In the shadowed corridors of corporate ambition, where algorithms are forged and marketed like relics of a new religion, Anthropic has ascended to a valuation of $183 billion-a figure as staggering as it is foreboding. It has been scarcely a month since OpenAI unveiled its latest creation, GPT-5, yet the ripple effects have already birthed rivalries that echo the clamor of empires vying for dominion.

Perplexity, with its audacious $34.5 billion unsolicited bid for Alphabet’s Google Chrome, sought to etch its name into the annals of audacity. Meanwhile, Anthropic-nurtured by the coffers of both Alphabet and Amazon (AMZN)-closes a $13 billion Series F funding round, casting its shadow over the artificial intelligence landscape. Its trajectory, like a meteor hurtling through the void, illuminates the path of those who seek to harness the computational Leviathan.

Since unveiling its AI chatbot Claude in March 2023, Anthropic has grown not merely in revenue but in influence. Its run-rate soared from $1 billion at the year’s outset to $5 billion by August-a testament to the insatiable hunger of markets eager to feast on innovation. Yet, beneath this veneer of triumph lies a deeper narrative, one where venture capitalists reap their rewards while corporations like Amazon weave these threads into the tapestry of their dominion.

Let us now turn our gaze to Amazon, whose alliance with Anthropic is no mere transaction but a stratagem of profound consequence. To comprehend this, we must delve into the labyrinthine depths of Amazon Web Services (AWS), the cloud colossus upon which much of modern enterprise rests.

AWS + Anthropic: The Calculated Embrace of Power

it differentiates AWS from competitors while anchoring customers within Amazon’s ecosystem. This stickiness, born of convenience and choice, fortifies Amazon’s position amidst the tumultuous battleground of cloud computing-a realm where loyalty is fleeting, and defection looms ever-present.

The Subversion of Silicon Titans

Yet another layer of this grand design reveals itself in Amazon’s quest to diminish reliance on Nvidia and Advanced Micro Devices (AMD). Through its custom silicon-Trainium and Inferentia-Amazon seeks to sever the umbilical cord binding it to premium GPUs. Should Anthropic succeed in scaling Claude on these chips, it will serve as a beacon to the market, proving that Amazon’s hardware can rival the entrenched hegemony of Nvidia and AMD.

This gambit, should it bear fruit, promises to realign the economics of AI computation. By steering workloads toward its own silicon, Amazon captures more value, enhancing AWS’s profitability and solidifying its role as arbiter of the digital age.

From Code to Capital

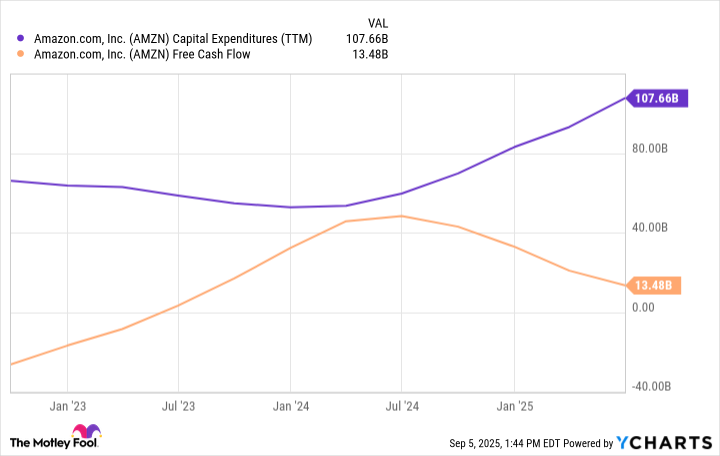

For investors, the question arises: how does Anthropic translate into tangible dividends for Amazon? The answer lies in the capex figures, which reveal an unprecedented outlay in AI infrastructure. Though such expenditures weigh upon free cash flow, they are not acts of desperation but deliberate strokes upon the canvas of long-term strategy.

Partnerships of this magnitude rarely yield immediate bounty; they are investments in epochs, not seasons. Anthropic bolsters AWS’s capacity to secure enduring enterprise contracts, embedding itself so deeply that the cost of defection becomes prohibitive. Once ensnared, customers find themselves tethered to Amazon’s infrastructure, reluctant to brave the uncertainties of rivals like Microsoft Azure or Google Cloud Platform.

Over time, these dynamics shall enable Amazon to capture an ever-greater share of AI workloads, generating fees both recurring and resilient. As profitability scales alongside revenue growth, Amazon stands poised for valuation expansion-a prospect that renders its stock a prudent harbor for the patient investor. And so, amidst the mechanized cacophony of progress, one truth remains immutable: the pursuit of power, whether in silicon or shareholder equity, is a tale as old as humanity itself. 🌟

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Banks & Shadows: A 2026 Outlook

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-09-10 04:30