks. This alignment of interests with customers may explain its rapid growth.

Management projects $1.3 billion in third-quarter revenue, all from software sales. This follows the sale of its mobile app business, which provided the data it needed. In 2023’s third quarter, software revenue stood at $500 million.

AppLovin’s growth has been extraordinary since Axon 2’s release.

Can AppLovin grow from here?

Previously, AppLovin managed full ad campaigns for clients. It now offers a self-serve platform, which Foroughi calls essential for future growth. This option may attract clients seeking greater control, a strategic move for the company.

AppLovin is also expanding beyond gaming, targeting e-commerce. Its ability to grow in a stagnant market suggests its software is effective. Diversifying its focus could sustain long-term growth.

Is AppLovin’s inclusion a game-changer?

AppLovin’s addition to the S&P 500 on September 22 may not guarantee future success. Investors must evaluate its fundamentals, not just its index status.

The company’s AI software, potential for broader customer appeal, and market expansion could form a solid investment case. However, its inclusion reflects market capitalization more than business strength. While index funds may buy its shares, this effect is temporary.

History suggests that index inclusion does not ensure long-term gains. The Trade Desk’s 42% decline since joining the S&P 500 in July underscores this risk.

If AppLovin succeeds, it will be due to its ability to attract new customers and expand beyond gaming. These trends warrant close attention. I believe the company has the potential to thrive as it diversifies.

📈

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-12 11:12