The market, that capricious mistress, has lately favored Applied Digital (APLD 0.91%), elevating it with a zeal bordering on the hysterical. A threefold increase in valuation within a year… a spectacle, certainly. Yet, beneath the surface of this exuberance lies a volatility that chills the soul. A dance between hope and despair, mirroring, perhaps, the very condition of man.

The stock ascended, a red-hot comet streaking across the autumn sky of 2025, only to falter, to descend into a seesawing uncertainty. Thirteen percent below its zenith as of January 21st… a sobering reminder that even the most promising ventures are subject to the whims of fate. The recent earnings report – a net loss of nineteen million dollars, though improved from the previous year – offered little solace. A wound, though lessened, still bleeds. But to focus solely on these fluctuations, to be blinded by the immediate, is to misunderstand the deeper currents at play.

Applied Digital: The Genesis of a New Order

Applied Digital does not merely construct buildings; it builds the very foundations of a new age. Data centers, those cathedrals of information, are the engines driving the relentless march of artificial intelligence. McKinsey, those sober arbiters of economic reality, predict a 3.5-fold increase in demand for AI-specific workloads by 2030. A staggering figure, a prophecy of exponential growth.

One hundred and twenty-four gigawatts of incremental capacity will be required. A colossal undertaking. And Applied Digital, it seems, is poised to become a principal architect of this digital realm. They offer not merely construction, but a complete ecosystem – the design, the building, the operation. A holistic vision, rare in this fragmented world. They lease space, customize facilities, and ensure the uninterrupted flow of data – a modern-day priesthood tending to the sacred flame of information.

In North Dakota, they are erecting these digital fortresses, securing contracts with the hyperscalers and neocloud companies – those shadowy entities that control the flow of modern life. Six hundred megawatts of capacity already leased, promising a potential revenue stream of sixteen billion dollars over the next fifteen years. A fortune, certainly. But wealth, like life, is fleeting. It is the potential for wealth that truly captivates, the promise of a future yet unwritten. They have begun to realize this potential, generating lease revenue from their first hundred megawatts. A billion-dollar investment, a gamble on the future. And they intend to expand, to build more, to consume more land, more resources. A relentless pursuit of growth, mirroring the insatiable appetite of the modern age.

The cost of construction is significant, exceeding six billion dollars for the planned six hundred megawatts. But the potential returns dwarf the investment. Their CEO, Wesley Cummins, speaks of modular designs, efficient construction, and prefabricated components. A pragmatic approach, certainly. But it is not merely about efficiency; it is about control, about the ability to adapt, to overcome obstacles, to build a future in the face of uncertainty.

“Our current data center designs are modular and highly efficient, allowing us to run numerous concrete plants simultaneously and leverage prefabricated components delivered by 18-wheelers.”

They envision a five-gigawatt capacity within the next five years, expanding to new campuses, securing land and utility agreements. A bold ambition, a testament to their confidence. But confidence, like faith, can be a dangerous thing. It can blind one to the risks, to the potential for failure. And in the world of finance, failure is always lurking, a specter haunting the dreams of even the most successful entrepreneurs.

The Price of Progress: An Expensive Salvation

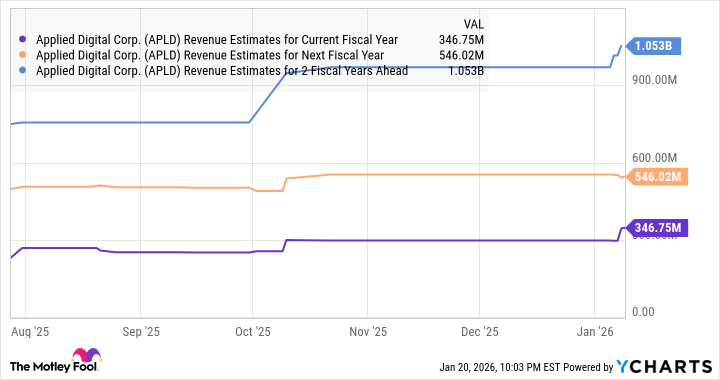

The stock trades at a premium – thirty-three times sales. An exorbitant price, some might say. But consider the context. This is not merely a company; it is a vessel carrying the hopes of a technological revolution. And in a world where demand far exceeds supply – Goldman Sachs predicts a ten-gigawatt shortfall in the next three years – such premiums are almost inevitable. It is a simple matter of economics. Scarcity drives price. And Applied Digital, it seems, is positioned to capitalize on this scarcity. They anticipate fifteen billion dollars in lease revenue from the six hundred megawatts already leased, generating twenty-five million dollars per megawatt. And they are building each megawatt for between eleven and thirteen million dollars. A profitable margin, certainly. But profit is not the ultimate goal. It is merely a means to an end. The end, of course, is to build – to create something lasting, something meaningful, something that will endure long after we are gone.

Savvy investors, those who understand the deeper currents at play, should not be deterred by the recent volatility. They should look past the immediate fluctuations and focus on the long-term potential. Applied Digital is not merely a stock; it is a key component in the proliferation of artificial intelligence – a technology that will reshape our world in ways we can scarcely imagine. It is a gamble, certainly. But it is a gamble worth taking. For in the relentless pursuit of progress, we may yet find salvation.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-23 14:04