Okay, so Apple. Everyone’s buying Apple. It’s up 11.6% in six months. Fine. The S&P 500 is up 5.8%. Still fine. But let’s be honest, it’s expected. They sell shiny rectangles. People buy them. It’s a self-fulfilling prophecy. And everyone pats themselves on the back for being so…predictable. The “Magnificent Seven”? More like the “Predictably Profitable Seven.” It’s exhausting.

They’re bragging about iPhone sales being up 16%. Sixteen percent! Like that’s some kind of achievement. They’re selling the same phone, slightly tweaked, every year. It’s a racket, frankly. And then they expect you to be grateful. Grateful! Meanwhile, I’m trying to find something…less obvious. Something where the risk isn’t already priced in by every algorithm on the planet. Is that too much to ask?

So, I started looking at the suppliers. Because that’s where the real action is. And I landed on Cirrus Logic. Cirrus Logic! It’s like the forgotten stepchild of the tech world. And that’s…intriguing. It’s up 33% in six months. Thirty-three percent. And nobody’s talking about it. Nobody. It’s practically a secret. Which, naturally, makes me suspicious. But a good kind of suspicious. Apparently, 94% of their revenue comes from Apple. Ninety-four percent! That’s…a lot. It’s like being completely dependent on one person for your livelihood. It’s unsettling. But also…smart? If you’re going to be reliant, pick the biggest, most stable entity. It’s basic risk management.

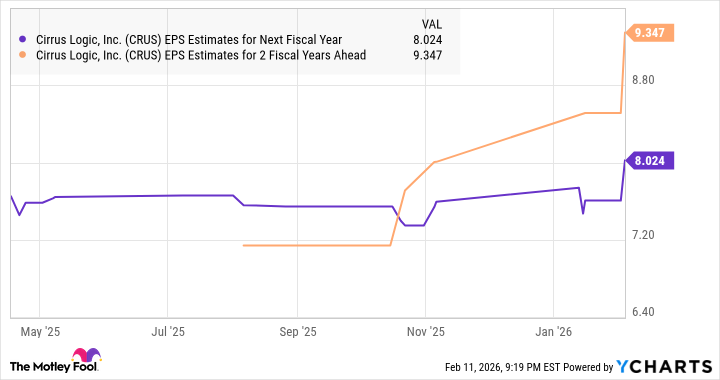

They make audio codecs, haptics, power management chips… all that stuff. It’s not glamorous. It’s not going to win any awards. But it’s essential. And that’s where the opportunity lies. The stock jumped 8% after their last earnings report. Eight percent! Because they shipped more components. More components! It’s like they’re surprised they’re making money by supplying parts to the most profitable company in the world. It’s… baffling. Their revenue was up 4.4%, earnings up 18%. And they’re trading at 19 times earnings. Nineteen! The S&P 500 is at 25. Apple? Thirty-five! Thirty-five! It’s highway robbery. It’s like they’re charging you extra for the privilege of owning a status symbol. And everyone just…accepts it.

So, Cirrus Logic is basically a proxy for Apple, but at a discount. A significant discount. And they’re growing just as fast. It’s… almost too good to be true. Which, of course, is why I’m slightly panicked. I mean, what am I missing? There has to be something. But I’m willing to take the risk. Because frankly, I’m tired of being told what to buy. I want to find something…undervalued. Something… overlooked. Something… that doesn’t require me to join the Apple cult.

Apple’s Solid Prospects Should Rub Off Positively on Cirrus Stock

Dan Ives says Apple could ship 250 million iPhones this year. Two hundred and fifty million! Because 315 million haven’t been upgraded in four years. It’s like people are hoarding iPhones. It’s… irrational. But hey, who am I to judge? And if Apple ships 250 million iPhones, Cirrus Logic benefits. It’s… simple math. And the market hasn’t caught on yet. They’re too busy obsessing over Apple’s quarterly earnings. It’s… predictable.

If Cirrus Logic gets a higher earnings multiple, the stock could go even higher. It’s… logical. And that’s why I’m buying it. Right now. Before everyone else does. Because frankly, I’m tired of missing out on the obvious. I want to be the one who sees the opportunity before it’s gone. I want to be…right. And if I’m wrong? Well, at least I tried something different. At least I didn’t just blindly follow the herd. And that, my friends, is worth something.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-16 04:13