So, everybody’s chasing yield these days. It’s like a national pastime. “Passive income!” they shout. As if sitting back and collecting checks is some kind of revolutionary concept. It’s… irritating. And the ETFs! Don’t even get me started. They all say they’re different. They all have these little marketing angles. “High yield!” “Dividend growth!” It’s just… noise. And frankly, it’s insulting to think anyone believes they’ve cracked the code.

They’re pushing this Schwab U.S. Dividend Equity ETF – SCHD, they call it, like it’s some kind of secret handshake – as the answer to all your income-seeking prayers. “Hold it forever!” they say. Forever? What is that, even? I’m not promising anything forever. I can barely commit to what I’m having for lunch. But, fine. Let’s examine this thing. Because that’s what I do. I examine things. It’s a compulsion.

One of These Things is Not Like the Others (And That’s the Point)

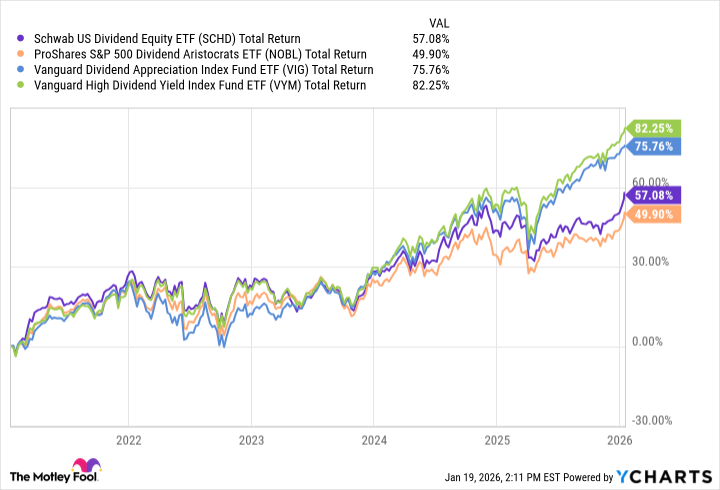

Look, I’ve been watching these dividend ETFs for a while, and they’re all jockeying for position. This SCHD thing? It’s been… lagging. Lagging! They act like that’s a bad thing. Like it’s some kind of moral failing. It hasn’t kept pace with the Vanguards, the flashier ones. And you know what? Good. I’m immediately suspicious of anything that’s performing too well. It reeks of hype. It’s like when a restaurant gets overly crowded; you just know the food is mediocre.

It’s only beating one other similar ETF – some “Aristocrats” thing. Aristocrats! Honestly. And even that one is barely hanging on. The whole market is obsessed with these AI stocks, these tech darlings, and this SCHD thing doesn’t touch them. It’s deliberately avoiding them. They’re saying that’s a feature. A feature! It’s like buying a car without a steering wheel and calling it “aerodynamically optimized.”

Apparently, it only buys stocks that are “high quality” and “attractively valued.” Attractively valued? Who decides that? And what does that even mean? It’s all subjective! They’re basically saying they’re picking the boring stocks. The ones nobody wants. And they’re proud of it. It’s infuriatingly logical. Like a robot trying to be a comedian.

Top holdings? Lockheed Martin. Bristol Myers Squibb. Chevron. Merck. Solid companies, sure. But they’re not exactly setting the world on fire. They’re the beige of the investment world. And everyone’s chasing the neon. It’s just… predictable.

SCHD Offers Everything Buy-and-Hold Income Investors Actually Want (Or So They Claim)

They say if you want decades of passive income, you don’t care about capital gains. That’s… convenient. It lets them off the hook for any potential price drops. They’re focusing on “reliability” and “growth” of dividends. Fine. But what if the dividends stagnate? What if the companies get disrupted? They conveniently gloss over that. It’s like saying, “This parachute is guaranteed to open… most of the time.”

They’re touting a ten-year dividend growth requirement. Ten years! That’s barely a blip in the grand scheme of things. And they’re bragging about free cash flow and return on equity. As if those numbers are foolproof. It’s just… data. Data can be manipulated. Data can lie. It’s not a guarantee of anything.

The fund’s payout is up 50% in five years. Okay. But what about the next five years? What if it drops? They’re conveniently ignoring the possibility of a downturn. It’s like building a house on sand and pretending it’s structurally sound.

The current yield is 3.8%. Higher than some others. Fine. But is it worth sacrificing potential growth? They’re framing it as a trade-off. But it feels more like a limitation.

The irony is, this whole thing is being propped up by the AI hype. Because nobody’s interested in these boring stocks, the yield is higher. It’s like a clearance sale on mediocrity. And they’re acting like that’s a good thing. It’s… frustrating.

If You Want It, Sooner Is Better Than Later (But Honestly, Who Knows?)

They say income investors don’t need a recovery in the near future. That’s… reassuring. But it also feels like a cop-out. They’re lowering expectations. It’s like saying, “This car might break down, but at least it’s cheap.”

They think these stocks will eventually appreciate. Maybe. But what if they don’t? What if the market changes? What if a meteor hits the Earth? They’re conveniently ignoring all the potential risks. It’s just… irresponsible.

There’s a case to be made for locking in a good yield. Maybe. But honestly, who knows? The market is unpredictable. It’s a chaotic mess. And this whole thing just feels like a gamble. A slightly less flashy gamble, but a gamble nonetheless.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 18:23