It has, of late, been the fashion to lament Apple’s apparent laggardship in the artificial intelligence stakes. The commentariat, ever eager to diagnose impending doom, clucked over the delayed overhaul of Siri and the muted reception to their ‘Intelligence’ offerings. One might have imagined the Cupertino gardens overrun with weeds of technological obsolescence. Meanwhile, the usual suspects – Microsoft, Alphabet – threw money at the problem with the reckless abandon of nouveaux riches. They built data centres the size of small principalities, all in pursuit of a digital simulacrum of thought. The irony, of course, is that the market, so enamoured with novelty, now appears to be experiencing a distinct chill.

For the discerning investor, the early months of 2026 reveal a rather more nuanced picture. Apple, it seems, has chosen a path of elegant restraint, a refusal to participate in the current frenzy. A sensible course, one might add, for a company with rather more pressing concerns than chasing the latest algorithmic chimera. The market, predictably, failed to grasp the subtlety. It preferred the theatricality of grand gestures and exorbitant capital expenditure.

The AI Bubble’s Disquieting Murmur

The prevailing enthusiasm for artificial intelligence has, for some time, resembled a particularly virulent strain of speculative mania. Shares in companies promising to unlock the secrets of the digital mind soared to frankly preposterous heights. Then, as often happens, reality began to intrude. Investors, belatedly awakening to the sheer scale of investment required and the dubious prospect of rapid returns, began to ask awkward questions. The high priests of Silicon Valley, accustomed to unconditional adoration, found themselves subjected to scrutiny. The whispers of a bubble, previously dismissed as the grumbling of Luddites, grew into a disquieting murmur.

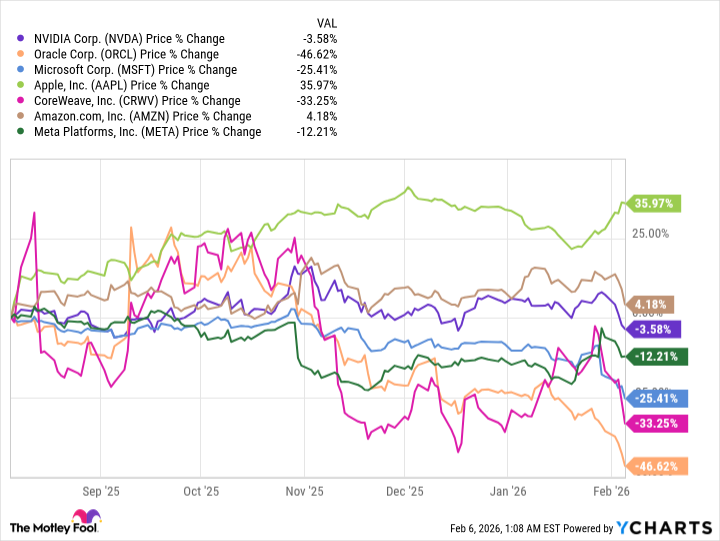

Over the past six months, Apple has quietly outperformed the more vociferous proponents of AI – Amazon, CoreWeave, Meta, Microsoft, Nvidia, and Oracle amongst them. The recent quarterly reports from these companies, whilst boasting impressive headline figures, were accompanied by announcements of capital expenditure plans so vast as to induce a mild panic amongst rational observers. Alphabet, for example, intends to spend somewhere in the region of $175 to $185 billion in 2026. Apple, by contrast, managed a mere $12.7 billion. A trifling sum, one might think, for a company of its stature, but perhaps indicative of a more prudent approach.

Whether this represents a full-blown market correction remains to be seen. The current leaders may yet recover, and those vast capital expenditures may ultimately prove justifiable. But Apple, for the moment, offers a haven of relative stability in a decidedly turbulent landscape. A place, if you will, to park one’s capital whilst the more adventurous souls risk ruin on the frontiers of technological speculation.

A Pragmatic Alliance

Apple’s strategy, it seems, is not one of outright rejection, but of shrewd collaboration. The recent partnership with Google, whereby Apple intends to leverage Google’s Gemini AI technology, is a particularly canny move. Why construct a costly and uncertain edifice of one’s own when a perfectly serviceable foundation is readily available? Gemini, by all accounts, is a rather impressive piece of engineering. To build upon it, rather than attempt to reinvent it, is simply good business sense.

The company’s first-quarter results for fiscal 2026, recently announced, were, predictably, robust. Revenue reached $143.8 billion, a 16% increase year-over-year, with the iPhone enjoying a particularly strong performance. Apple appears to have successfully navigated the prevailing anxieties surrounding its AI strategy. The future, as they say, looks bright. And, for those of us charged with managing portfolios, the stock appears, at this juncture, to be a decidedly attractive proposition.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-10 16:23