The current fever for artificial intelligence, a relentless tide reshaping the technological landscape, has lifted many boats. The Nasdaq Composite, a barometer of this enthusiasm, has surged, a testament to the capital flowing towards these digital promises. Yet, amidst this effervescence, Apple, a name once synonymous with disruption, has moved with a deliberate, almost melancholic pace. For a company so adept at anticipating desire, its recent performance has been… restrained. A mere 89% gain over three years, while the broader market danced a more vigorous jig. One might almost feel a touch of pity for this titan, momentarily eclipsed.

But to dismiss Apple as a relic, a fading grandeur, would be a grave error. The company, like a seasoned landowner, possesses reserves of strength, a quiet accumulation of assets that often go unnoticed in the clamor of the present. The proliferation of AI, far from being a threat, presents a fertile ground for Apple’s particular talents. It is not about being first, but about being…right. And perhaps, in its patient unfolding, Apple is preparing a bloom of its own.

A Measured Advance

The smartphone market, that ever-shifting terrain of consumer whim, has shown a modest resurgence. But it is Apple, with a characteristic grace, that has outpaced the field. A 10% increase in iPhone shipments, a figure that speaks not of frantic innovation, but of enduring appeal. It is as if, while others chase fleeting trends, Apple cultivates a loyal following, a community bound by habit and a certain…expectation of quality. To be the largest OEM, commanding 20% of the market, is not merely a matter of numbers; it is a statement of enduring influence.

The introduction of Apple Intelligence across the latest iPhone lineup is not a revolution, but a refinement. It is the subtle integration of a powerful technology into the fabric of everyday life, a gentle nudge towards a more intelligent existence. The shift in consumer preference towards these models is not merely a matter of features, but of a perceived…completeness. A sense that Apple understands, not merely what its customers want, but what they need.

access to cutting-edge technology and a potential new avenue for monetization. A quiet dividend, earned through collaboration, rather than conquest.

The Promise of Acceleration

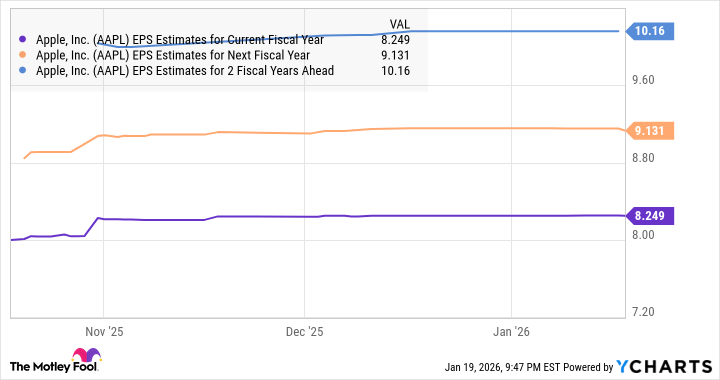

Should Apple’s growth accelerate beyond 2028, as analysts predict, the stock could experience a substantial uplift. A 15% increase in earnings over the next two years could bring the bottom line to $13.44 per share. A multiple of 33 times earnings, in line with the Nasdaq-100, would translate to a stock price of $443 – a potential gain of 74%. These are, of course, projections, built on assumptions and hopes. But they hint at a possibility, a potential for resurgence.

The true potential, however, may lie in the monetization of AI. If Apple can successfully integrate these technologies into its ecosystem, and extract value from its vast user base, the gains could be even more substantial. It is a delicate balance, of course. To push too aggressively would be to alienate loyal customers. But to remain passive would be to cede ground to more nimble competitors. Apple, as always, must tread a path between innovation and preservation. A task that requires not merely intelligence, but a certain…wisdom.

The market, like a restless sea, is ever in flux. But amidst the turbulence, Apple remains a steadfast presence. A company that understands the value of patience, the power of quality, and the enduring appeal of a well-crafted experience. And in the age of intelligence, these qualities may prove to be more valuable than ever.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-21 19:32