Apollo Global Management. The name itself… a curious echo of power, of dominion over the ephemeral currents of capital. They are, ostensibly, managers of assets, purveyors of retirement’s fragile promise. But beneath the polished veneer of financial engineering lies a darker truth: they deal in probabilities, in the calculated risk that haunts the dreams of every rational man. They are, in essence, gamblers – sophisticated, yes, but gamblers nonetheless. And on February 9th, the reckoning approaches.

The last pronouncement from this financial oracle – November 4th – revealed a bounty of $1.7 billion, a sum that might tempt a lesser soul into complacency. But I, having witnessed the capricious nature of markets for decades, remain… unsettled. It is not the magnitude of the profit that disturbs me, but the ease with which it was attained. A doubling of earnings, they boast. A siren song to the naive. And the record-breaking fee-related earnings of $652 million? A fleeting illusion, I suspect, built upon foundations of borrowed time and inflated expectations. The $871 million in spread-related earnings… a temporary reprieve from the inevitable entropy of the market.

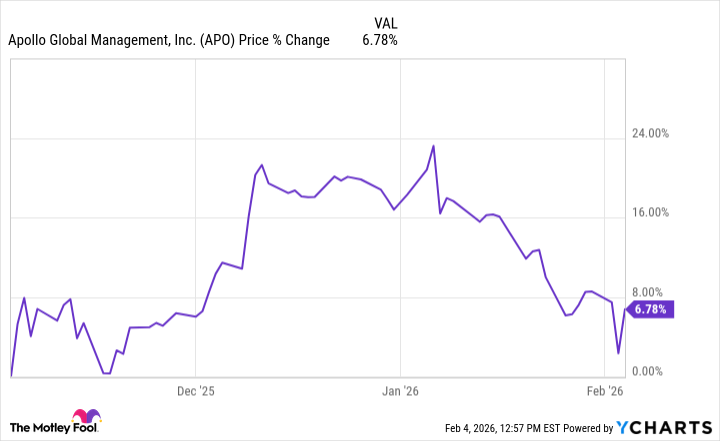

They speak of $75 billion in origination activity. A deluge of funds flowing through their hands. But what is money, truly? A mere symbol, a phantom limb of desire. It can build empires, yes, but it can also crush souls. The chart, as they present it, shows a momentary surge after the last earnings report – an 8% leap, they proclaim with a touch of smugness. But observe closely. The ascent was fleeting, followed by a descent, a dance of hope and despair. A microcosm of the human condition, wouldn’t you say?

Now, they whisper of projections for the fourth quarter, estimating around $880 million in spread-related earnings. A comfortable figure, they assure us. But comfort is a dangerous illusion. It breeds complacency, blinds one to the lurking shadows. They speak of 20%+ growth in fee-related earnings by 2026, and a steady 10% SRE growth thereafter. Such certainty… it smacks of hubris. Do they not understand that the future is a chaotic, unpredictable beast? That even the most meticulously crafted projections are but fragile castles built on shifting sands?

They claim confidence, fueled by embedded growth from past investments and current momentum. A self-serving narrative, I suspect. Momentum is a fickle mistress. It can carry you to great heights, but it can also abandon you at the precipice of ruin. The likelihood of a post-earnings sell-off, they suggest, is diminished. Perhaps. But the market, my friends, is a master of subversion. It delights in shattering expectations, in punishing those who dare to believe in its rationality.

So, should one venture a purchase before February 9th? A difficult question. A gamble, if you will. The stock, after all, remains elevated above its previous low. But that is no guarantee of future success. The allure of potential gains is strong, I admit. But one must weigh the risks, confront the inherent uncertainties. To buy now is to embrace the possibility of reward, yes, but also to accept the inevitability of suffering. Perhaps, in the grand, tragic comedy of the market, that is the only certainty.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- The Best Actors Who Have Played Hamlet, Ranked

2026-02-05 17:12