In the boundless digital expanse—a realm where ephemeral light meets the immutable spirit of enterprise—AppLovin (APP) has emerged as a protagonist of modern commerce. Much like a bold hero in Turgenev’s lyrical tales, this adtech pioneer has charted an audacious course, achieving nearly a 1,200% gain over the past two years. Its revenue, having swelled by over 250% in half a decade, reflects not merely robust expansion but also the discipline of a seasoned navigator.

Once a modestly valued enterprise, AppLovin traded at about ten times its sales only a few years ago; today, the market’s exuberance has elevated its multiple to over twenty. In this subtle shift, one discerns the gentle yet unmistakable nod of investor confidence—a quiet acknowledgment that the company’s innovative spirit is both recognized and rewarded. Yet, as any prudent value investor knows, such exuberance must be weighed against the immutable truths of fiscal discipline.

As 2025 unfolds and AppLovin’s stock ascends another 10% year to date, the discerning observer—much like a sagacious elder perched at the edge of a changing horizon—must peer beyond the immediate spectacle. Beneath the surface of these numbers lies a narrative of transformation, where growth and caution perform a delicate, almost melancholic dance.

What AppLovin Does

At the heart of AppLovin’s odyssey stands its Axon software—a digital compass that guides applications to their destined users, harnessing the subtle genius of artificial intelligence. This ingenious platform, much like a skilled conductor orchestrating an unseen symphony, balances the twin imperatives of user acquisition and revenue generation. Its algorithms, refined by years of evolution, whisper of both promise and prudence.

In the first quarter of 2025, the company’s revenue soared by 40% year over year to reach $1.5 billion, while its gross margin ascended from a modest 72% to an enviable 82%. Simultaneously, fiscal discipline shone through as sales and marketing expenses fell by 19% and research and development spending receded by 21%. This juxtaposition of soaring profits and cautious spending reflects a generational tension—between the insatiable appetite for innovation and the stern realities of market discipline.

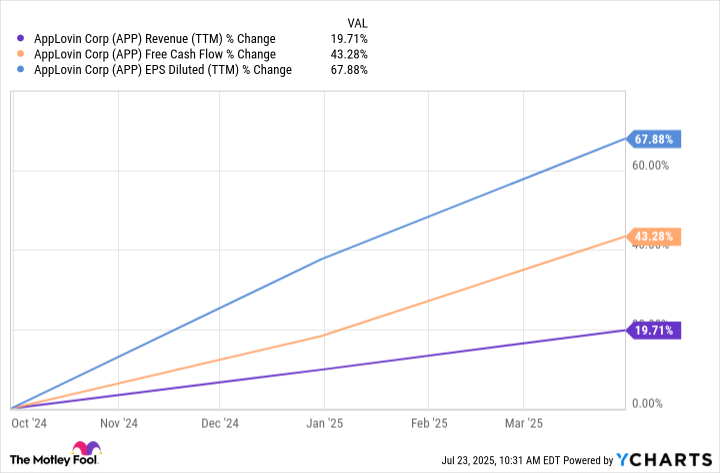

The chart below—a visual echo of the company’s triumphs—captures how free cash flow and earnings per share have outpaced revenue growth, much like the quiet victories of nature’s unfolding seasons.

What to Watch with AppLovin

AppLovin’s journey thus far has been a masterclass in mastering a niche—the world of mobile gaming—a realm where youthful exuberance meets the refined craft of ad monetization. Yet now, the company stands at a crossroads, much like a young protagonist stepping beyond the familiar embrace of home into the vast uncertainty of the wider world. With its sights set on web-based advertising, connected TV, and e-commerce, AppLovin is venturing into territories that promise both grandeur and challenge.

Should this bold expansion succeed, the company could very well deliver market-beating performance, outpacing stalwarts such as the S&P 500 with both robust growth and enviable profitability. However, as with any tale of ambition, risk lingers in the wings. A valuation exceeding twenty times sales rests precariously on the assumption of continued, vigorous growth—a burden that may prove heavy should the company’s software fail to transcend its original niche.

For those of us who, as value investors, take pleasure in the quiet majesty of measured growth and fiscal discipline, the unfolding saga of AppLovin is one of cautious optimism. The market, much like the unpredictable Russian landscape that so often inspired Turgenev, holds both promise and peril. It is in the subtle shifts—the whispers of change in a changing market—that the astute observer will find the true measure of success.

As AppLovin prepares to unveil its second-quarter results on August 6, let us, in the spirit of a reflective observer, remain watchful of the subtle cues that will reveal whether its expanded strategy is a triumphant odyssey or a cautionary tale. ⚖️

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-27 11:38