The cryptocurrency began the day at $89K before surging 5% to $94K, leaving observers scratching their heads like a cat in a room full of clockwork mice.

When a bank CEO, a trader, and a self-proclaimed “Internet villain” all whisper the same suspicious secret, you know the kettle’s brewing something odd. Enter Custodia Bank’s Caitlin Long, “Whale Panda” Stefan Jespers, and Andrew Tate (the “Top G” who once sold cars like a man possessed). All three reckon BTC is being puppeteered by shadowy whale overlords-Tate’s rant being the freshest.

“I’m a BTC enthusiast,” Tate declared, “but when a whale buys 10k BTC and the price yawns, it’s time to question the universe.” He’s referencing Strategy’s recent 10,624 BTC splurge, which did less to move the needle than a squirrel tossing acorns into a volcano. “So. Much. Manipulation,” Long snorted, her Wall Street resume glinting like a pirate’s cutlass.

But before Tate and Long joined the chorus, “Whale Panda” had already raised the alarm like a boy who cried wolf… and then invested his kids’ college fund in crypto. “I really don’t want to be right about ‘paper BTC,’” he wrote, “but if I’m wrong, my net worth and my children’s future will thank me. If I’m right? Well, let’s just say the whales are throwing confetti parties behind the curtain.” 🐳🎭

“Paper BTC,” for those playing along at home, is a fancy term for IOU-backed phantom coins. It’s the crypto equivalent of selling air but calling it “cloud-based equity.” The phrase gained traction in 2024 when ETFs hit the scene like a rogue wave, but since October’s “Great Liquidation,” even the most bullish have been left scratching their heads. “BTC is liquid,” chuckled CZ Binance, “unless you’re a whale with a grudge.”

Market Metrics: A Tale of Two Whales

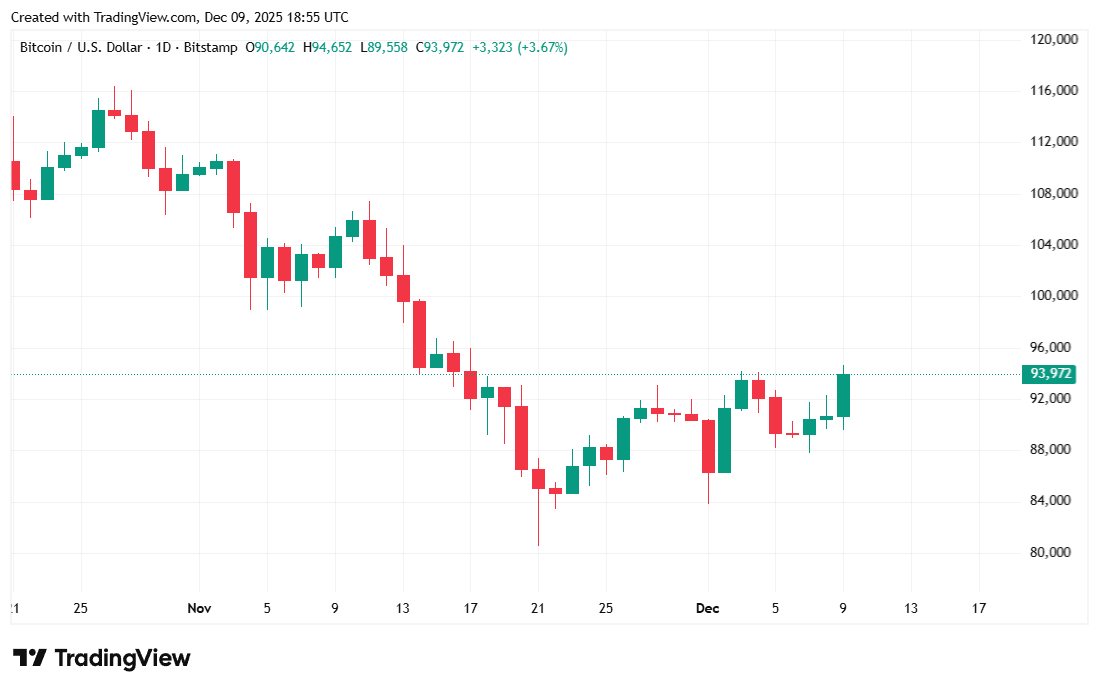

Bitcoin now trades at $93,948.67, up 4.33% from yesterday-a bounce that made short sellers weep into their coffee cups. After hitting a low of $89,586.98, it rallied to $94,601.57, proving that even a 5% spike can feel like a rollercoaster in a world of crypto earthquakes. 🎢

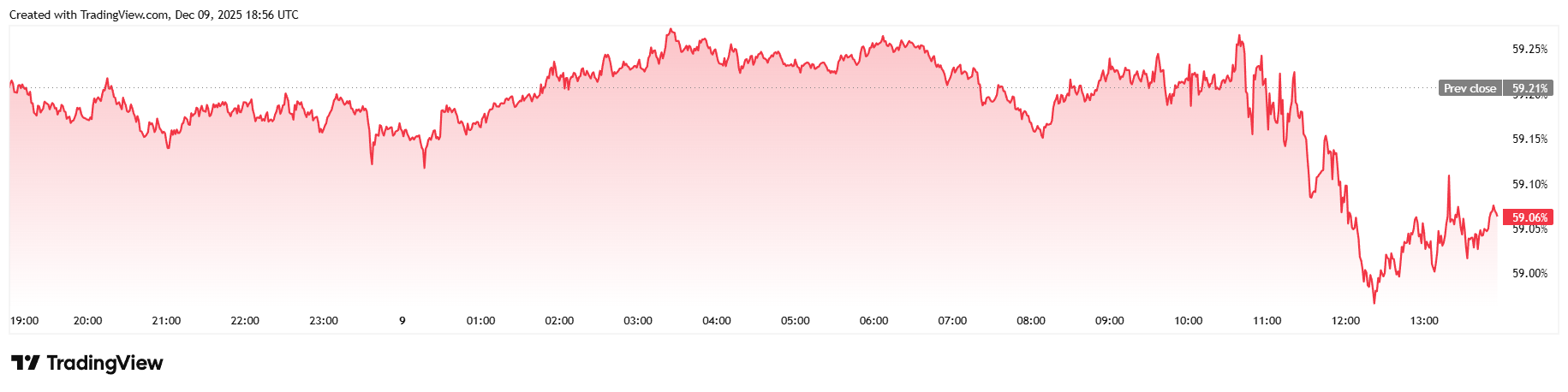

Daily volume hit $65.35 billion, and the market cap ballooned to $1.97 trillion. Yet Bitcoin’s dominance slipped to 59.06%, while futures open interest climbed to $59.69 billion. Short sellers lost $140.63 million in liquidations-a tidy sum, though not enough to buy a yacht, let alone a whale’s silence.

FAQ ⚡

- Why is everyone suddenly talking about BTC manipulation?

Because Andrew Tate, a Harvard Law grad, and a trader with a nickname like “Whale Panda” all think whales are playing 3D chess with the market. 🐠♟️ - Why didn’t Strategy’s 10,624 BTC buy move the needle?

Maybe the whales are busy printing IOUs on their laser printers. Or maybe they’re just laughing at us all. 😂 - What’s “paper Bitcoin”?

It’s like owning a house but just borrowing the keys. Real coins? Hard to say. Maybe the blockchain’s version of Monopoly money. - Does BTC’s 5% jump prove manipulation?

Not yet-but if this keeps up, the next price swing might come with a popcorn warning. 🍿

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-12-09 23:09