![]()

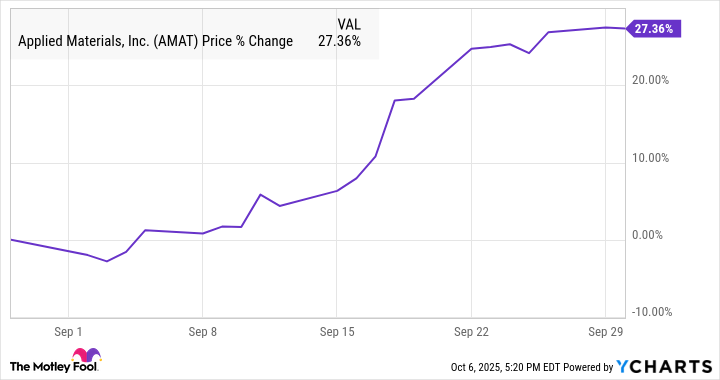

In a world where the stock market behaves like a particularly volatile tea kettle, Applied Materials (AMAT) managed to leap 27% in September, leaving analysts scratching their heads and shareholders clutching their pearls. This was not a miracle, but rather the predictable result of a cosmic dance between macroeconomic tides and sector-level gossip (a phenomenon akin to a group of squirrels debating the merits of acorn storage).

While the company itself remained as silent as a well-locked vault, the universe conspired to make its stock dance. According to S&P Global Market Intelligence, the gains were not the result of any singular event, but rather a confluence of factors so mundane they could have been orchestrated by a committee of overworked baristas. (Imagine a world where the stock market’s entire strategy is to wait for the Fed to mumble something about rates, then leap like a startled penguin.)

As the chart reveals, the majority of the action occurred mid-month, a period so unremarkable it might as well have been a Tuesday. (Or, as economists call it, “the time when markets remember they exist and panic about it.”)

A New Semiconductor Boom (Or: Why Everyone Is Buying Things They Don’t Understand)

The AI boom has turned Nvidia into a multibagger, but the semiconductor equipment sector-operating on a timeline so glacial it could double as a glacier-has been lagging. This is not because it lacks potential, but because it’s too busy being the unappreciated uncle at the family reunion, quietly fixing things while everyone else argues about who gets the last slice of cake. (China, in this analogy, is the relative who keeps bringing up the time the cake was burnt.)

Yet, investors, ever the optimists, responded to September’s news like a toddler to a shiny object. This suggests that a new spending cycle might be on the horizon, though it’s equally likely to be a fleeting flicker of hope, like a firefly in a thunderstorm.

The Federal Reserve, ever the reluctant magician, pulled a 25-basis-point rabbit out of its hat on Sept. 17, and its forecast for two more cuts over the year. Semiconductor equipment, being as expensive as a mid-1990s luxury car, benefits from lower rates, which make borrowing as easy as ordering a pizza. (Or, as the Fed might say, “a 25-basis-point reduction in interest rates, which is like giving the economy a gentle nudge in the ribs.”) The stock gained 2.6% that day, a number so small it could have been a typo. (Or, as a cynic might note, the market’s way of saying, “We’re not sure, but let’s pretend we are.”)

The following session, Applied Materials jumped 6.5% after Nvidia and Intel announced their partnership-a move as surprising as a surprise party for someone who hates parties. This partnership, which involves Nvidia’s $5 billion investment in Intel, is expected to fuel spending on chip equipment, though it’s unclear whether this will result in more chips or just more corporate press releases. (Intel, as a major fab, is the kind of company that could probably build a spaceship if it felt like it. It’s just that it hasn’t decided to yet.)

Finally, on Sept. 22, Applied Materials jumped 5.4% after Morgan Stanley upgraded it to “overweight,” a classification that would make a goldfish reconsider its life choices. The bank hiked its wafer fab equipment sales growth forecast from 5% to 10%, citing increased demand in memory. (This is the kind of news that makes analysts sound like they’ve just discovered gravity, though it’s more likely they’ve simply stopped counting the days since the last recession.)

What’s Next for Applied Materials? (Or: The Unending Saga of Cyclical Hope)

A strong earnings report from Micron at the end of the month also seemed to boost Applied’s prospects, though this is the kind of news that could just as easily have been a coincidence. (Like a parrot repeating “I’m a good boy” after you’ve already decided to throw it into the ocean.)

Like ASML, Applied Materials’ business strength is not in question, but its revenue growth-8% in the most recent quarter-feels about as exciting as a spreadsheet. (This is the part where the market says, “Yes, but what about the future?”)

Still, the news around Intel and AI is promising, though it’s worth noting that “promising” is a word that has been used to describe everything from a new diet to a nuclear reactor. If this momentum continues, Applied Materials has room to move higher-though it’s also possible it will simply hover in place, like a confused seagull.

–

🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-07 03:02