Apple (AAPL), once a lovable darling of the investment world, has tumbled from its towering perch. The fairy tale has turned into a peculiar story of muddled fortunes, where the main character—our dear Apple—finds itself wrestling with uninvited foes in the market’s enchanted forest. Once upon a time, it was the golden goose, the chief wizard of technology, and the unrivaled champion of smartphones, especially in the bustling land of China. Today, though, it’s a different tale altogether.

Oh, don’t get me wrong! Apple still struts about with a gleaming market cap of $3.2 trillion, firmly nestled among the “Magnificent Seven.” However, behind those shiny doors, the stock has plummeted by a meager 14% this year, leaving it trailing behind its mystical peers. Only the electric steed Tesla has managed a more lackluster performance. What a curious pickle!

So, what riddle must Apple solve to reclaim its dainty throne? Recently, there’s been a teasing twinkle of hope as the stock danced upward a jaunty 6% over the last month, hinting at tales of fortune yet to come! But oh dear investors, do mind the lurking shadows of dwindling market share in China—this, my friends, is the most critical chapter of 2025. For within this realm lies the heart of Apple’s bounty, and they seem to be looking decidedly chummy with vulnerability. But wait, there’s more to this fable!

Chinese Smartphones: The Gigantic Gummy Bears

Our story takes a rather sprightly turn as we revisit 2010 when Apple penetrated the land of the Great Wall and dragons, flaunting its wares with a flourish. Fast forward to the roaring eras of 2022 and 2023, where Apple gobbled up $70 billion! But as fortune would have it, the fabled giants of Huawei and Xiaomi have awoken from their slumber and unleashed a barrage of sassy 5G beasts equipped with shiny, locally-crafted chips, bypassing beyond the clutches of sanctions like magicians!

As if plucked from a nightmarish childhood tale, national subsidies trickle from the pockets of the Chinese treasury, crafting smartphones that tinkle with affordability—almost like delightful sweets, but only for those under 6,000 renminbi ($838). Alas, that’s far beneath Apple’s lavish price range, leaving the Apples looking rather sheepish!

From a jolly 21% market share in the fourth quarter of 2023, Apple has plummeted into the depths of mere 15% by the first quarter of 2025, while the brawny Huawei and plucky Xiaomi swagger with 19% apiece, showing the world they mean business! The horror continues into the second quarter, where Apple’s sales in the Greater China lands stumbled by 2% year-over-year, even as other realms flourished! Oh, the dreadful plight of declining fortunes!

| Region | Fiscal Q2 2025 Sales (ending March 29, 2025) |

Fiscal Q2 2024 Sales (ending March 30, 2024) |

Percent gain (loss) |

|---|---|---|---|

| Americas | $40.3 billion | $37.8 billion | 8% |

| Europe | $24.4 billion | $21.1 billion | 1% |

| Greater China | $16 billion | $16.4 billion | (2%) |

| Japan | $7.3 billion | $6.2 billion | 17% |

| Other Asia-Pacific | $7.3 billion | $6.7 billion | 8% |

| Totals | $95.3 billion | $90.7 billion | 5% |

Oh, what phantoms of weakness these figures portray! Apple’s inability to conquer the Great Wall is setting the financial scene ablaze with worry, igniting the very critiques that swirl like leaves in autumn.

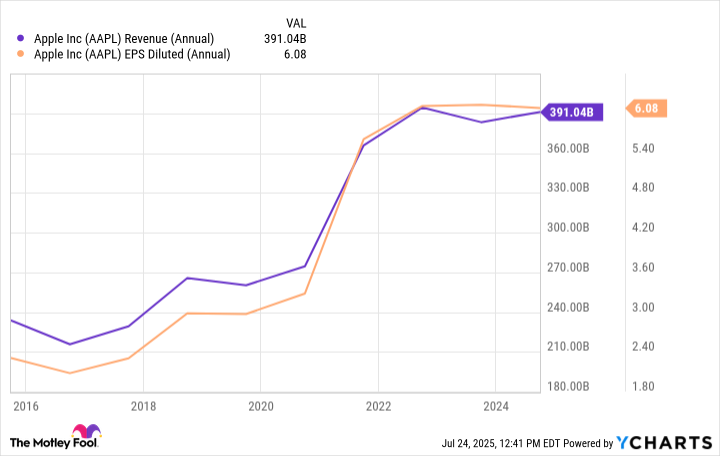

Profits Dreaming in a Land of Stagnation

It was once a raucous row of growth stocks, and yet our dear Apple now finds itself in a stagnant pond of flatlined revenue. The sprightly metrics of years past are now merely echoes, slipping quietly into the ether.

But hark! Don’t let the tidings twist your trousers! The magical Services segment, which includes whimsical realms such as the App Store, Apple Music, and iCloud, is still bursting with life and coin! It’s the golden egg in the henhouse, needing fewer golden feathers and more canny winks.

| Segment | Fiscal Q2 2025 (ending March 29, 2025) |

Fiscal Q2 2024 (ending March 30, 2024) |

Percent gain (loss) |

|---|---|---|---|

| iPhone | $48.84 billion | $45.96 billion | 6.2% |

| Mac | $7.94 billion | $7.45 billion | 6.6% |

| iPad | $6.4 billion | $5.55 billion | 15.3% |

| Wearables, Home, and Accessories | $7.52 billion | $7.91 billion | (4.9%) |

| Services | $26.64 billion | $23.86 billion | 11.6% |

| Totals | $95.3 billion | $90.7 billion | 5% |

But hark to the thumping feet of idle iPhone dreams! The once-cherished gadget that made hearts flutter now languishes in a realm of mockery—longer upgrade cycles watched by eyes once wide with wonder. And this, my dear reader, is where the troubles thrum: Apple’s bank vault is filled to bursting with coin from iPhone sales, and if the treasures are left untouched for too long, it may unleash woes most dire!

The Tariff Tumble: A Topsy-Turvy Saga

In the grand tapestry of Apple’s escapades, a cloud of tariffs looms ominously like an angry giant. Most of Apple’s splendid creations are birthed in China while devilish trade wars dance with glee! Oh, what a carnival of chaos! Upon Apple’s doorstep lies a treatise threatening a staggering 25% tariff! But fret not, dear Apple is embarking on a thrilling quest to move production to the distant lands of Vietnam and India; but this, alas, is a slow march through the quagmire.

Trapped in this monumental tussle, Apple squabbles for survival. In China, it’s an outsider facing the brunt of a trade tug-o-war, while in its homeland, the sky darkens with hints of surging costs. O, the glory days seem so far away!

Hopes for Tomorrow’s Dawn

As the clock tick-tocks towards July 31, all eyes will be glued to Apple’s fiscal third-quarter earnings—a tide-turning moment for the sullied star of our tale. Will it reign victorious from the rocky shores of Greater China, or will it continue its melancholic pirouette down the financial hall of mirrors? Fear not, fairness shall remain! The company still produces a steady deck of profits and a charming little dividend as if by clockwork. Yet, without a magical resolution to weave their China woes into something splendid, the investors’ dreams of outpacing the market will remain just that—dreams.

And so, the tale meanders on, filled with uncertainty yet tinged with the whimsical hopes of market watchers. 🍏

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2025-07-28 08:50