Apple. The name hangs in the air like a bad habit. They’ve had their share of shadows – tariffs whispered about in back rooms, legal skirmishes that smelled of stale coffee and desperation. Doubters? They were a dime a dozen, clinging to the hope of a fall. They figured the iPhone’s magic was gone, that the well had run dry. They were, as usual, looking at the wrong side of the street.

Tim Cook, the man at the helm, isn’t one for theatrics. He just lays out the numbers. And the numbers, lately, have been talking. Loudly.

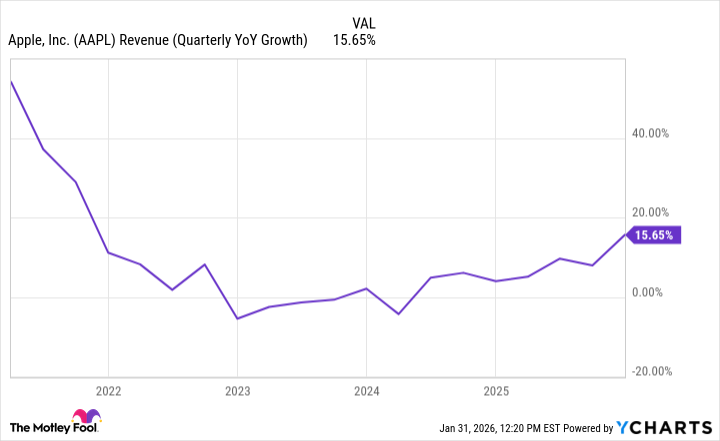

The Quarter They Couldn’t Ignore

First quarter of fiscal ’26. They brought in $143.8 billion. A sixteen percent jump. Not a ripple, a surge. They’d predicted ten to twelve percent. Pleasant surprise, they called it. I call it a statement. It’s been years since Apple showed that kind of top-line heat. The kind that warms a portfolio.

The engine? You guessed it. The iPhone. Cook said demand was “staggering.” Twenty-three percent growth. Records broken in every corner of the globe. The iPhone 17, fresh off the assembly line, was doing most of the heavy lifting. The cycle continues. Predictable, maybe. But profitable. They’re forecasting another thirteen to sixteen percent jump this quarter. A solid bet, if you ask me.

A Buy, Even With the Static

Every new iPhone won’t be a knockout. That’s the nature of the game. But Apple’s business model? It’s holding. People trade up. Every few years, they want the shine. And Apple delivers, adding bells and whistles – including that artificial intelligence stuff everyone’s buzzing about. It’s a smart play. It expands the base.

Two and a half billion active devices. That’s a lot of potential. A lot of opportunity to squeeze out revenue. Their services segment is where the real money’s hiding. High margins. Expanding quickly. It’s a slow burn, but a steady one.

They’ll face challenges. They always do. Lawsuits. Regulatory hurdles. The tariff game is a never-ending dance. But Apple has a way of navigating the shadows. They’ve been dodging bullets for years. And they’ll keep dodging. For all those reasons, and a few I’m keeping to myself, Apple remains a solid hold. A cold case of continued profit, in a world full of warm air.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

2026-02-04 22:32